Bitcoin Cash keeps payments cheap and fast. It combines low fees with a limited supply and ongoing upgrades that keep it practical for real-world use.

Bitcoin Cash (BCH) was created to make cryptocurrency work better as money. It came from Bitcoin’s original code but focuses on low-cost, everyday transactions instead of just long-term holding.

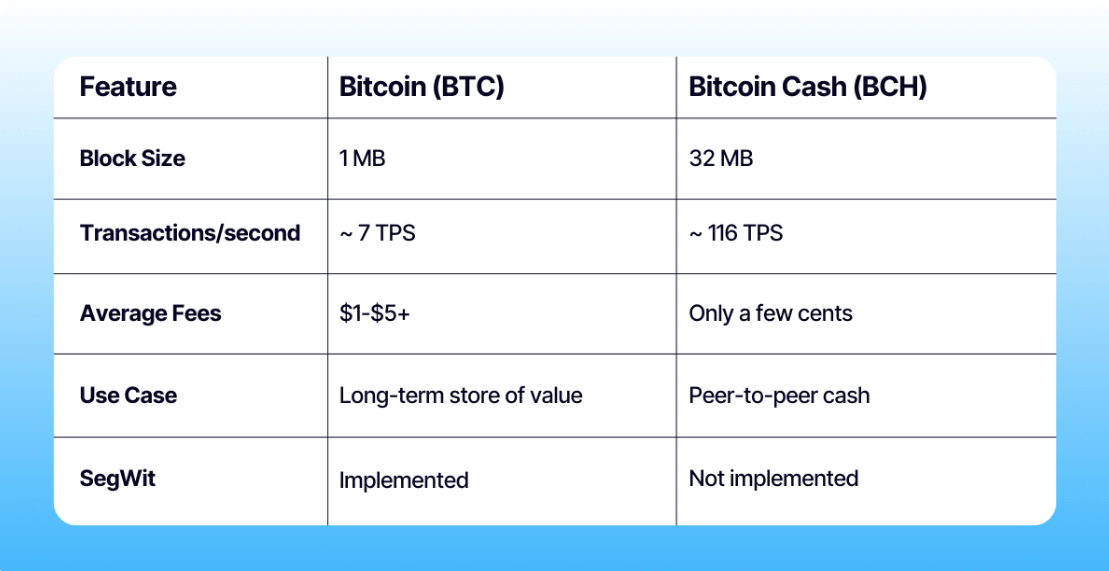

With its larger block size, BCH can process more payments per block, keeping transaction costs low and confirmations quick.

Below are five reasons to buy BCH.

1. Built For Payments: Low Fees And Fast Confirmations

Bitcoin Cash was designed to handle many transactions at once. Its larger blocks mean more space for payments, keeping fees small and stable even when activity increases. On average, sending BCH costs less than $0.01, while Bitcoin transactions can cost several dollars during busy times.

Low fees make BCH ideal for everyday use; buying coffee, sending small tips, or transferring funds across countries.

Because transactions confirm quickly, it feels closer to real cash payments, which helps both senders and merchants. Affordable, fast transfers make BCH one of the few cryptocurrencies still practical for daily spending.

RELATED: 5 Reasons to Invest in Bitcoin Cash (BCH) and 1 Reason Not To

2. Fixed Supply And Predictable Issuance

Like Bitcoin, BCH has a maximum supply of 21 million coins. This cap means new coins cannot be created once the limit is reached. The steady release schedule also follows a known pattern, with mining rewards halving roughly every four years.

This fixed supply gives BCH scarcity, which supports its long-term value. Many investors see this as an advantage compared to fiat currencies, which can be printed without limit. The difference is that BCH combines this scarcity with usability; it can be held as a store of value and spent without high fees.

3. Growing Merchant And Payment Support

Over the years, BCH has built real payment infrastructure. Several wallet apps and payment processors allow merchants to accept BCH directly or convert it into local currency instantly. Businesses can now take BCH payments online or in person using simple QR codes or checkout plugins.

Lower processing costs are another advantage. Merchants pay much less in fees than they would with traditional card networks. Faster settlement and reduced middlemen make BCH appealing for small businesses, freelancers, and cross-border sellers who want quick, direct payments.

4. Active Development And Network Upgrades

Bitcoin Cash continues to evolve. Developers maintain and improve the network through scheduled updates that keep it secure and functional.

One key addition was “CashTokens,” a feature that lets developers create tokens directly on the BCH blockchain. This expands what the network can do beyond simple payments.

Active development means BCH isn’t stuck in the past. Regular upgrades help it stay efficient, compatible with modern wallets, and adaptable to new BCH use cases.

For long-term holders, an active developer community signals that the network is being maintained and improved over time.

5. Real Use Cases

Bitcoin Cash serves clear, lasting purposes: sending money across borders, making micropayments for online content, and handling small transactions where traditional systems are too costly.

For example, a worker sending remittances home can use BCH to avoid high transfer fees. A creator can accept small payments from fans without relying on costly payment platforms.

These are simple, universal needs that are not going away anytime soon. BCH’s low costs and global reach make it a useful tool for these everyday payments.

Conclusion

Bitcoin Cash remains one of the few cryptocurrencies designed for real-world spending. Its low fees, fast confirmations, fixed supply, expanding merchant support, and active development give it lasting relevance. While prices can be volatile, BCH continues to fulfill the idea of electronic cash that anyone can use. For investors who want both utility and long-term potential, BCH deserves a closer look.

The easiest way to buy Cryptocurrencies is through a trusted crypto exchange like Moonpay, Coinbase, or Uphold. These platforms allow users to purchase and trade crypto instantly from any device, including smartphones, tablets, and computers.

Buy Crypto NowCrypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here.

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)