KEY TAKEAWAYS

- The Graph processes billions of queries each quarter and supports thousands of active subgraphs.

- Its multi-chain expansion into Solana, Arbitrum, Base and TRON increases reach, usage and revenue potential across different Web3 ecosystems.

- GRT has clear utility through staking, curation, delegation and governance, with token demand tied directly to network operations.

- The revenue model distributes real income in GRT to indexers, curators and delegators based on actual query usage.

- A decentralized network structure with ongoing governance updates supports long-term stability and continued evolution.

Strong developer usage, practical token utility and real fee income give GRT measurable relevance. Expanding chain coverage continues to increase adoption and activity.

Web3 apps need quick and reliable access to blockchain data. The Graph solves this by providing a decentralized way to index and query that data using simple GraphQL calls.

Developers build subgraphs, which work like reusable APIs that apps use to pull real-time blockchain information.

This cuts development time and removes the need to run complex nodes. The network continues to record steady growth in subgraph deployments and query volumes.

This means developers keep using the platform, not just trying it out once. That active demand gives GRT practical value beyond trading, since it ties directly to network usage.

Below are five reasons to buy The Graph today.

Reasons To Buy The Graph

Below are the five reasons to know before you invest in The Graph (GRT).

1. Real Product-Market Fit

Many decentralized apps rely on The Graph because it makes getting blockchain data fast and efficient.

The network processes billions of queries each quarter, and developers have created thousands of subgraphs for use cases like DeFi, NFT analytics, wallets and dashboards.

This shows real-world demand for the technology. When a blockchain app needs data, it can call a subgraph instead of building its own complex data system. That reduces costs and cuts development time.

The consistent query traffic displays practical value and long-term relevance. Developers rely on it regularly, making it an important infrastructure layer with sustained usage.

2. Expansion Across Multiple Blockchains

The Graph has moved beyond Ethereum and now supports chains such as Solana, Arbitrum, Base and the TRON Token API. Each additional chain introduces new developers and applications.

High-performance blockchains can generate a larger volume of queries, which increases activity on the network.

Supporting multiple chains reduces overdependence on one network and opens up new revenue opportunities.

More blockchains mean more subgraphs and more apps relying on The Graph to manage data.

This broader coverage helps The Graph use cases across different ecosystems, which supports long-term growth and enhances its role as a core data layer across Web3.

3. Clear Token Utility And Active On-Chain Role

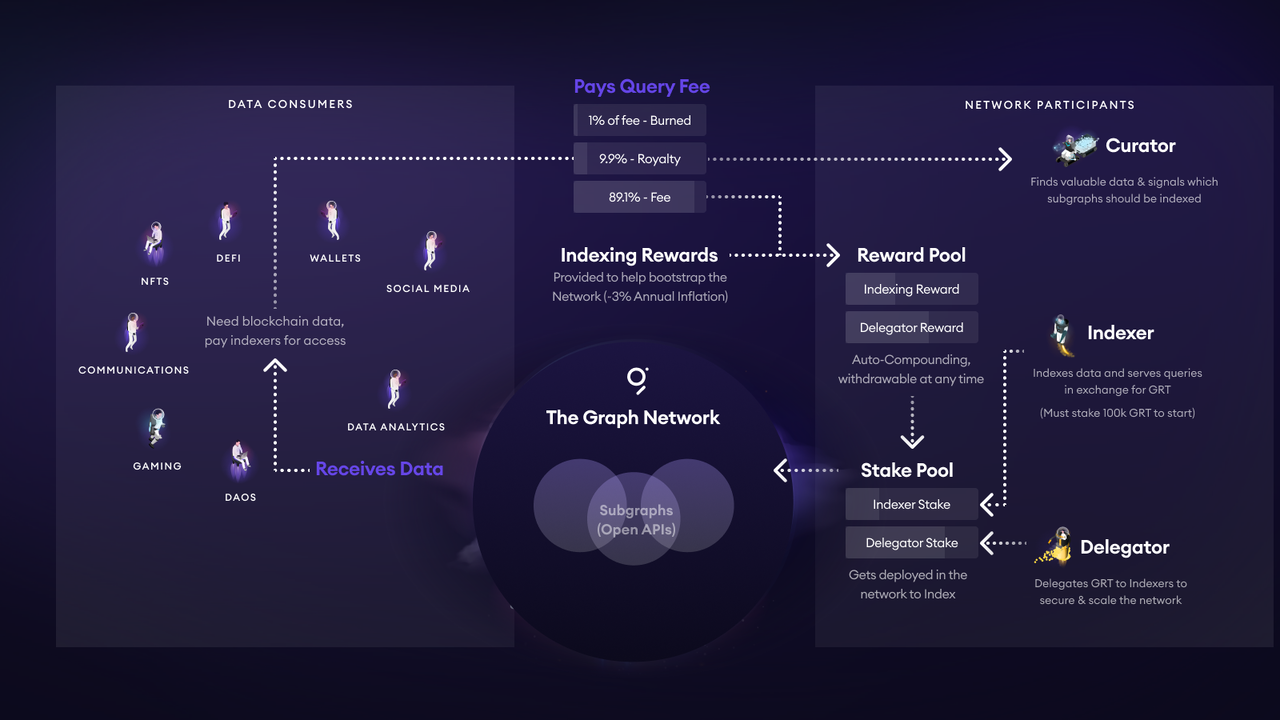

GRT plays a central role within the network. Indexers must stake GRT to operate, curators use it to signal subgraphs they believe are valuable and delegators stake GRT with indexers to earn a share of rewards.

