Kaspa offers instant confirmations, strong security, and impressive capacity for transactions. It launched fairly and continues to gain real community and miner support.

Kaspa is a relatively new blockchain that works differently from Bitcoin or Ethereum. It launched on November 7, 2021, without any pre-mine or early token sale. That means everyone had the same chance to mine or buy KAS from the start.

Unlike most chains, Kaspa uses a special design that allows many blocks to be created at once, instead of waiting for one block to finish before the next begins. This makes transactions much faster and more efficient.

Here are five reasons to buy KAS

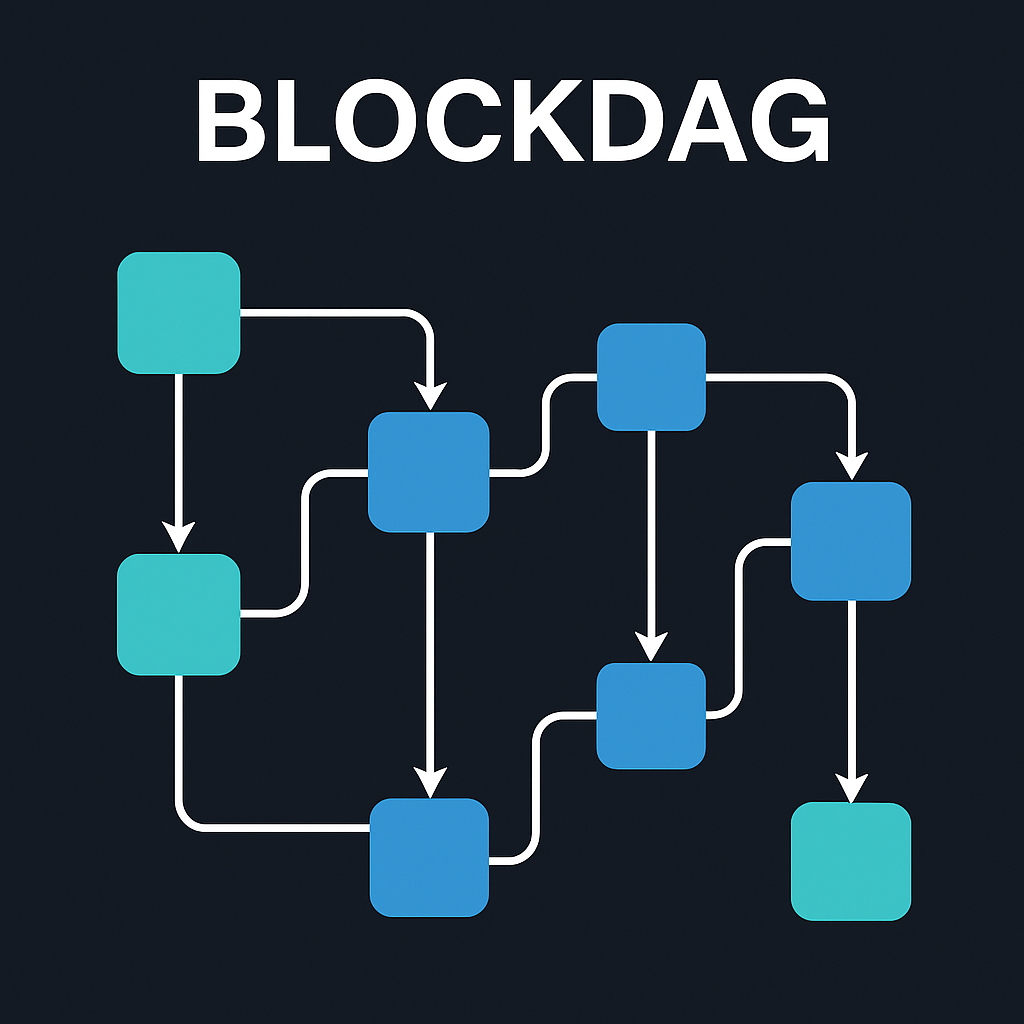

1. BlockDAG Architecture Enables Real Scalability

Most blockchains rely on a single chain of blocks, which often limits how fast they can process transactions. Kaspa uses BlockDAG technology, where blocks can be added in parallel.

Instead of discarding competing blocks, the network keeps them and puts them in order using clear rules. This design reduces wasted work, increases efficiency, and makes the system much more scalable.

Kaspa already runs blocks every second, with research showing it can move toward subsecond block times. For users, this means faster confirmations and a network that can handle high activity without slowing down.

RECOMMENDED: Next Big Cryptocurrency to Boom in 2025: Can Kaspa (KAS) Be the Next Solana?

