KEY TAKEAWAYS

- The UK now offers safer and smoother crypto access thanks to FCA registration and EMI-licensed exchanges that protect GBP deposits.

- EMI licences improve GBP transfers, separate client funds, and reduce risks during deposits and withdrawals.

- Choosing the right exchange depends on your needs: simplicity, low trading costs, strong security, or an all-in-one investment app.

- Always verify FCA status and test GBP deposits/withdrawals before committing, especially for long-term or high-value holdings.

Regulated UK exchanges now offer safer GBP transfers, clearer custody protections, and diverse features that help investors trade, earn, and manage crypto confidently.

If you are in the UK and curious about investing in crypto in 2026, you now have more good options than ever.

Better payment rails, clearer regulation, and new banking-style features from exchanges make it easier to buy, hold, and move between GBP and crypto.

Ready to invest? Here are the 5 best crypto exchanges in the UK for 2026.

These platforms stand out today for their mix of safety, ease of use, product features, and fair pricing.

RELATED: 10 Regulated FCA-Approved Crypto Exchanges In The UK (2025)

The Top Crypto Exchanges In The UK

Below are the best crypto platforms in the UK:

- eToro

- Coinbase

- Kraken

- Crypto.com

- Gemini

1. eToro

eToro (UK) Ltd is FCA-regulated and combines crypto trading with stocks, ETFs, commodities, and forex in one app. This makes it a good choice if you want both traditional and crypto assets under one roof.

GBP deposits use local payment rails and are usually fast. eToro also offers CopyTrader, letting beginners mirror experienced traders’ moves.

Pros

- Easy for beginners, intuitive interface.

- Combines crypto with other investments.

- Social trading & copy portfolios help new users.

- FCA-regulated for UK users.

Cons

- Fees built into spreads can be higher than maker/taker models.

- Withdrawal fees (e.g., £5) apply.

- Not many advanced trading tools.

Fees

- About 1% spread fee on crypto trades.

- £5 withdrawal fee.

- No GBP deposit fee, but currency conversion fees can apply.

Who It’s Best For

Beginners and UK investors who want an all-in-one app with simple pricing and social trading tools.

RECOMMENDED: eToro Review 2025: Is It Safe, Legit & Worth It?

2. Coinbase

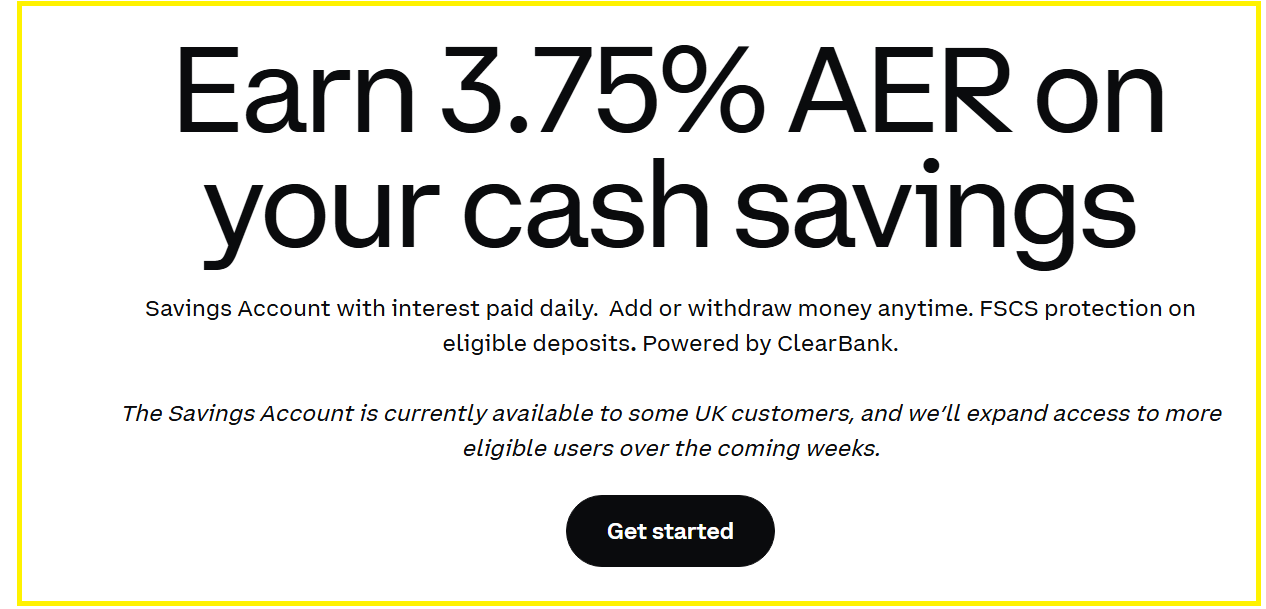

Coinbase offers a clean, easy-to-use interface which is ideal for people new to crypto. For UK users, it now provides a savings account with a 3.75% AER on GBP balances. Interest applies daily and deposits are held by a regulated partner bank.