The current circulating supply is around 11.4 billion GRT. GRT is also used for voting in governance decisions. These functions create real demand for the token, tied to platform operations.

That means activity on the network translates into token use, linking value to practical roles rather than only market sentiment.

4. Revenue Model Creates Incentives For Participation

Indexers earn query fees in GRT and receive additional indexing rewards, while curators collect a share of the fees generated by the subgraphs they support.

Research reports that curators have historically received around 10% of query fees, while indexers keep most of the remaining fees and rewards.

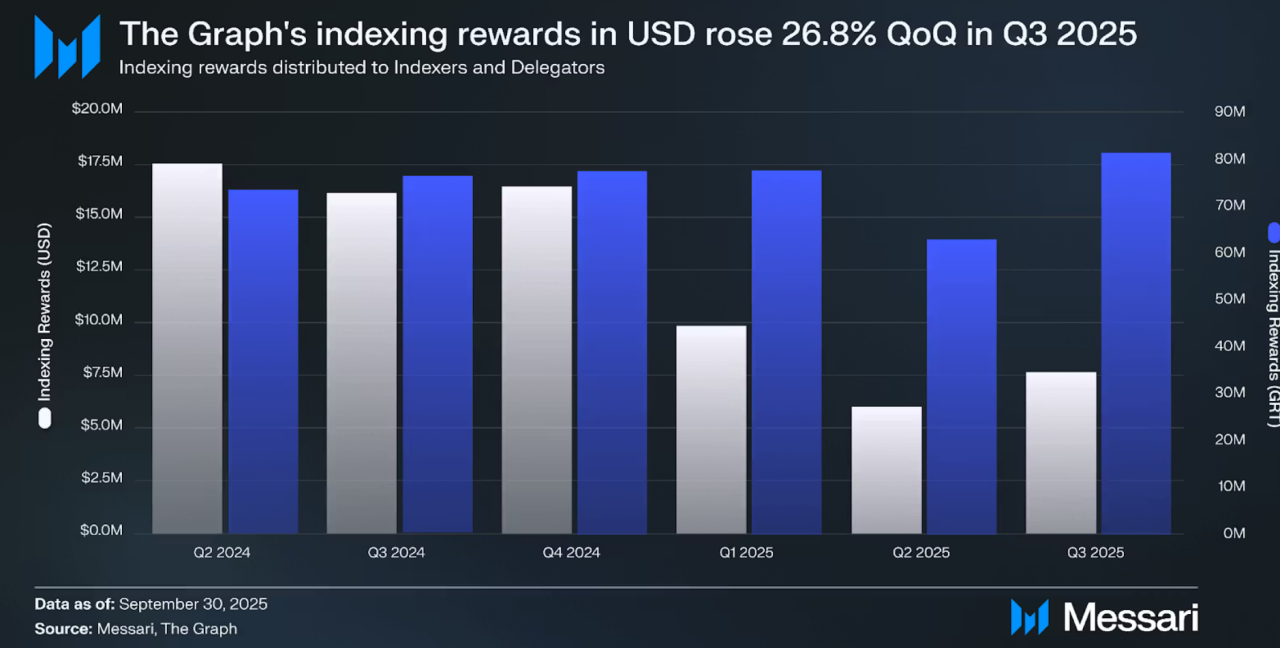

According to Messari, indexing rewards grew by 26.8% in Q3 2025.

Delegators can also earn by staking GRT with indexers without running infrastructure themselves. This setup rewards participants for contributing to the health and performance of the network.

As query volume grows, so does the fee income distributed across stakeholders. This makes the network economically active and aligns income with usage levels.

5. Decentralization And Governance

The Graph uses a decentralized model with indexers, curators and delegators all working together. Indexers stake GRT and face penalties if they act dishonestly, which improves security.

Governance is open to GRT holders, who vote on upgrades and changes, and the project continues to release proposals and tune incentives. This ongoing community involvement keeps the network adaptable.

Since responsibilities are shared and aligned through staking, there is no single dependency or point of failure.

The structure supports long-term resilience and helps maintain consistent quality even as developers and applications scale. It gives users confidence in the network’s future.

Conclusion

The Graph offers strong developer adoption, growing support across chains, clear token roles, an active revenue system and a decentralized structure that keeps the network flexible.

These factors tie token relevance to measurable network activity and are solid reasons to buy The Graph (GRT).

To track progress, pay attention to query volumes, chain integrations, subgraph deployments and revenue distribution.

Otherwise, if you are looking for tokens with practical use, The Graph shows consistent demand and a functioning model that supports long-term usage and evolution as Web3 continues to grow.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):