KEY TAKEAWAYS

- Pepe’s community remains one of the strongest in the meme coin space, keeping the token relevant through consistent online engagement.

- Broad exchange listings and high trading volumes provide strong liquidity, allowing easy entry and exit for investors.

- The massive token supply creates a low price per coin, appealing to small investors and supporting long-term accessibility.

- The ecosystem is expanding beyond memes, with projects exploring staking, NFTs, and utility-based applications.

- High volatility presents both risk and opportunity, favoring disciplined investors who take a patient, long-term approach.

Pepe’s strong community, wide exchange listings, unique supply model, growing ecosystem, and volatility offer potential for investors who stay patient and informed.

Pepe (PEPE) has grown from a viral meme token into one of the most recognized coins in the crypto market. Its humor and online culture made it popular, but its staying power comes from more than memes.

As of October 2025, Pepe’s market cap is around $3.04 billion, with a circulating supply of about 420.69 trillion tokens. Daily trading volumes often reach hundreds of millions of dollars, showing strong liquidity and active market participation.

While many meme coins rise and fade, Pepe continues to attract attention.

Here are 5 reasons to buy Pepe.

1. Strong Community and Consistent Social Buzz

Pepe’s success starts with its community. Online engagement around PEPE remains among the highest in the meme coin category. Social data platforms report millions of interactions each week and tens of thousands of daily posts mentioning the token.

This strong online presence is more than noise. Active communities keep coins relevant by fueling awareness, liquidity, and exchange listings. The stronger and more consistent the activity, the longer a coin can stay in focus through market ups and downs.

RELATED: 3 Reasons to Buy PEPE and One Reason Not To

2. Broad Exchange Listings and High Liquidity

Pepe’s wide availability gives it a major advantage. It is listed on nearly all major crypto exchanges, including eToro, Binance and Coinbase. These listings make it easy for both retail and institutional investors to buy or sell without complicated steps.

Daily trading volumes often stay above $400 million, confirming deep liquidity. Liquidity matters because it allows investors to enter and exit positions efficiently, without facing huge price changes caused by small orders.

For long-term investors, strong liquidity is a sign of health. Coins that maintain high trading volumes across many platforms tend to attract steady inflows of capital. It also means less risk of being stuck in a position when the market turns.

3. Massive Supply and Price Psychology

Pepe’s tokenomics play a big role in how people view and trade it. The total supply of 420.69 trillion tokens gives it an extremely low price per token. This low entry price appeals to retail investors who enjoy owning large amounts of a token for a small amount of money.

That psychology is powerful. Many investors like the feeling of holding “millions” or “billions” of tokens, even if the total value is modest. This sense of accessibility helps attract new participants, especially during bull markets.

The large supply could also support future microtransactions or tipping systems, if developers build such use cases.

However, investors should understand the trade-off: because of the high supply, it takes significant market cap growth for PEPE’s price to rise meaningfully. Long-term holders should set realistic expectations and focus on gradual appreciation rather than chasing short-term spikes.

RECOMMENDED: Pepe Coin Under Pressure: Whale Dumping Grows When Will Bulls Strike Back?

