Chainlink’s real-world utility, institutional partnerships, and role in asset tokenization make LINK a strong long-term investment opportunity.

As crypto markets continue navigating a turbulent macro environment, Chainlink (LINK) stands out as one of the few projects showing both resilience and real-world relevance.

Known as the leading decentralized oracle network, Chainlink acts as the connective tissue between blockchains and external data sources — a crucial function as smart contracts continue expanding beyond simple token transfers. While LINK’s price hovers around $13.05, down about 37% year-to-date, the asset’s underlying fundamentals are strengthening at a rapid pace.

Below, we break down five compelling reasons to consider buying Chainlink now.

1. Institutional Adoption and High-Profile Partnerships

Chainlink has made major strides in winning institutional trust, forming a range of high-impact partnerships that validate its infrastructure. In June 2025, Chainlink helped facilitate a groundbreaking cross-border CBDC pilot involving Hong Kong’s e-HKD+ and an Australian dollar-backed stablecoin. Participants included Visa, ANZ, China AMC, and Fidelity — a consortium that sparked an 8% surge in LINK’s price following the announcement.

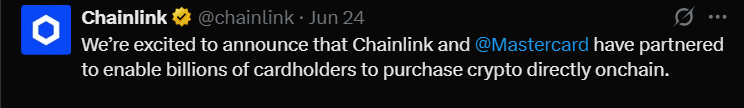

The Mastercard integration is another standout moment. This partnership enables over 3 billion cardholders to access on-chain crypto transactions through Chainlink’s infrastructure, a move that significantly expands its reach into mainstream finance.

Other established partners include Coinbase, PayPal, and multiple asset managers, all of whom rely on Chainlink’s oracles to enable secure, reliable data feeds. These partnerships are not just symbolic — they’re a sign that Chainlink is becoming core infrastructure for the tokenized economy.

2. Technological Leadership in Cross-Chain and DeFi Infrastructure

Chainlink is delivering critical backend technology that powers real-world financial systems. Its Cross-Chain Interoperability Protocol (CCIP) is live and increasingly used to facilitate asset transfers across blockchains — solving one of crypto’s biggest bottlenecks. CCIP is being adopted by major players, including SWIFT pilots and decentralized finance (DeFi) protocols.

According to Chainlink’s own metrics, the network has processed over $22.35 trillion in total value enabled (TVE) and currently secures more than $43.45 billion in smart contract value. It has verified over 17.6 billion on-chain messages — numbers that underscore how deeply embedded it is in crypto’s core infrastructure.

DeFi leaders such as Aave, Compound, and Kamino Finance use Chainlink for accurate pricing data and automation. This level of integration makes LINK not just a speculative token but a token with intrinsic demand tied to actual utility.

3. Accelerating Network Effects and On-Chain Growth

On-chain metrics are painting a bullish picture. New wallet addresses for LINK are growing at the fastest pace since late 2022, and whale activity has surged: nearly 2,000 large LINK transactions (worth a total of $858 million) were recorded in a single week. Meanwhile, exchange balances for LINK are at their lowest since September 2024 — a sign that investors are moving tokens into long-term cold storage.

Chainlink also maintains one of the most active developer communities in crypto. It recently surpassed Ethereum in GitHub commits over a 30-day period, logging 449 contributions. This high level of developer activity bodes well for the network’s future upgrades, performance, and feature expansion — all signs of a living, evolving protocol.

4. Bullish Technical Indicators Support a Rebound

After a prolonged drawdown, LINK is beginning to show signs of technical recovery. The token has broken above its 20-day and 50-day exponential moving averages (EMAs), now acting as support levels around $14 to $15. The relative strength index (RSI) has moved back above 50, indicating growing bullish momentum.

Price action has been consolidating between $14 and $16, building a potential base for a breakout toward the $20–$25 range — historically strong resistance. Analysts believe that if LINK breaks through these levels, a technical rally could be sustained, especially given the institutional flows supporting the ecosystem.

Although some risks remain — such as the potential for oracle glitches or macro-induced volatility — Chainlink’s setup looks increasingly favorable for medium- to long-term upside.

5. Key Player in the Tokenization of Real-World Assets (RWA)

One of Chainlink’s most exciting frontiers is its role in tokenizing real-world assets — a market expected to explode over the next decade. Chainlink’s oracle services are already powering tokenized treasuries, money market funds, and even real estate on-chain. Fidelity, PayPal, Fireblocks, and Coinbase are just a few of the many institutions turning to Chainlink to secure these tokenized products.

The numbers speak for themselves: the tokenized RWA market has grown from under $2 billion just three years ago to more than $13 billion in 2025. Analysts forecast this figure could balloon to $10–$16 trillion by 2030.

As this trend accelerates, Chainlink is well-positioned to become the go-to infrastructure layer facilitating real-world value flows on-chain.

Conclusion

Chainlink is no longer just a speculative DeFi token — it’s becoming a foundational layer of the next financial system.

Backed by blue-chip partnerships, proven technology, strong on-chain growth, and a rising role in tokenized real-world finance, LINK represents a high-potential opportunity amid current market consolidation.

While no investment is without risk, Chainlink’s multi-faceted strengths make it one of the most promising crypto assets for long-term investors looking to gain exposure to the convergence of traditional finance and blockchain.

For those bullish on Web3 infrastructure and institutional crypto adoption, now may be an opportune time to take a closer look at LINK.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)