Polkadot combines interoperability, on-chain governance, developer tools, staking rewards, and a growing ecosystem to create lasting value for DOT.

Polkadot was designed to solve one of blockchain’s biggest challenges; getting different blockchains to work together.

Over the years, it has grown into a large ecosystem that connects dozens of independent blockchains, called parachains, under one secure network.

Its design makes it flexible, upgradeable, and capable of supporting many use cases without sacrificing security or speed.

Below are practical reasons to buy DOT.

1. Interoperability at Scale

Polkadot’s greatest strength is its ability to connect many blockchains into one network. Here is how Polkadot interoperability works:

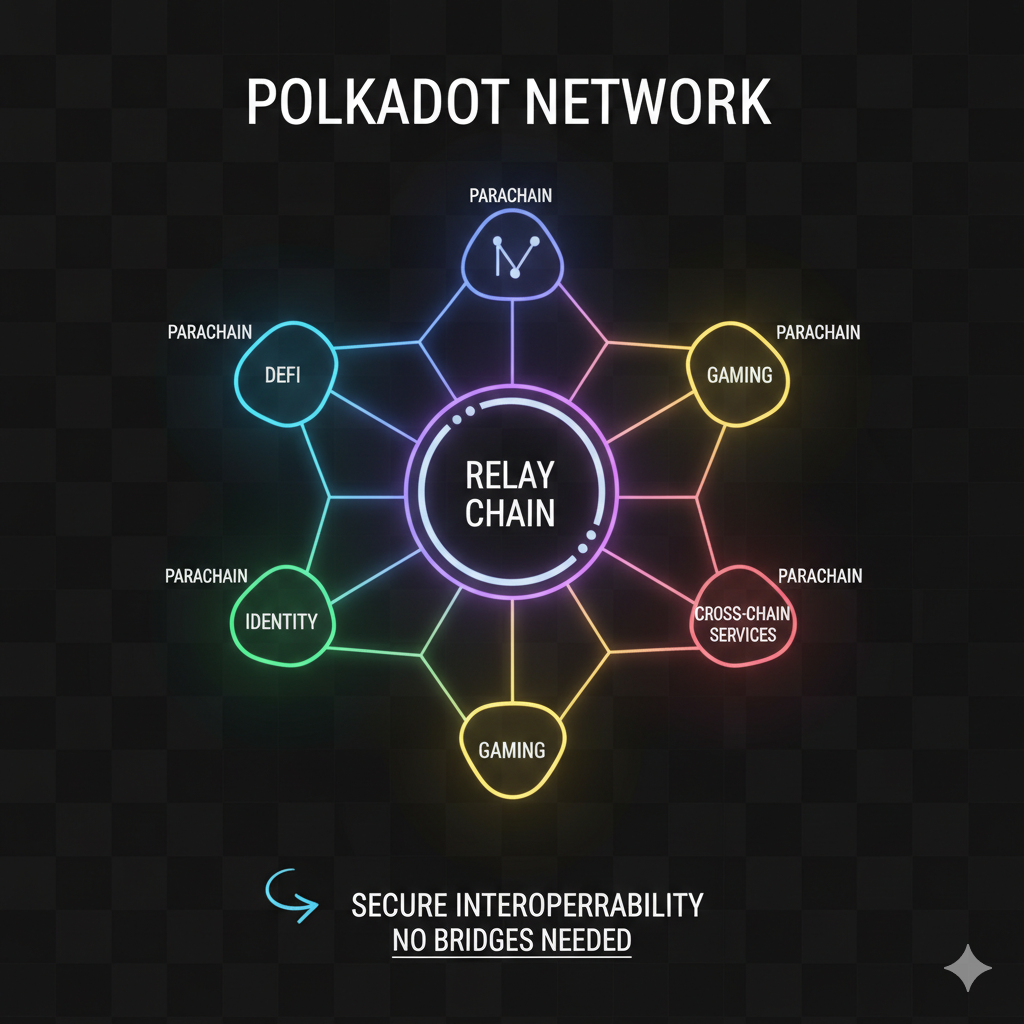

Its design separates the main security layer, called the Relay Chain, from the application layer, where different parachains operate. Each parachain can have its own design and purpose while still communicating with others through the Relay Chain.

This setup means one parachain can handle DeFi applications while another focuses on identity, gaming, or cross-chain services and they can all interact without needing bridges that often cause security issues.

Polkadot’s messaging system, known as XCM (Cross-Consensus Messaging), allows these parachains to exchange assets and data safely. The latest version, XCM v5, introduced improvements that make communication between parachains faster, more reliable, and cheaper.

