SuperVerse offers strong upside in 2025 with growing ecosystem, deep liquidity, and discounted price compared to GameFi peers.

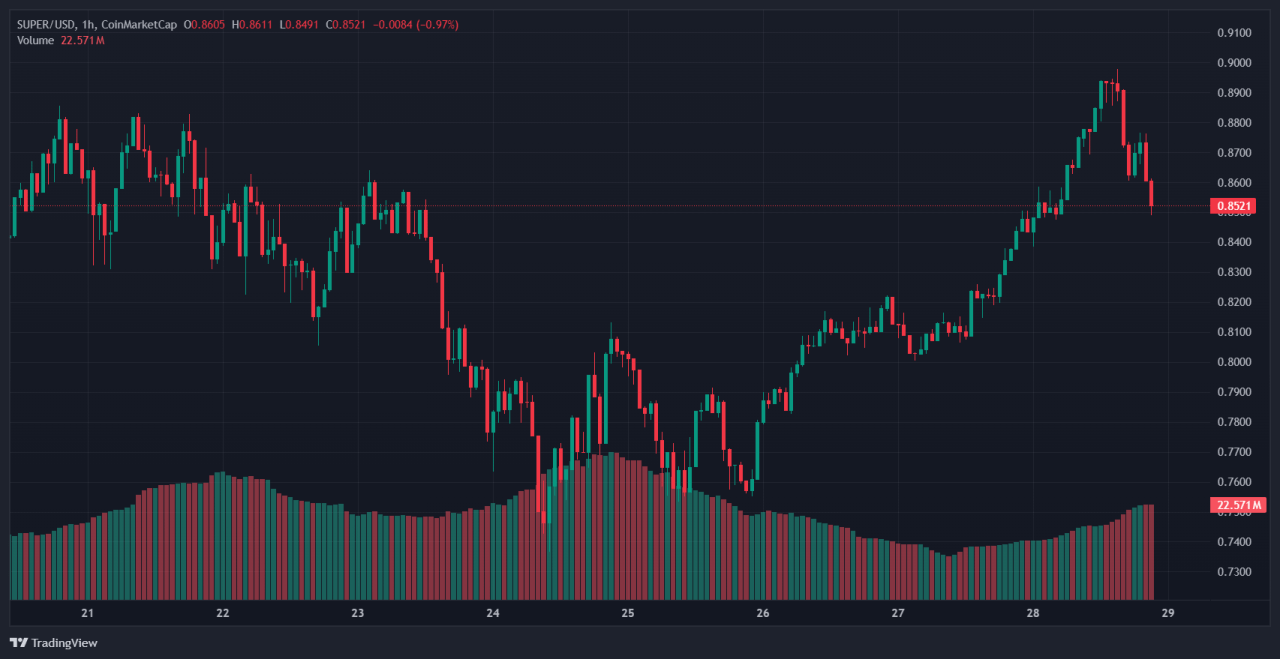

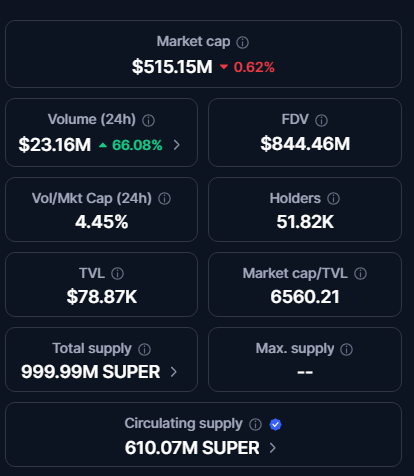

SuperVerse is back in focus heading into mid‑2025. Trading around $0.85 with a market cap near $530 million and daily volume exceeding $20 million, SuperVerse is suddenly drawing renewed attention.

Despite a steep drop from its December 2024 highs above $2.20, current prices now hover in an area of technical support, setting up a potentially attractive entry point.

For investors in Web3 gaming and GameFi, these market conditions could mark the ideal window to position in SuperVerse now.

Here are five reasons you should buy Superverse.

1. Attractive Entry Near Technical Support

SuperVerse is trading near key technical support, roughly between $0.64 and $0.75, as momentum indicators show oversold conditions. In early March 2025, RSI readings were as low as 41, and SUPER’s dip from about $2.20 in December down into the mid‑$0.60s has triggered rebound potential.

Falling‑wedge patterns visible on both daily and four‑hour charts suggest a breakout could bring price levels toward resistance around $0.93 to $0.98.

Put simply, the technical setup offers a well‑defined risk‑reward range at current valuation.

2. Strong Ecosystem Growth & Partnerships

SuperVerse ecosystem growth in 2025 has been robust. The project integrated with the Ronin network in February, expanding token utility in in‑game events and decentralized governance features.

In March and again in July, SuperVerse added partnership with the PLYR gaming ecosystem – including integration of $BLACK DeFi token – bridging DeFi and GameFi experiences.

A June collaboration with the AI‑native gaming platform Tabi further diversified its ecosystem reach. Backed by names like Animoca Brands and featuring integrations with platforms like Metacade Base and AAA gaming studios, SuperVerse token utility is gaining momentum in the GameFi sector.

3. Robust Liquidity & Market Access

SuperVerse is listed on major exchanges such as Binance and Coinbase, ranking around #120 by market capitalization and offering deep liquidity. Daily trading volume consistently ranges between $15M–$24M USD, supporting efficient entry and exit execution.

Circulating supply sits around 610 million of a roughly 1 billion max supply, leaving room for future token unlocks and potential FDV expansion.

Strong exchange access and transparent liquidity make SuperVerse an accessible option for both retail and institutional investors.

4. Discounted Valuation Compared to GameFi Peers

SuperVerse trades at under $1, significantly below its March 2021 all‑time high of about $4.73, implying substantial discount relative to potential highs. Forecast models from Gate and CoinCodex project a 2025 average between $0.88 and $0.91, with potential upside if sentiment shifts.

Compared to other GameFi and NFT infrastructure tokens, SuperVerse offers comparable fundamentals but at a lower entry price, offering mean‑reversion potential if sector rotation returns money to well‑positioned gaming assets.

5. Positive Forecasts & Upside Projections

Diverse 2025 price‑prediction models now place SuperVerse above current trading levels. CoinCodex forecasts show a short‑term gain of approximately 9% to $0.93+ by early August 2025.

Longer horizon CCN analysis suggests potential upside toward $2.19 if broader market conditions improve. Even Cryptoticker’s more bullish projection sees end‑of‑year levels in the range of $2.73–$3.41, though that is an outlier estimate.

More conservative models like Binance’s growth‑rate forecast range toward $0.87–$0.91 for 2025 and $0.93 in 2026. These scenarios support both a tactical entry and a long‑term accumulation opportunity for those looking to buy SUPER in 2025.

Conclusion

SuperVerse offers a compelling mix of attractive entry valuation, strong ecosystem developments, and solid exchange liquidity. As it trades below $1 – with strategic partnerships and bullish forecasts in play – it stands out among GameFi tokens at a discounted price level.

Whether you’re aiming for short‑term tactical gains or longer‑term exposure to Web3 gaming growth, this is a project worth watching. We recommend smart risk management and dollar‑cost averaging to help navigate volatility while capturing upside potential.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Alt Season 2025 – Progress Update (July 26th)

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)

- Crypto Charts Are Improving, Just Have A Look At These 3 Leading Indicators (July 6th)

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)