Last year we published our astonishing Bitcoin (BTC) price forecast of 160,000 USD. Is this price forecast still relevant after the crypto crash? This article features our Bitcoin price forecast for 2019.

[ Ed. note: How to get the maximum out of crypto and blockchain investing? We invite followers to subscribe to our blockchain & cryptocurrency forecasting service. It contains dozens of detailed charts on cryptocurrencies and blockchain stocks. It continuously analyzes the crypto market and continuously reports back to its users when opportunities arise. Most, if not all, of our crypto recommendations already tripled since flashing the first buy alerts in January/February of this year! ]

[Ed. note: on April 2nd, 2019 the new crypto bull market started. We did update this Bitcoin price forecast article on April 2nd, 2019 as well as April 14th, 2019.]

[Ed. note: This article about Bitcoin’s price forecast for 2019 was originally published on September 30th, last year. Readers can verify this by checking the dates on the charts. Throughout 2019 we will update our Bitcoin price forecast on a regular basis. The new updates will appear below in this article. It allows readers to track the evolution of the crypto market, Bitcoins evolution but also how our initial Bitcoin price forecast 2019 performs. Last update of our Bitcoin forecast: April 14th, 2019.]

Since last year when we wrote our $160,000 forecast for Bitcoin many things have changed in crypto land. First and foremost, Bitcoin has matured as an investment vehicle, primarily with the introduction of Bitcoin futures. Second, the crypto crash brought a great level of cleanup, and considerably changed the dynamics in the crypto market. Third, we started to see a trend in the type of Bitcoin ETFs that are submitted to the SEC, which, according to us, delivers an important insight.

That said, we can revise our previous forecast, and add lots of new insights to derive an up-to-date Bitcoin price forecast for 2019.

Is our previous Bitcoin price forecast of $160,000 still accurate?

The short answer: we do not see Bitcoin rising to $160,000 anytime soon. It may be a very long term target, potentially, but not by 2020 or 2022 which was the timeframe we used when we published this Bitcoin price forecast.

One of the most important reasons for this is the introduction of Bitcoin futures. This allows large investors to put pressure on Bitcoin’s price in a way not seen before. In other words, the introduction of Bitcoin futures on December 17th 2017 resulted primarily in subdued returns to Bitcoin going forward.

Moreover, with so many Bitcoin ETF proposals submitted to the SEC this year we start seeing a trend that is somehow concerning for our Bitcoin price forecast. As said, a physical Bitcoin ETF was rejected in April of this year. On August 22nd the SEC decided to reject 9 more Bitcoin ETFs. As per Bloomberg:

“The nine ETFs denied this time around came from three sponsors: ProShare Capital Management, GraniteShares Advisors and Direxion Asset Management. All of these funds sought to use futures contracts to get exposure, with several planning to short Bitcoin. The regulator had a hard-deadline to deny or approve all of these products over the next month; their requests to list had been pending since December and January. Investors’ hopes for a Bitcoin ETF now rest on just one fund from VanEck Associates Corp. and SolidX Partners Inc. The regulator this month pushed back a ruling on that product until at least September and could ultimately take through February to make up its mind.”

What we see is an emphasis on non-physical Bitcoin ETFs. The ETFs that are submitted are primarily derivatives. They can go short, or are correlated to Bitcoin futures. We don’t like this, at all in fact. Only physical Bitcoin ETFs are good for the Bitcoin market, derivatives bring a market to another state.

On the flipside, however, institutional investing is likely going to enter Bitcoin in 2019. Think of the Bakkt platform as well as the Nasdaq offering cryptocurrency investing to institutions. That’s a positive.

All in all we believe increasing derivatives in Bitcoin’s market will put pressure on returns. The $160,000 Bitcoin price forecast which we did set by 2022 is not realistic in current circumstances.

Bitcoin price forecast vs. Bitcoin usage

As per the Bitcoin usage and adoption statistics on Statista.com the ownership of Bitcoin is still very low, slightly but not much higher than when we wrote 10 Investment Tips For Cryptocurrencies Investing 18 months ago.