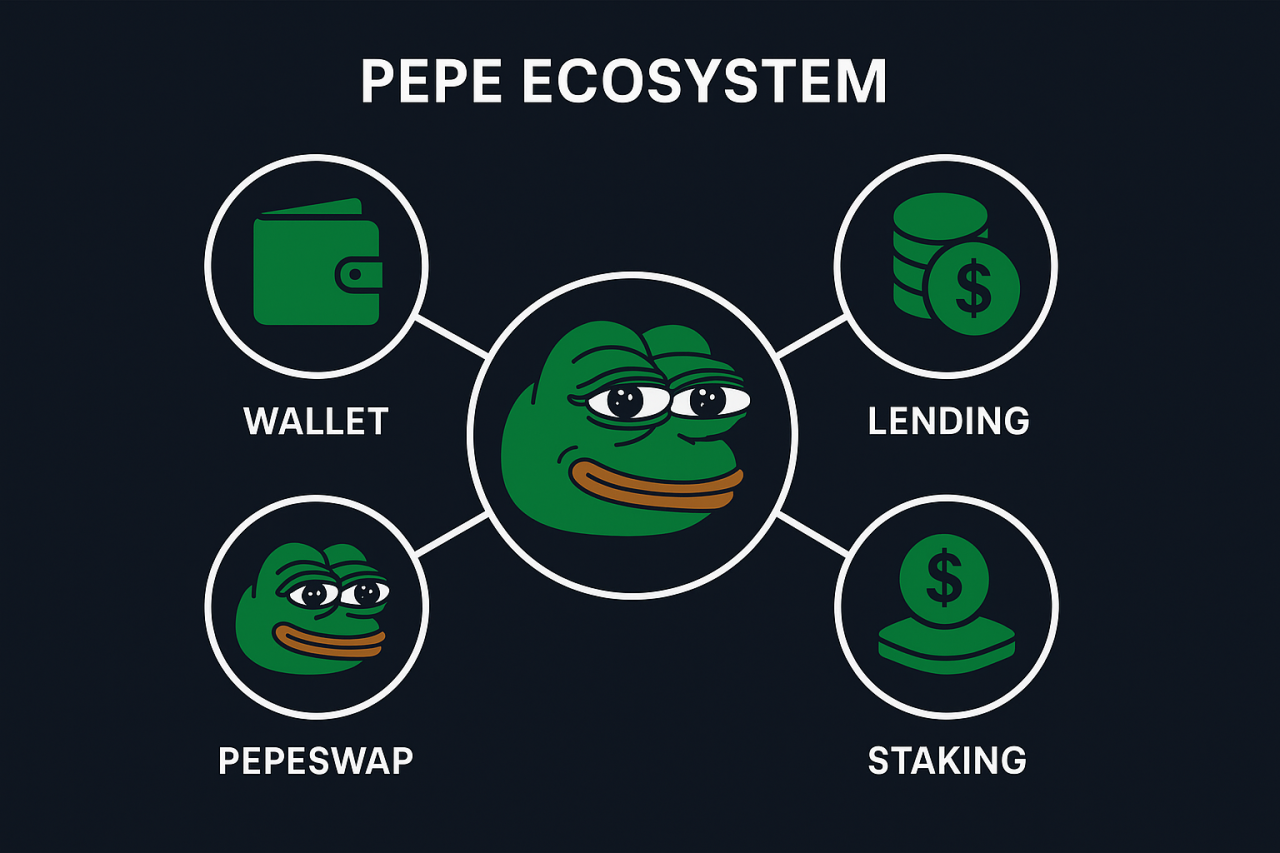

4. Growing Ecosystem and Early Utility Signs

While Pepe started as a pure meme coin, parts of the community and outside developers are experimenting with ways to expand its utility. Some projects are exploring Pepe-themed NFTs, staking options, and community-based governance ideas.

These early signs are important because coins with real-world use or ecosystem growth often last longer. As seen with other meme coins that evolved over time, added functionality can shift perception from “just a joke” to “a usable token.”

Investors should, therefore, watch for verified projects, audits, and active on-chain development tied to PEPE. Growth in wallets, transaction counts, or developer activity would suggest the ecosystem is moving from entertainment toward practical use.

Even small steps toward utility can strengthen the token’s long-term potential and help it weather future market cycles.

