Optimism offers lower fees with strong EVM compatibility which supports everyday blockchain use. It also has a growing Superchain and active governance making it a potential long-term bet.

Optimism helps Ethereum scale while keeping the familiar tools and developer experience that make the ecosystem strong.

It reduces fees, speeds up transactions, and supports an expanding network of apps that benefit from shared infrastructure.

These improvements make everyday on-chain activity smoother, from simple transfers to more complex dApps.

With growing liquidity, active development, and a clear governance structure, Optimism continues to position itself as one of the most practical and user-friendly Layer-2 solutions available today.

Here are five reasons investors are buying Optimism.

Top Reasons To Buy Optimism

1. Layer-2 Scaling That Lowers Fees And Speeds UX

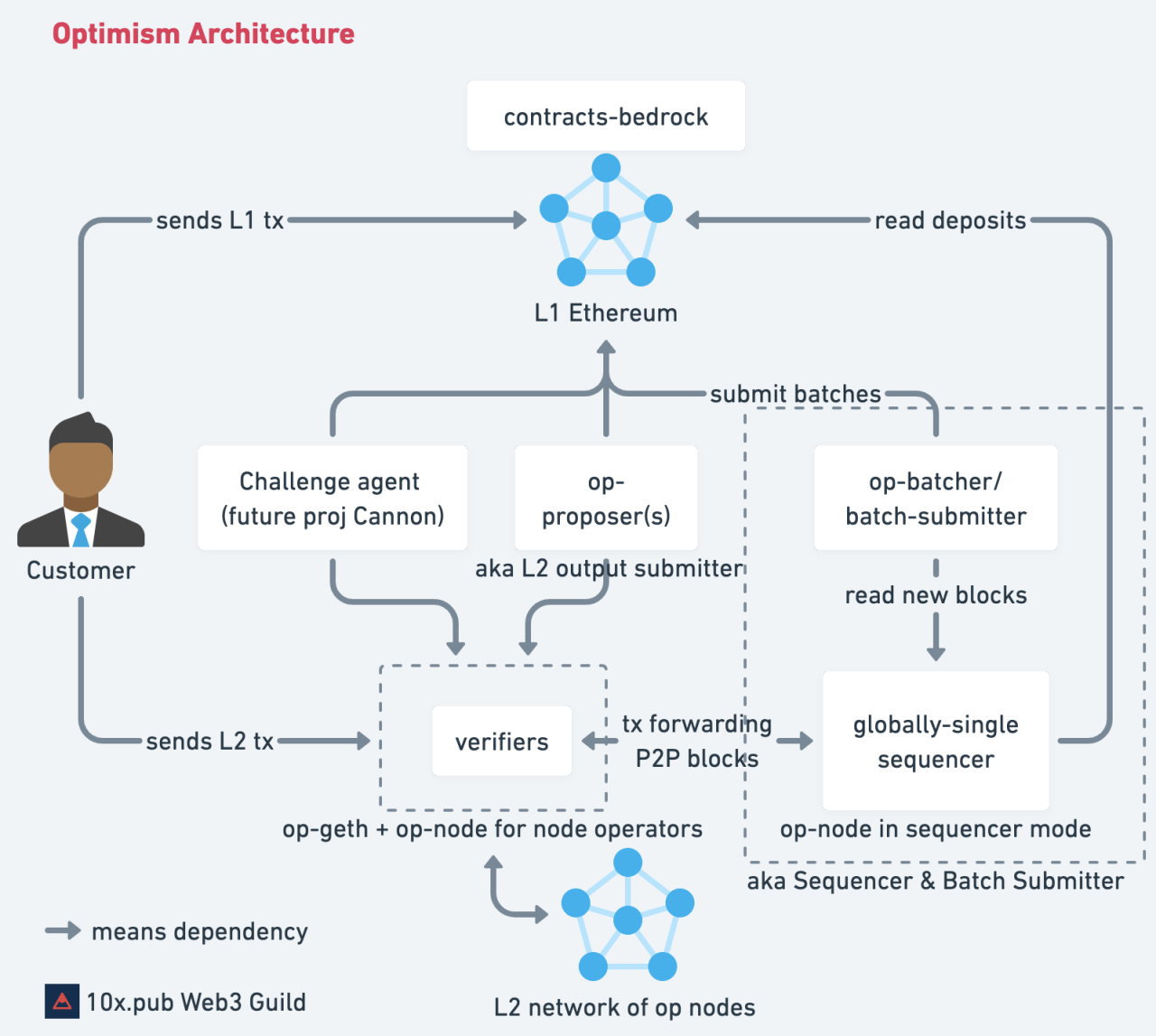

Optimism processes transactions off-chain and settles them on Ethereum, which cuts fees and improves user experience.