The 3 stats shown below, however without precise figures as that’s only available for premium members, show that Bitcoin ownership was very low in the U.S. amid an amazing Bitcoin price rise, willingness to use Bitcoin for transactions is significant (equally spread yes, no, neutral answers) and the shares of U.S. adults planning on investing in Bitcoin is clearly a phenomenon for the younger generation who probably view crypto as a product of ‘their’ digital age.

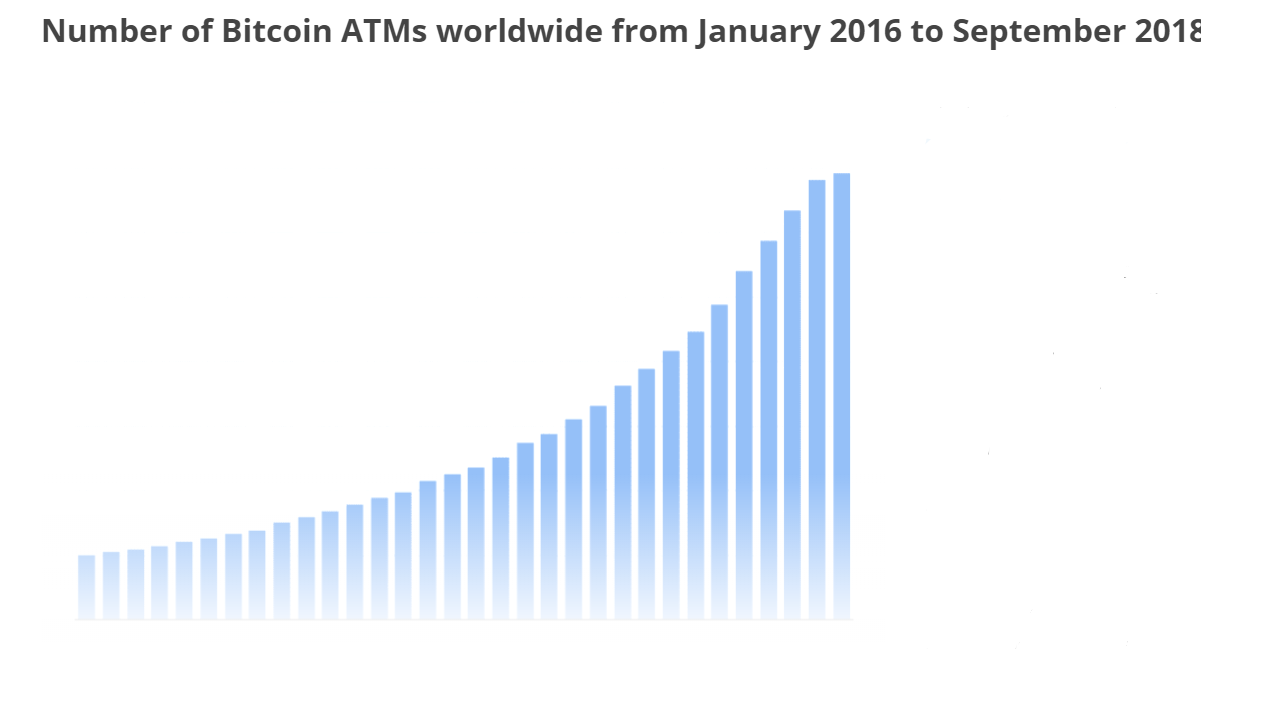

Moreover, when it comes to Bitcoin ATMs worldwide, we see a stagnation in the last few months. This is the first sign of stagnation. It suggests to us that the idea of using Bitcoin as a payment method is being challenged right now. With the advent of stablecoin we believe Bitcoin has a serious competitor for payments and transactions.

Bitcoin sets the primary trend for crypto and blockchain investments

What we believe is happening with Bitcoin, still the highest market cap in crypto space, can be summarized with the following points. This, of course, is critical information for our Bitcoin price forecast for 2019.

- Bitcoin as an investment is maturing, with futures being introduced already and other derivative products coming online in 2019 and beyond.