This makes it simple to earn interest on pounds before converting them to crypto whenever you want.

Pros

- Very simple and clear interface.

- FCA-registered and highly trusted.

- Fast GBP deposits.

- Large selection of coins.

Cons

- One of the higher fee structures among UK exchanges.

- Customer support is sometimes slow.

- FCA recently fined a Coinbase UK unit over compliance lapses, showing the importance of checking risks.

Fees

- Standard fees often around 1.49% + a spread.

- Lower fees possible on Coinbase Advanced (maker/taker model).

Who It’s Best For

New UK users who prioritise ease of use and trustworthiness, even if that means paying a little more in fees.

RECOMMENDED: 10 Best Crypto Exchange Or Apps in 2025

3. Kraken

Kraken prioritizes security, control, and flexibility. It provides a tiered maker/taker fee model: as your monthly trading volume increases, fees drop. That makes it cost-effective for active traders.

Kraken also supports staking on certain tokens, and advertises returns; for example, bonded Ethereum staking may offer up to 4.5% APR for eligible users.

Since Kraken in the UK now holds an Electronic Money Institution (EMI) license, GBP deposits and withdrawals are smoother and faster.

Pros

- Transparent, predictable maker/taker fee model.

- FCA-registered and secure platform.

- Supports staking rewards on many cryptos.

- GBP deposit/withdrawal support.

Cons

- Interface feels more old-school and less beginner-friendly.

- Customer support can be slower than rivals.

Fees

- Competitive 0.02%–0.26% maker/taker fees depending on volume.

Who It’s Best For

Intermediate/advanced traders and UK users who want low fees and strong security with staking potential.

4. Crypto.com

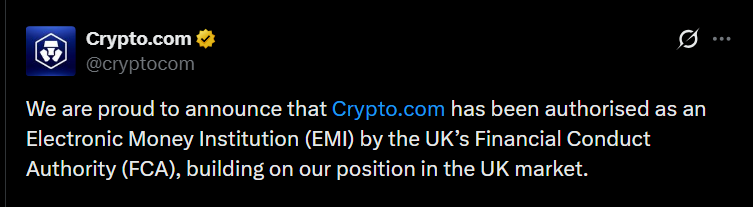

Crypto.com offers many tools in a single app. The company received EMI authorisation from the UK’s financial regulator, giving it the ability to handle GBP deposits and withdrawals under regulated e-money rules.

Pros

- Broad crypto selection and trading promotions.

- Prepaid card lets you spend your crypto easily.

- Rewards and cashback options.

Cons

- Some users say withdrawal fees can be high depending on method.

- Fee structure more complex than simple exchanges.

Fees

Who It’s Best For

UK users who want a versatile app that combines crypto investing with spending and rewards.

5. Gemini

Gemini takes compliance and custody seriousness seriously. In the UK, it operates under an EMI structure, which helps it handle GBP deposits securely and separate client funds from company funds. This is important for deposit safety.

Pros

- High security and regulatory focus.

- Separate custody options for larger investors.

- Easy to use interface with pro tools available.

Cons

Fees

- Roughly 0.35%–1.49% depending on trading mode.

Who It’s Best For

UK investors prioritising fund security and compliance over ultra-low fees or maximum coin choice.

How UK Crypto Regulation Works

Under current rules, any service in the UK that exchanges crypto for money or provides crypto custody must register with the Financial Conduct Authority (FCA) under the Money Laundering Regulations.

Exchanges may also need an Electronic Money Institution (EMI) license.

EMI licensed exchanges must keep client money separate from company funds and follow e-money regulations.

This improves the safety and clarity of GBP deposits and withdrawals.

Importantly, FCA registration does not guarantee full protection for crypto holdings.

Crypto assets themselves remain outside many traditional financial safeguards, even if fiat balances may benefit from e-money protections.

This makes it crucial for users to verify the firm’s status on the FCA register before moving any money.

How To Choose The Right Exchange

- Check that the platform is registered with the FCA and, if handling GBP, that it has EMI authorisation. This affects how your money is held and your ability to deposit and withdraw safely.

- Make a small test deposit and withdrawal in GBP. That will show you how fast the rails are and whether any hidden fees or delays apply.

- Compare cost and usability. Have a look at live trade fees for the coins and order sizes you expect to use. Also check what custody options are offered; for instance, whether the platform offers cold storage or has insurance for holdings.

If you plan to keep large sums or hold long-term, treat these checks as essential before you commit.

Conclusion

UK crypto exchanges now offer safer, faster, and more versatile ways to trade and hold digital assets.

Choosing a regulated platform with clear GBP handling, transparent fees, and strong security ensures your funds and trades remain protected and efficient.