5. Volatility Creates Opportunity for Disciplined Investors

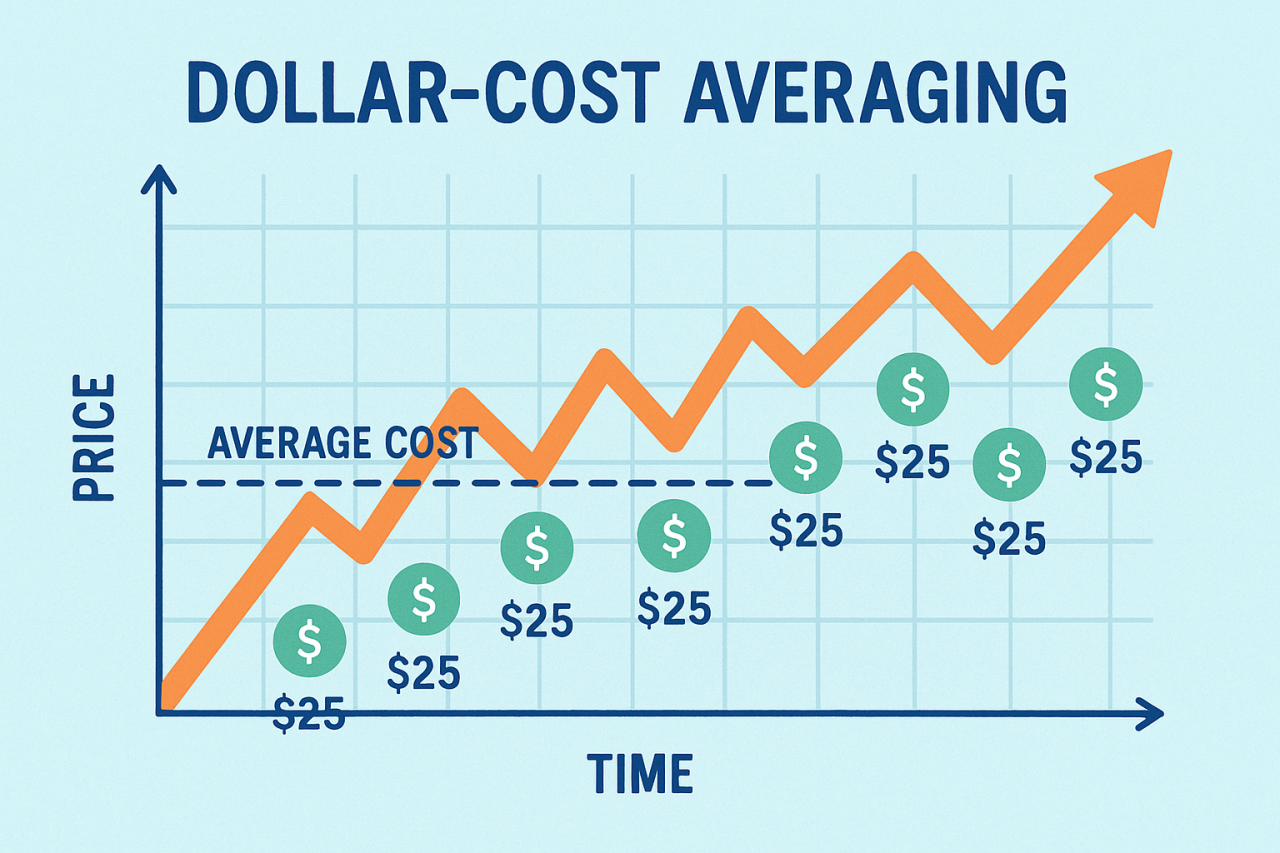

Pepe’s price history shows large swings—sharp rallies followed by deep pullbacks. This volatility can scare some investors, but it also creates opportunity.

For those with a long-term view, buying during periods of low prices and holding through market recoveries can produce strong returns. Using strategies like dollar-cost averaging (DCA) helps manage timing risk and smooths out volatility over time.

However, it’s important to keep allocations small and controlled. Meme coins can move quickly in both directions, so discipline and position sizing are key. Diversify across assets, avoid overexposure, and rebalance after big gains to lock in profits.

RECOMMENDED: Pepe Price Prediction 2025 – 2030

Conclusion

Pepe’s ongoing relevance comes from a combination of factors: a loyal community, wide exchange access, a distinctive supply structure, early ecosystem growth, and strong volatility cycles. Together, they make PEPE one of the few meme coins with real staying power.

Still, investors should remember that meme coins remain speculative. Always do your own research, track market data, and invest only what you can afford to lose.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here