Sui’s strong technology, active developer base, growing ecosystem, clear token structure, and institutional interest make it a blockchain worth watching for the long term.

Sui is one of the few new blockchains built to scale without sacrificing speed or simplicity. Since launching its public mainnet on May 3, 2023, it has attracted developers, users, and investors looking for practical blockchain solutions.

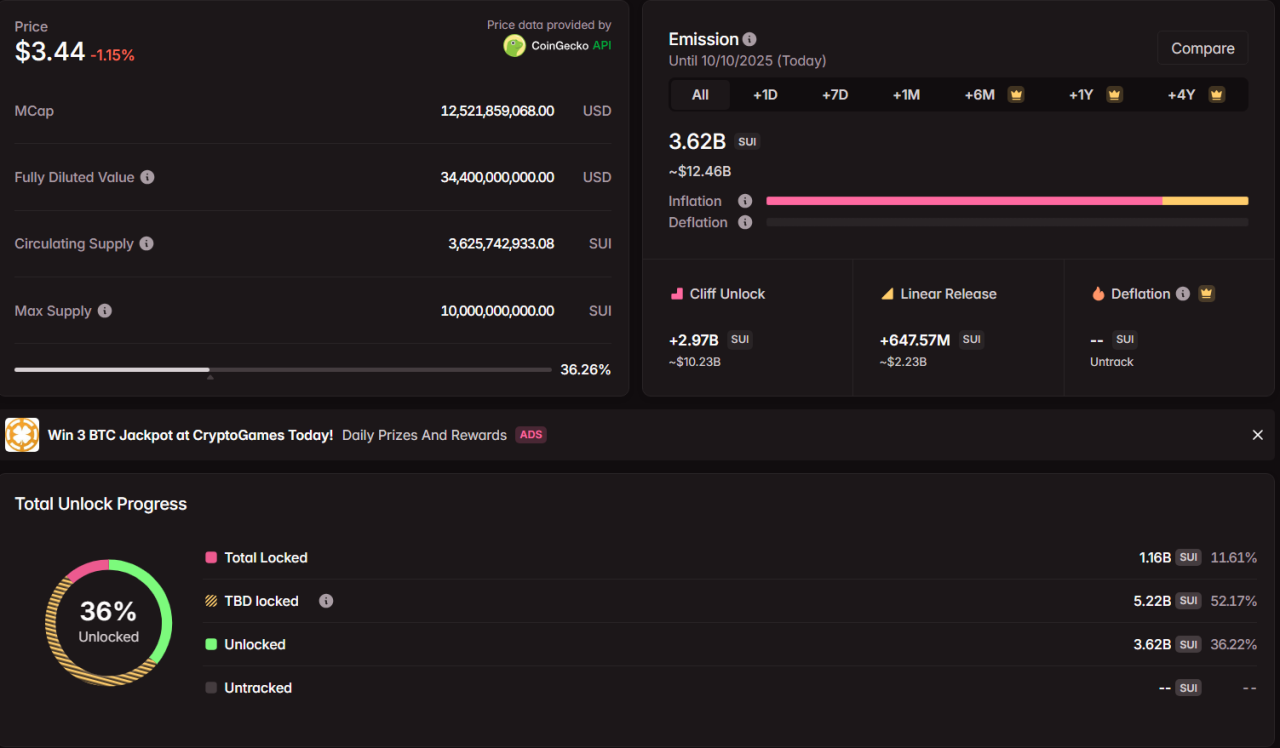

The total token supply is capped at 10 billion SUI, giving it a transparent and predictable structure. With fast transactions, low fees, and a unique data model, Sui aims to make digital ownership and on-chain applications more efficient for everyday use.

Here are five reasons to buy SUI

1. Scalable Architecture Designed for Real-World Apps

Sui uses an object-based system that treats each asset or piece of data as a separate object. This lets the network handle many transactions at once instead of processing them one by one.

As a result, Sui achieves high throughput and fast confirmation times. This design works especially well for consumer applications like games, payments, and marketplaces where quick actions matter.

Developers using the Move programming language can build apps that process thousands of transactions per second without major bottlenecks. This efficient model reduces fees and keeps the user experience smooth, helping Sui stand out among other Layer 1 blockchains.

RECOMMENDED: Can SUI Reach $100?