RECOMMENDED: Avalanche (AVAX) vs. Polkadot (DOT)

2. Future-Proof Governance and Upgradeability

Another major advantage of Polkadot is how it governs itself. Many blockchains struggle with upgrades because decisions depend on off-chain coordination or forks, which can divide the community. Polkadot solves this with a complete on-chain governance system called OpenGov.

OpenGov lets any DOT holder propose and vote on network changes. Decisions, such as software upgrades or treasury spending, happen transparently on-chain. This process eliminates the need for disruptive hard forks and allows Polkadot to evolve continuously.

This built-in ability to adapt through open governance gives Polkadot long-term flexibility. It ensures the network can grow and respond to new technology needs without losing stability or splitting into competing versions.

3. Built for Developers

Polkadot’s developer ecosystem is another reason for its durability. The network uses Substrate, a modular framework that makes it easier for teams to create new blockchains.

Instead of building everything from scratch, developers can use Substrate’s ready-made components for consensus, governance, and smart contracts.

This modularity saves time and reduces complexity, making it possible for small teams to build specialized blockchains that plug into Polkadot’s network.

In addition, Polkadot supports EVM-compatible chains through parachains like Moonbeam. This means developers who already know how to build on Ethereum can easily deploy their existing contracts on Polkadot without major rewrites.

A strong developer base ensures Polkadot remains relevant. As more projects launch, the network gains new use cases, activity, and value that strengthen DOT’s role within the ecosystem.

ALSO READ: Polkadot (DOT) Price Prediction 2025 2026 2027 – 2030

4. Staking Economics

DOT plays an active role in keeping the network secure through a system called Nominated Proof-of-Stake (NPoS). Validators run the network, while nominators support them by staking DOT. In return, both groups earn rewards.

Staking DOT is not just about earning yield. It directly contributes to the network’s stability and security. When more DOT is staked, it becomes harder to attack the network. This alignment between economic reward and security makes DOT a productive asset, not just a speculative token.

Staking rewards typically range between 8% and 10%, depending on the validator and market conditions. DOT is also used to bid for parachain slots, giving it additional utility beyond trading and staking.

5. Real-World Traction

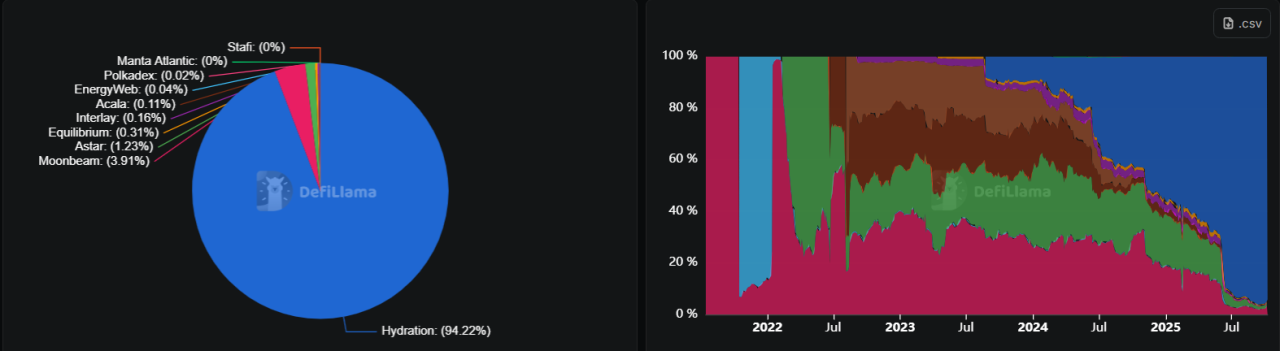

Polkadot ecosystem growth is largely due to active parachains and real applications. As of early 2025, the network hosts dozens of parachains working on DeFi, infrastructure, cross-chain tools, and staking services.

According to data from DefiLlama and Messari, the total value locked (TVL) across Polkadot parachains sits in the hundreds of millions of dollars.

Top examples include Acala with about $69 million in TVL, Bifrost with $44 million, Hydration with $41 million, and Astar with around $30 million. Moonbeam also continues to attract activity with EVM-compatible apps and bridges.

This shows that real projects are using Polkadot’s infrastructure to build products people interact with.

Conclusion

Polkadot offers a combination of technology and design that few other blockchains match. Its interoperability model connects independent blockchains securely, while its governance system ensures continuous improvement without splits.

Developers benefit from Substrate and EVM compatibility, making it easier to build new applications.

DOT’s staking system aligns incentives for holders and validators, and the growing parachain ecosystem proves real adoption and the long-term value of DOT.

The easiest way to buy Cryptocurrencies is through a trusted crypto exchange like Moonpay, Coinbase, or Uphold. These platforms allow users to purchase and trade crypto instantly from any device, including smartphones, tablets, and computers.

Buy Crypto NowCrypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here.

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)