Avalanche delivers speed, flexibility, and real-world use in crypto. These five strengths make AVAX a compelling choice for long-term investors.

Not every blockchain network can deliver both performance and real usage.

Avalanche (AVAX) stands out because it combines fast transactions, growing adoption, strong security, and clear token utility. While investors often focus on price swings, the real value lies in what the crypto enables.

Below are five solid reasons to buy AVAX today.

RELATED: How to Buy Avalanche (AVAX) in the USA: Simple Guide

1. High Performance and Quick Finality

Avalanche’s consensus design lets it confirm transactions in well under a second. Its structure uses a set of validator sampling steps, rather than requiring every node to vote on each transaction. This reduces bottlenecks and boosts throughput.

The architecture splits responsibilities into three chains (X, C, P), keeping processes modular and efficient.

Further, Avalanche supports “subnets” (custom chains) that let projects scale without overloading the base network.

Because of this speed and scalability, Avalanche can host high-volume dApps, gaming platforms, DeFi, and tokenized assets without lag or high fees.

2. Strong Ecosystem Growth and Developer Activity

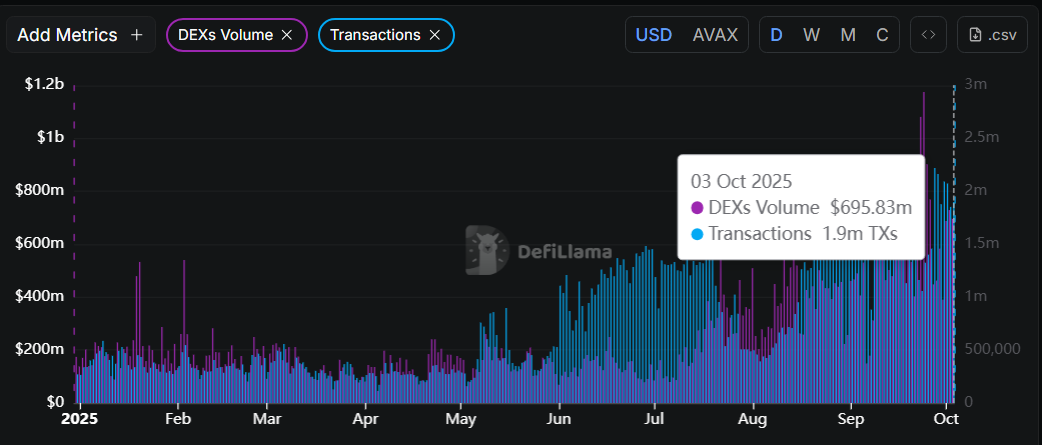

Avalanche’s DeFi ecosystem now handles billions in daily volume. For instance, its DEXs recently recorded over $690 million in trading volume, with around 1.92 million transactions executed in a single day.

Across chains, active addresses and new users continue to climb.Several well known projects (like Aave, Uniswap, Curve) have deployed on Avalanche, increasing interoperability with Ethereum tools.

The availability of grant programs, developer tooling, hackathons, and a supportive community also helps sustain growth momentum.

This expanding ecosystem means more use cases and more demand for AVAX over time.

RECOMMENDED: Which Crypto Is More Likely to Be a Millionaire Maker? XRP vs. Avalanche

3. Real-World Asset Tokenization and Institutional Use Cases

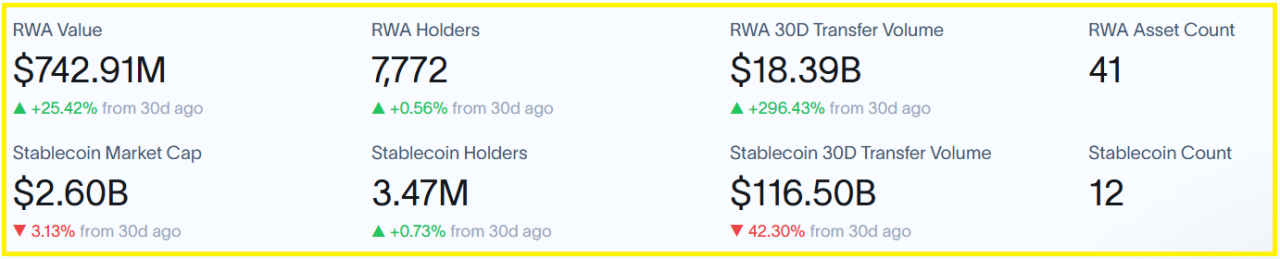

Avalanche supports significant activity in tokenized real-world assets (RWAs). It currently has over $18.39 billion in RWA transfer volume across 41 different asset types.