2. Strong and Active Developer Community

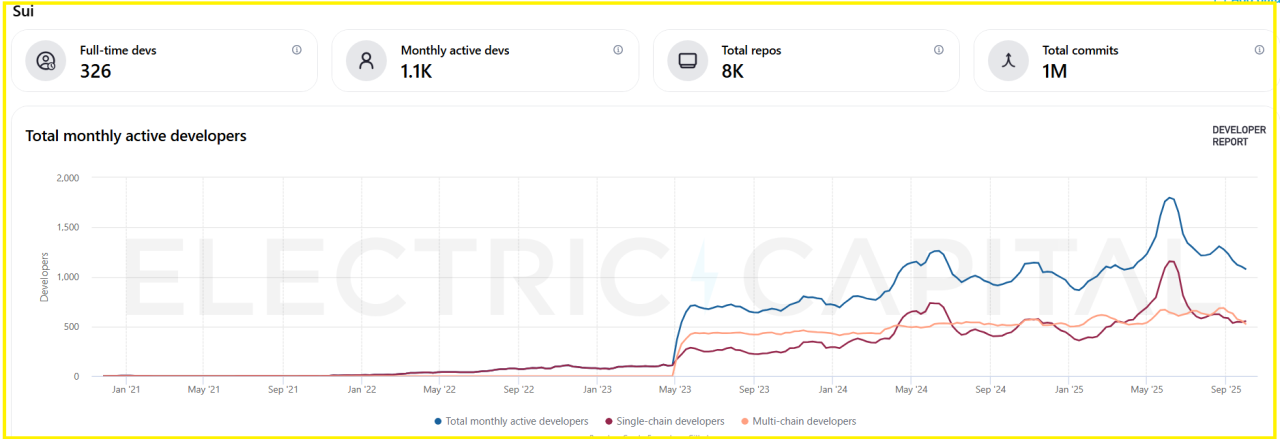

A strong developer base is one of the best signs of long-term project health, and Sui continues to perform well in this area. Its open-source codebases show consistent updates and frequent contributions.

The team behind Sui, Mysten Labs, organizes hackathons and workshops that attract new developers to the ecosystem. Regular improvements to software tools, wallets, and SDKs make building on Sui easier every month.

The platform’s GitHub activity remains among the most active in the blockchain space, showing ongoing innovation. This steady development pace increases reliability and gives investors confidence that the network will keep evolving as new technologies and user needs emerge.

3. Growing Ecosystem of DeFi and NFT Projects

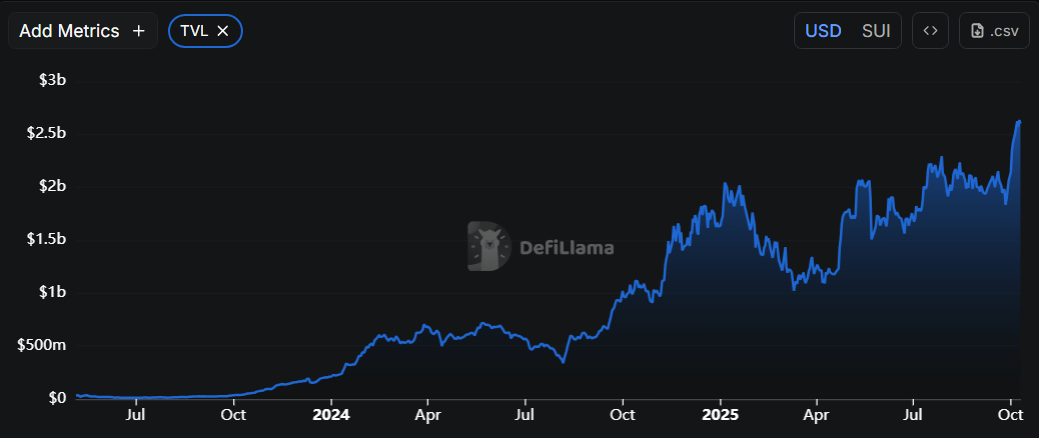

Sui’s ecosystem is already home to a range of decentralized finance (DeFi) and non-fungible token (NFT) projects. Decentralized exchanges, lending platforms, and NFT marketplaces have launched, creating real on-chain activity.

Recently, the total value locked (TVL) on Sui crossed $2.6 billion, a clear sign of traction and DeFi growth.

NFT trading, gaming, and digital collectibles also continue to grow, showing that users are not just speculating but actually using the network.

As more projects launch and liquidity deepens, the demand for SUI tokens used for gas fees and staking rises. These real Sui use cases make it more than just another speculative crypto asset.

RECOMMENDED: Top 3 Cryptos to Buy Today: Bitcoin, Sui, and XRP

4. Transparent Tokenomics and Clear Utility

Sui’s tokenomics were designed to support long-term growth. The total supply is capped at 10 billion SUI, with new tokens released gradually over time. This approach helps manage inflation and prevents sudden supply shocks.

Holders can stake their SUI tokens to secure the network and earn rewards, creating an ongoing reason to hold rather than trade. SUI is also used to pay gas fees for transactions and participate in governance decisions.

These utilities give the token consistent demand as the network grows. Because the release schedule is public, investors can track how much of the supply is in circulation and make informed decisions.

5. Increasing Institutional Interest and Market Access

Institutional involvement adds credibility and liquidity to any blockchain project. Sui has started to attract partnerships and attention from regulated entities exploring blockchain applications.

Reports of pilot programs, exchange listings, and infrastructure integrations show that Sui is becoming more accessible to both retail and institutional investors. Broader support from custodians and asset managers could help increase trading volume and make SUI easier to access through compliant channels.

While not all partnerships lead to guaranteed results, these developments suggest that Sui is maturing into a network with real market potential. As adoption expands, institutional presence can help bring long-term stability to the ecosystem.

RECOMMENDED: Sui (SUI) Price Prediction 2025 – 2030

Conclusion

There are many reasons to invest in SUI: a scalable design, strong developer activity, a growing ecosystem, transparent tokenomics, and rising institutional interest. Each element supports the others, creating a balanced and sustainable foundation for growth.

While no investment is without risk, Sui shows the qualities of a project designed to last. Investors who understand these fundamentals can view SUI as a token with both practical utility and long-term potential. Always research and manage risk before investing.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)