Bedrock upgrades made deposits much faster and reduced gas costs for common actions, which has made wallets, games, and trading apps simpler to use.

These improvements remove the usual pain points that make Ethereum feel slow or expensive.

As more people use on-chain apps, platforms that reduce friction gain an advantage, and Optimism has built a reliable track record in this area.

2. A Growing, Money-Attracting Ecosystem

Optimism’s ecosystem shows real traction. Superchain networks hold billions of dollars in total value locked, and active periods often see a strong rise in trading volume.

This is important because capital and users tend to gather where apps, liquidity, and incentives are strongest.

When developers launch new projects on Optimism-compatible chains, they gain easier access to liquidity, partners, and ready-made infrastructure.

That makes it faster to reach users and build sustainable products.

An ecosystem that attracts real value is a practical signal of long-term health that is important to investors.

3. OP Stack And The Superchain Standardize Composability

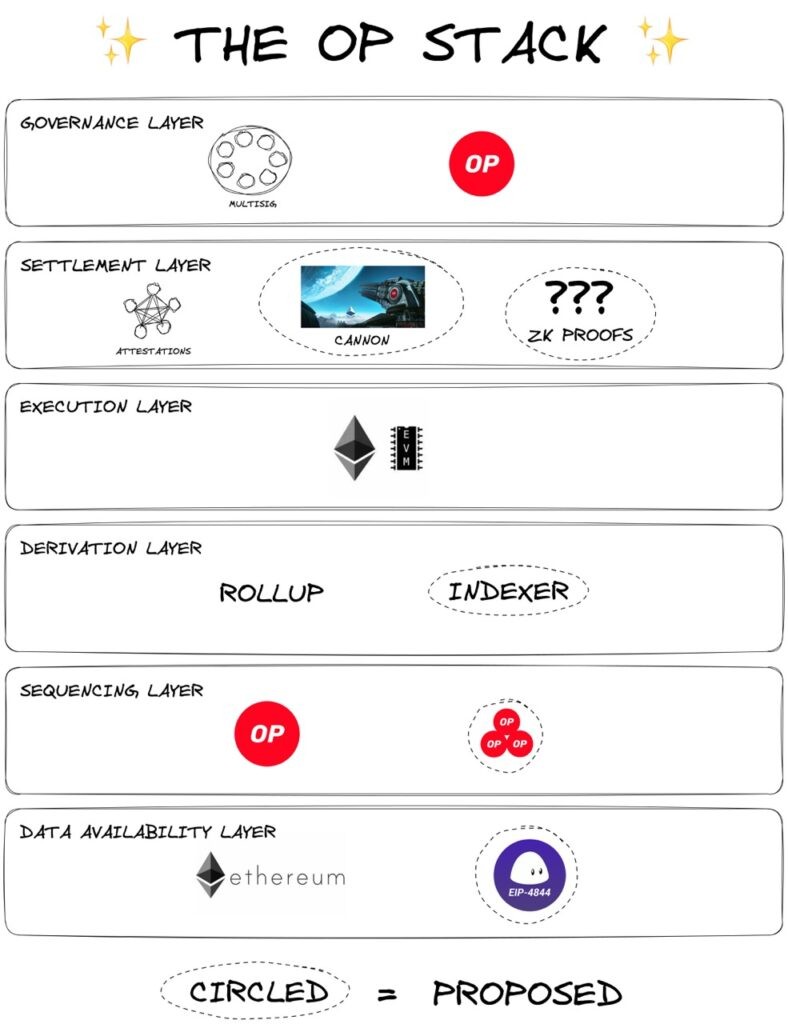

The OP Stack gives developers a simple, open toolset to launch their own Layer-2 chains with predictable behavior.

Many teams are already using it, which creates a shared environment where apps can move across chains with minimal changes.

With the Superchain, these OP Stack-based networks can adopt the same upgrades, the same tools, and often the same security assumptions.

This reduces fragmentation and helps builders avoid reinventing the wheel.

A widely used standard also strengthens integrations with wallets, indexers, and analytics tools, which benefits both developers and users.