- The adoption of Bitcoin as a medium for transaction is not likely going to continue. That’s because Bitcoin does not have the mandatory features of a payment method. That’s why the number of Bitcoin ATMs worldwide starts stagnating.

- Primarily the young generation is open for Bitcoin usage as they consider it a product of their age. The older generation is skeptical.

That said, and as per InvestingHaven’s blockchain & crypto investing research, Bitcoin evolved into the leading indicator for the crypto market early this year. We started writing about this already in February, as the crypto crash was going on. Many crypto investors made a big mistake by focusing on the wrong indicators for the crypto market. We told our premium crypto subscribers countless times to focus on Bitcoin, and its chart structure, in trying to understand how the crypto market will shape up.

We believe that Bitcoin will only function as the leading indicator for the crypto market, setting the high level direction, per its chart structure. Nothing more, nothing less.

Obviously, if this is true, it yields critical information for any crypto related investment, not only cryptocurrencies but also blockchain stocks.

Our Bitcoin price forecast for 2019: $25,000

With all the insights laid out in this article can we do a Bitcoin price forecast for 2019? Yes, is the answer, and our annotated long term Bitcoin price chart should help us with this.

Below is the 4 year chart of Bitcoin. It shows a perfect long term channel with 4 bands. Note that Bitcoin never fell into its ‘support band’, implying there was still plenty of downside potential before the long term bull market would be over. This certainly is not how crypto investors felt about it, on the contrary.

Bitcoin is now trending in its ‘transition band’, since May of this year. We believe that the ‘transition band’ will be the one in which Bitcoin will trade most of the time. Arguably, when the next strong period of momentum in crypto land starts, Bitcoin will move to its ‘bullish band’. But with all insights laid out in this article we don’t see Bitcoin going to its ‘super bullish band’ though.

That’s why we believe that it is very realistic to expect a Bitcoin price of $25,000 to be reached in 2019, assuming the crypto crash is over. Previous all-time highs will be taken out, but we believe Bitcoin will trade within its ‘bullish band’, not higher.

** January 6th, 2019 **

Bitcoin price chart as 2019 kicks off

It was a rough ride at end of the previous year, for all global markets including cryptocurrencies.

That’s why it is worth revising the Bitcoin price charts in this article which was originally written 3 months ago as part of our Bitcoin price forecast 2019!

What happened since we originally published this article is that Bitcoin fell through its rising channel. This is not the most bullish development, admittedly. But the whole point is that this is part of the corrective cycle in the context of the 2nd bull market with subsequent bear market. Exactly the same happened during the first bear market.

People are doubting whether the crypto bull market will ever resume. We make the point that the next crypto bull market will be there the latest by 2020. The answer to this question is easily derived from below chart which maps fundamental analysis with chart analysis as per our proprietary method of our blockchain investing research service (this chart is a sneak preview of our service).

** February 17th, 2019 **

Bitcoin price forecast underway because sentiment is horribly bad

This statement does not make sense, does it?

Because sentiment is bad we would believe that our bullish Bitcoin price forecast will materialize.

It’s the world turned upside down!

A horrible sentiment is what happens when we see news items like “the longest bear market ever” as published by Coindesk.

And that’s a great thing, because bear markets beget bull markets, as per our 100 investing tips!

Bear markets beget bull markets. It is at the depth of a bear market that all sellers leave, which makes place for a market to consolidate and set the basis to turn into a future bull market.

People are doubting whether the crypto bull market will ever resume. We make the point that the next crypto bull market will be there the latest by 2020.

New crypto bull market underway

Why do we think so?

Because of Bitcoin’s historical price chart. It shows strong similarities with the 2014 bear market, which ended early 2015 after which a long consolidation period started! Interestingly, early 2015, the sentiment was as horrible as it is today.

Not convinced? this just a subset of news that was published back then:

- “Is Bitcoin headed to fresh new lows” published in March 2015. This article came out AFTER the low of January, after which Bitcoin never came back to that point.

