BNB combines regular utility use and shrinking supply while strong liquidity and active development add steady, practical demand.

BNB serves as the native token for Binance and BNB Chain. It powers on-chain transactions, lowers trading fees on Binance, and enables staking and validator activity.

Today BNB ranks among the top cryptocurrencies, with a market cap around $143 billion and a circulating supply of about 139.2 million.

These figures reflect steady exchange use and on-chain demand. The blend of daily utility and supply controls gives BNB a unique position for long term holders, making it one of the best cryptos to buy.

Let’s look at the top reasons to buy BNB today.

1. Native Utility Across A Huge Ecosystem

BNB acts as the primary token for transaction fees, smart contract gas, and other services across the BNB Chain. Traders use BNB to get fee discounts on Binance, which creates recurring demand every time someone trades.

Users stake BNB to support validators or run nodes, and projects use BNB for token sales, launchpads, and in-app payments. BNB also appears in Binance products such as savings, lending, and payments, so holders find practical ways to use it beyond price speculation.

Because BNB serves both a major exchange and a live smart-contract network, real world activity on either side increases token utility and recurring demand, and real usage growth.

RECOMMENDED: BNB Price Predictions 2025-2030

2. Built In Deflationary Mechanics

BNB includes a scheduled burn program that removes tokens from circulation. The protocol moved to an auto-burn model that adjusts burn size based on BNB price and block activity.

Binance and the BNB Chain publish regular burn reports. For example, a recent quarterly burn removed about 1.6 million BNB, which had a market value over $1 billion at the time.

A predictable reduction in supply creates a structural scarcity element when on-chain activity or exchange volume rises.

Holders can track burns each quarter, which improves transparency and lets investors link network activity to confirmed supply changes directly.

3. Low Fees And High Scale For Everyday Use

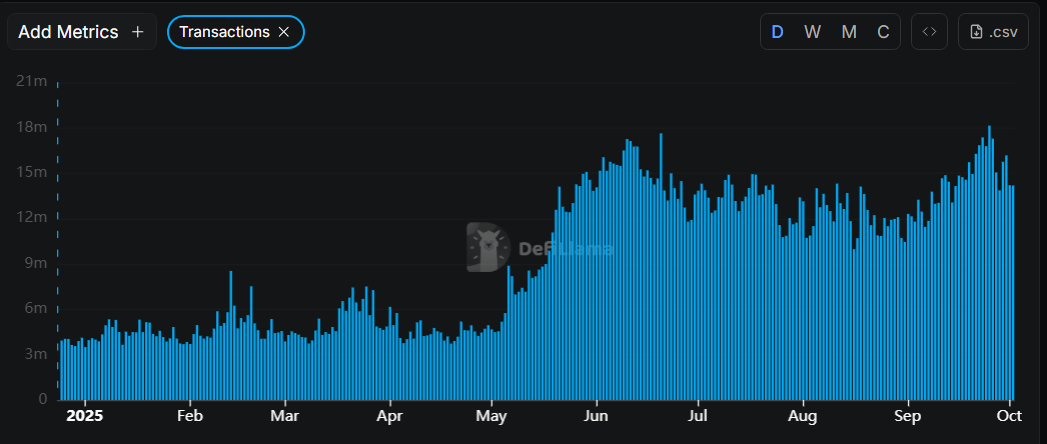

BNB Chain handles high transaction volume at very low cost, which makes on-chain activity practical for retail users. Chains metrics show millions of daily transactions and millions of active addresses, with BNB Chain reporting over 14 million transactions in a 24 hour snapshot.

Daily chain fees remain low compared with legacy smart contract chains, which keeps small payments, NFT minting, and micro DeFi actions affordable. For investors, tokens that serve as gas tend to see consistent usage demand because each transaction requires the native token.

Lower fees encourage developers to build apps with frequent small interactions, which produces more transactions and practical token demand for everyday users across markets.

RECOMMENDED: Top 3 Cryptos for ETF Gains: BTC, SOL, BNB

4. Deep Liquidity And Exchange Integration

BNB benefits from deep liquidity and broad exchange coverage, which lowers slippage for buyers and sellers. Major exchanges list BNB in many fiat and crypto pairs, and global trading venues show strong daily volumes for both Binance overall and the BNB market.

A healthy 24 hour trading volume for the token and large order books let investors enter and exit positions with less price impact than smaller tokens. Custodians, brokerages, and major wallets commonly support BNB, improving access for retail and institutional users.

Binance posts billions in daily volume, and BNB often records multi-billion 24 hour volume, which supports deep markets for active traders.

5. Developer Activity, dApps And Institutional Interest

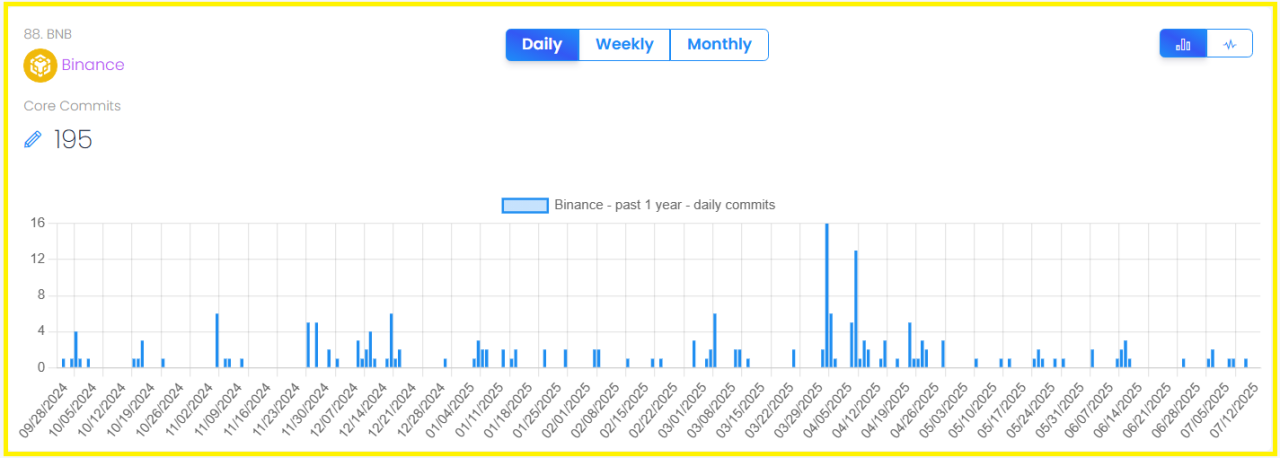

BNB Chain shows active development and a growing set of dApps, which creates long term demand for the native token. Tracking tools record sustained GitHub commits across core repositories and dozens to hundreds of active projects building on the chain.

DeFi and NFT applications on BNB Chain contribute measurable TVL and user activity, which translates into gas fees and token use. Institutions and firms occasionally announce sizeable allocations or purchases of BNB, which can add another layer of demand beyond retail traders.

A recent developer snapshot recorded 195 commits across core repositories, and on-chain dashboards report billions in DEX volume each day.

Together, developer momentum, live dApps, and occasional institutional interest form a practical foundation that supports ongoing token utility.

RECOMMENDED: Top 3 Cryptos To Buy As A Beginner

Conclusion

Among the many reasons to invest in BNB include utility, predictable supply burns, low fees, deep liquidity, and active development. These five pillars create lasting demand, but you should research risks and size positions carefully before investing.

Which Crypto Should You Invest In Right Now?

For alerts on the key crypto assets that are primed for investment right now you should consider Join the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’ll be following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)