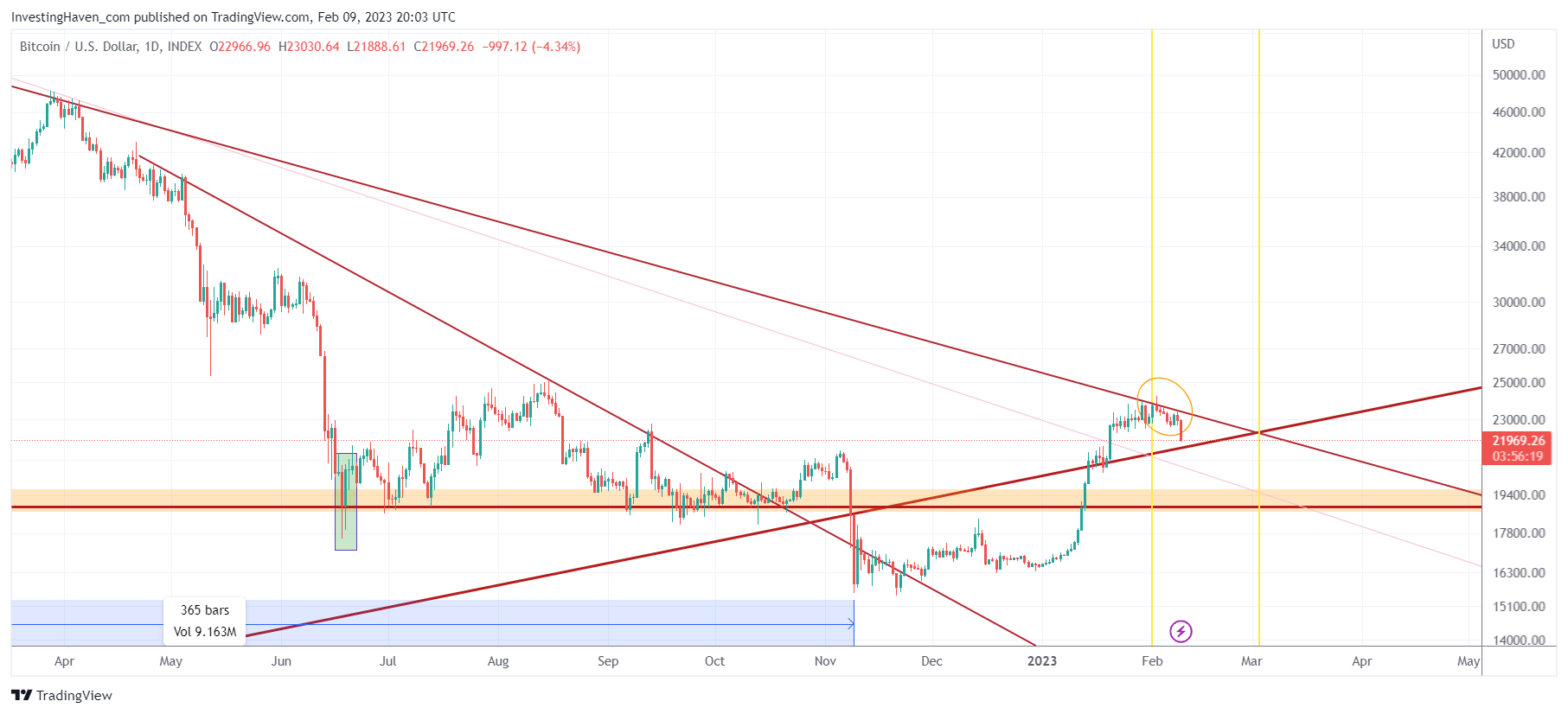

Bitcoin is entering a ‘high tension’ area. If anything, a market in such a ‘high tension’ area on its chart is most of the times unable to create a bullish momentum trend. Tension needs to be released first, after which a bullish momentum can start. The pattern that typically comes with this ‘event’ is a reversal. Note that this is one of the many principles that is a guiding principle in our crypto investing research service. It is even one of the underlying principles that we applied when we wrote our 5 Cryptocurrency Predictions For 2023 back in October.

Bitcoin is our leading indicator for crypto markets.

Although we firmly believe that ‘BTC dominance’ will disappear over time, it remains a good leading indicator for broad based momentum in crypto.

On the other hand, though, we believe that 2023 will be characterized by bi-furcation in crypto markets. We explained this in great detail in our annual forecast. It already got confirmed in the first month of the year, making our public crypto forecast already stand out of the crowd (in terms of quality), as evidenced by The Artificial Intelligence (AI) Frenziness Is Hitting Crypto Markets.

That said, what do we see on the Bitcoin chart currently?

First, BTC did hit resistance, strong resistance. Any market that is unable to clear resistance will move back to support before it can re-attack resistance.

Second, several trendlines coincide in the 19-22k area in the period February & March. This is the ‘tension’ we were talking about in our introduction. As seen, as of April, there is only one trendline above 22k which suggests that IF Bitcoin is able to get back to 23k in April/May it should be able to clear that resistance level.

Lastly, broad markets are struggling lately to move higher. As said, Leading Indicators Confirming A Pullback Is Underway. When broad markets get volatile, crypto is hardly ever escaping it.

So, for multiple reasons, we believe that BTC will move from resistance (early Feb) to support (mid-Feb to mid-March), after which it can re-attack resistance with a higher confidence level to stage a breakout.

In our crypto research service, we will be tracking relative strength in our watchlist of 30 tokens. We also do expect to hit at least one unicorn (a multi-bagger) before the start of the summer.