In one notable case, New Jersey’s Bergen County committed to migrating $240 billion of real estate deed records onto Avalanche’s blockchain.

Tokenization reduces friction because processes like loan underwriting, settlement, and transfer become faster and cheaper via smart contracts.

Many institutions and asset managers are exploring or already adopting Avalanche for these purposes. These real uses tie the network to tangible financial activity, not just price speculation.

RECOMMENDED: Avalanche Price Prediction 2025-2030

4. Security, Decentralization, and Protocol Soundness

Avalanche is open source and has no minimum hardware requirement for nodes, lowering barriers to participation.

The minimum stake to run a validator is 2,000 AVAX on the primary network, which makes node operation accessible.

Its architecture splits tasks: the P-chain handles staking and validators, the C-chain handles EVM smart contracts, and the X-chain handles assets. This isolates tasks and strengthens resilience.

The consensus model (the “Avalanche family”) has been praised by experts for its safety, liveness, and resistance to adversarial behavior. Generally, this setup helps keep the network secure, decentralized, and robust over time.

RECOMMENDED: Avalanche (AVAX) vs. Polkadot (DOT)

5. Tokenomics, Utility, Liquidity, and Upside Potential

AVAX is not just a token, it is central to the Avalanche network. It pays fees, secures subnets, and is used for staking and governance.

Every transaction burns AVAX tokens, which creates a natural deflationary pressure when usage is high.

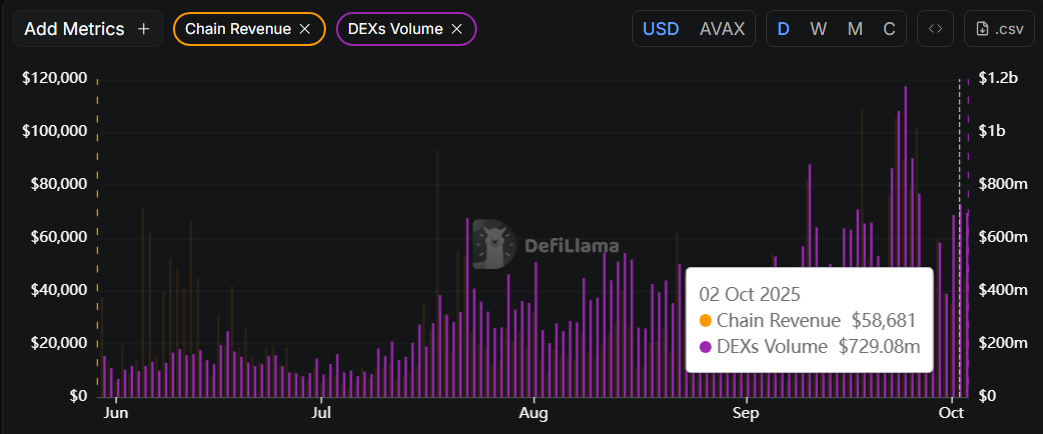

According to DefiLlama, daily chain revenue (fees) recently reached tens of thousands of dollars, while daily volume on the chain often exceeds hundreds of millions.

The circulating supply is around 422 million AVAX, out of a maximum of 715.74 million. Growing demand, coupled with limited supply and burning, gives AVAX real upside over time as usage increases.

Conclusion

Avalanche stands out because it combines speed, real usage, strong security, and a meaningful token model. It is a network ready for real finance and growth, not just hype. Of course, no crypto is risk free. There is competition, regulation, and volatility issues.

But if you are looking for a blockchain with real traction, institutional ties, growing developer interest, and deep technical grounding, we recommend you invest in Avalanche.

Which Crypto Should You Invest In Right Now?

For alerts on the key crypto assets that are primed for investment right now you should consider Join the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’ll be following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)