2. GHOSTDAG And Proof Of Work Provide Reliable Security

Kaspa combines its unique BlockDAG design with proof-of-work, the same security model that has kept Bitcoin safe for more than a decade. The difference is in how Kaspa organizes blocks.

It uses an algorithm called GHOSTDAG, which can handle multiple blocks at once and still agree on a single transaction history. This keeps the network secure while avoiding the delays of older proof-of-work systems.

Kaspa also uses its own mining algorithm called kHeavyHash. It was designed to encourage broad participation by miners instead of concentrating power in a few hands. The result is a network that stays secure, decentralized, and resistant to manipulation.

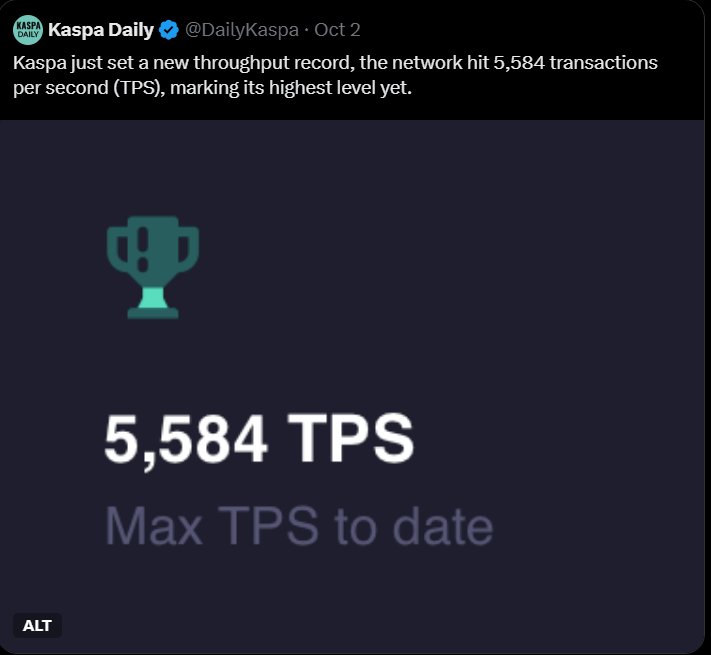

3. High Throughput And Low Latency For Real Use Cases

Speed is one of the most important features for any blockchain that wants to support payments or real-world applications. Kaspa has already shown that it can process up to 5,584 transactions per second (TIPS) in test environments, with block times as fast as 0.1 seconds.

Transactions confirm almost instantly, making it practical for microtransactions, gaming, and day-to-day payments. Unlike chains that require extra layers to achieve speed, Kaspa can already handle this performance directly at the base level.

That long-term ability to manage high demand makes it more adaptable and useful as adoption grows.

4. Fair Launch And Strong Community Development

One of Kaspa’s most attractive qualities is how it started. There was no pre-mine, no early allocations, and no venture capital advantage. The coins were introduced fairly through Kaspa mining, so everyone had an equal opportunity.

That approach has built trust among users and miners, who know the project was not designed to favor insiders. On top of that, Kaspa’s development is open-source and community-led. Anyone can view the code, contribute, or propose improvements.

This openness helps Kaspa avoid the risks that come when a small group of people control the direction of a project. It also gives the protocol staying power, since improvements come from many contributors, not just one team.

RECOMMENDED: KAS Price Prediction 2025 – 2030

5. Growing Miner And Infrastructure Support

Kaspa has also gained strong support from miners and infrastructure providers. The hash rate, which measures the computing power securing the network, has been rising steadily.

Multiple mining pools now support KAS, and both ASIC and GPU miners are active in securing the chain.

On the infrastructure side, more exchanges are listing KAS, wallets are adding support, and tracking tools make it easier to monitor the network. This growth in ecosystem support means Kaspa is becoming more reliable and accessible over time.

A healthy base of miners and infrastructure partners is essential for any blockchain to survive long term, and Kaspa is showing solid progress on that front.

Conclusion

So, should you buy KAS? Kaspa stands out for several reasons. Its BlockDAG architecture allows for real scalability, while GHOSTDAG and proof-of-work keep the network secure.

High throughput and low latency make it practical for payments and everyday use. A fair launch and open development build trust, while growing miner and infrastructure support strengthen its reliability.

For anyone looking at blockchain projects with long-term potential, Kaspa checks important boxes of speed, fairness, and security. Always research further and review the latest data before making any investment decisions.

The easiest way to buy Cryptocurrencies is through a trusted crypto exchange like Moonpay, Coinbase, or Uphold. These platforms allow users to purchase and trade crypto instantly from any device, including smartphones, tablets, and computers.

Buy Crypto NowCrypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here.

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)