- “Will Bitcoin ever rebound”, published by CNN early 2015. This is a great quote from that article: “Bitcoin was a bubble that has burst. Jeffrey Gundlach, head of influential investment firm DoubleLine, is firmly in the Bitcoin bear camp. In a webcast on Tuesday, Gundlach declared that Bitcoin is “on its way to being relegated to the ash heap of digital currencies.”

- “Bitcoin might be dead. It doesn’t matter,” published by Telegraph in the UK almost the same day Bitcoin set its lowest point between 2013 and the present day. What about this last paragraph of the article: “Jeffrey Smith, chief information officer of one of the largest mining operations going, CEX.IO, recently said that the company would soon be shutting-down to ride out the storm: a “forced temporary measure, the result of cloud mining costs exceeding mining profit.” This could create a negative feedback loop as miners retire, the network becomes less secure and resilient, investors lose faith, and the price drops further.“

The vast majority of people make this horrible mistake of buying high and selling low. Smart investors do the opposite. When Bitcoin’s price was at all-time highs there were only few out there recommending to sell, even CNBC said so. InvestingHaven flashed a sell call on Dec 31st, 2017, in this article.

Right now we see the opposite: everyone is scared to death to buy crypto while we recommend to start becoming more aggressive in buying quality cryptocurrencies! Indeed, it’s the principle buy low sell high that we apply.

The driver for our Bitcoin price forecast to materialize

We strongly believe that institutional money is waiting to enter the crypto space. We spoke about this extensively.

The new crypto bull market will be driven by institutional money in combination with the new wave of innovation and adoption which will come from security tokens combined with stablecoins.

This is our main thesis on the next phase of the crypto bull market!

That’s what we start seeing on Bitcoin’s price chart. Again, the similarities between 2015 and the present day are strong, the drivers are different. But who cares about the drivers? As long as they are in place and prices follow the path higher!