4. Token Utility And Governance For Public-Goods Funding

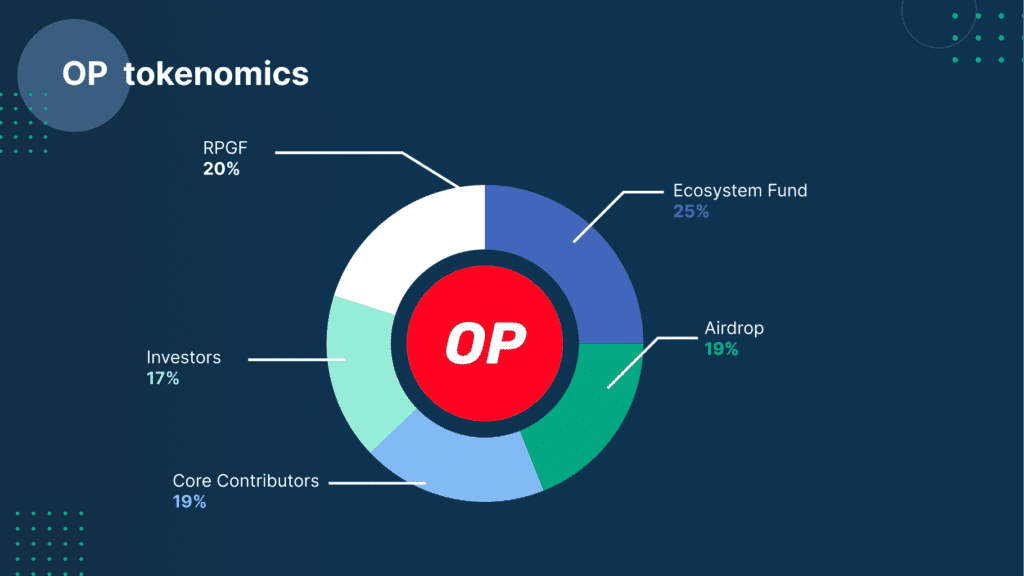

OP plays a direct role in governance and public-goods funding through the Optimism Collective.

Holders vote on proposals, budgets, and long-term roadmap decisions. This gives the token real utility beyond trading.

Circulating supply is around 1.9B OP out of a planned 4.294B total, so investors can track dilution by watching vesting schedules and unlock dates.

Governance has funded infrastructure, research, and ecosystem growth.

This structure helps maintain transparency and builds trust in how funds are managed.

5. Developer Momentum, EVM Compatibility, And Easy Onboarding

Optimism’s EVM equivalence lets developers reuse existing Ethereum tools and smart contracts with minimal changes.

This saves time, cuts costs, and reduces the need for repeated audits.

Wallet support is strong, bridging is straightforward, and onboarding flows are familiar to anyone who already uses Ethereum.

Developer and user activity often increase during incentive programs, showing that Optimism can attract both builders and active participants.

Teams like environments that allow fast iteration, clear documentation, and smooth upgrades, and Optimism delivers on these needs.

Conclusion

Optimism combines lower fees, a strong ecosystem, shared OP Stack standards, meaningful token governance, and smooth developer onboarding.

These features create durable value that does not depend on short market cycles.

If you want to invest in Optimism, review current TVL numbers, circulating supply, and active governance discussions.

Match these with your personal risk tolerance and time horizon. This gives you a grounded, fact-based view before deciding whether OP fits your long-term strategy.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

“I got to tell you, you guys and your charting and your predictions are AMAZING!

I don't know how people can even give you a hard time when you make pullback predictions.

Markets cannot go up forever!”

“I LOVE how you talk about the ‘buy the dips’ times vs the ‘sell for profit’ times

to get more free coins. You have been right sooo many times — it’s actually amazing!”

— Newsletter Subscriber

“Your team puts a huge amount of work into the newsletters and the analyses.

You’ve been doing this for so many years already, and the passion is still there. Respect.”

“Because of your research, I’ve become a much more patient investor. And ‘more patient’

basically means ‘better.’ Over the past few years, my capital has often just stayed unused

rather than constantly invested — and it has paid off.”

“Now that my perspective is strictly long term, I have far more peace in my life. Nothing is more stressful

than constantly wondering what your crypto might do the next day. After seeing firsthand that

long-term investing outperforms trading, the difference is night and day.”

— Crypto Research Subscriber

“As a faithful follower, I really miss the commentaries — the wisdom, the thoughts, the analysis.

Truly appreciate the knowledge you share.”

— Long-Time Follower

What Our Readers Say