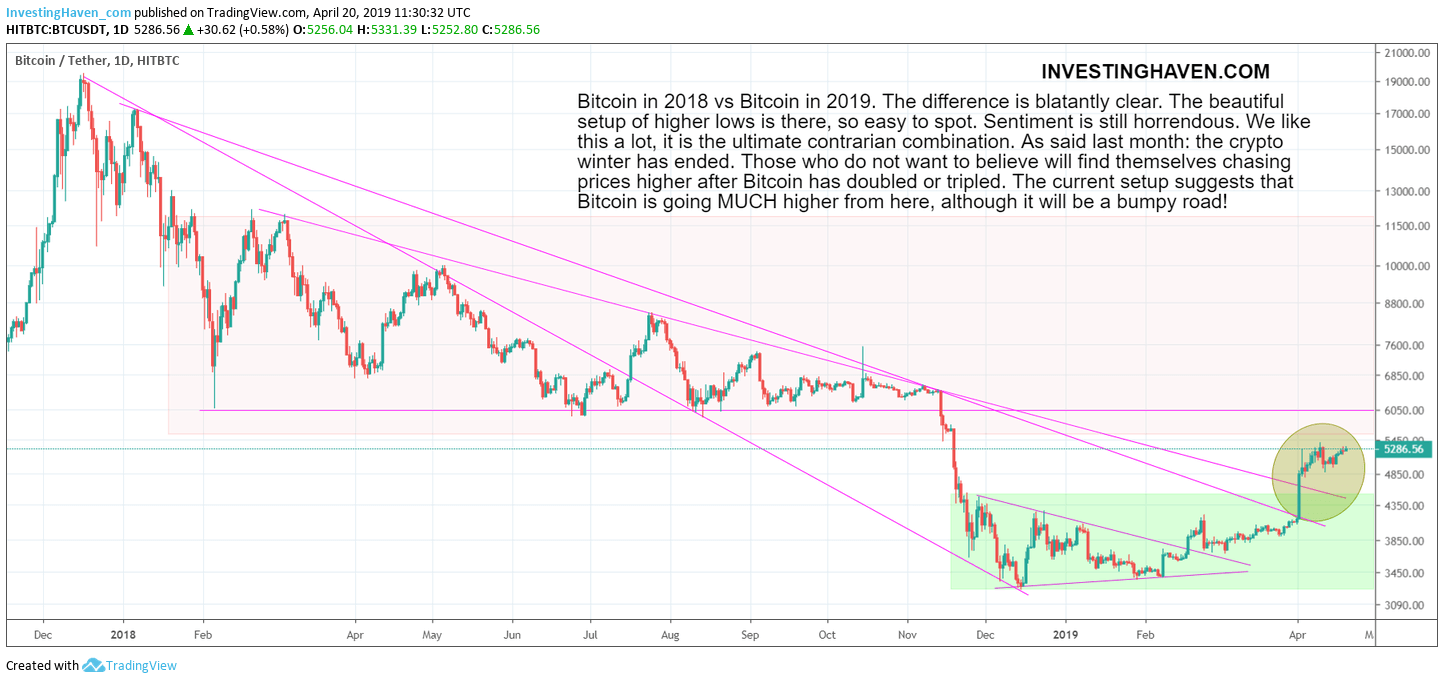

The yellow circles on below charts are the ones that really matter.

Our conclusion is simple and straightforward: crypto is alive and kicking. With each passing day that Bitcoin remains stable around current price levels (while sentiment becomes worse) there is additional confirmation that our Bitcoin forecast will materialize. We like this, a lot even!

Thinking to buy Bitcoin? Think twice, as we feature several other cryptocurrencies with a more outspoken intrinsic value. Get instant access to our crypto investing research service >>

** April 14th, 2019 **

Bitcoin confirms breakout. New crypto bull market is a fact!

InvestingHaven’s followers received 9 months ago (!) the confirmation of the end of the crypto winter. As per our research it was a question of ‘when’ (not ‘if’). The secular bull market was about to resume in 2019, is what we said last year. And the evidence is now there, finally!

Note that InvestingHaven followers were among the first ones in the world to get an official market call. In February we called for the end of the crypto winter, although not confirmed at that point in time.

- In the public domain InvestingHaven’s research team flashed a cryptocurrency alert forecasting that the Crypto Winter Ended.

- More importantly, in the restricted research area we flashed an alert to premium members with the following subject. We wrote: “Buy alerts everywhere. As forecasted, 2019 is a great year to accumulate extremely undervalued crypto assets!”

One of the sentences in this research report in the form of a crypto alert to its members said: “This alert has the largest number of buy signals we have ever flashed in our blockchain & cryptocurrency investing service since its inception!”

This is one of classic cases where people are so beaten down by ever declining prices. Consequently, they could not believe the crypto winter ended. Not many people got in at the low prices of January and February of 2019. Strange, as we were very (!) vocal about it.

How could we know?

As per our 50 cryptocurrency investing tips:

Tip # 49: By far the most important crypto investing tip is that ‘bear markets beget bull markets‘. It is at the depth of the cryptocurrency bear market that all sellers leave, which makes place for a market to consolidate and set the basis to turn into a future bull market.

That’s how it mostly goes. A new bull market starts at peak pessimism. Sentiment is a great barometer to know when bear markets turn into bull markets, and vice versa. The timing is right at extremes. January 2019 was really extreme in terms of crypto sentiment.

The message of the Bitcoin chart

Anyone who is open to read a chart sees what happened on Bitcoin’s chart in the month of April 2019.

- A GIANT breakout took place on April 2nd, 2019.

- The breakout is confirmed after 18 trading days as it continues to trade ABOVE its bear market trendlines.

- This week’s formation suggests Bitcoin is moving higher (see setup within the annotated circle).

We have to warn readers for a bumpy road. It will not be one straight line in which prices will move up.

Bitcoin’s price forecast of $25k is still valid, and more valid than ever before!

However, given the breakdown of last November / December we believe the forecast may be delayed with 9 to 15 months.

[Ed. note: on April 2nd, 2019 the new crypto bull market started. Sign up for InvestingHaven’s blockchain & cryptocurrency investing service to get access to how to play the new crypto bull market, a selection of 10 best cryptocurrencies to invest in.]