Stellar Lumens (XLM) is drawing fresh investor attention in 2025 as blockchain adoption accelerates, with growing real-world use cases, institutional partnerships, and payment network expansion — but what’s really driving XLM’s renewed momentum might surprise you.

Tiny fees and fast settlement make XLM practical for payments. Programmability and real-world rails support tokenization and liquidity.

XLM is the native token of the Stellar network, a blockchain built to move money quickly and cheaply across borders and to tokenize real assets. Stellar aims to connect banks, payment providers, and apps so they can transfer value without heavy fees or long delays.

The network’s design focuses on predictable costs, fast settlement, and simple tools for developers and operators. Below are five practical reasons to buy XLM.

RELATED: Is XLM Still Worth Buying in 2025?

1. Low Fees And Fast Settlement

Stellar charges a tiny base fee of 100 stroops, equal to 0.00001 XLM per operation. That small fee exists to deter spam while keeping transaction costs stable. For example, at a recent XLM price of about $0.365, the base fee equals roughly $0.00000365 per operation.

Transactions can include multiple operations, so total cost scales with complexity, but typical transfers remain far below $0.01. The Stellar ledger closes roughly every 5 seconds, which means payments settle quickly and users face minimal waiting.

These make XLM attractive for micropayments, tipping, and frequent merchant settlement.

Businesses can budget fees precisely, and wallets can offer instant-fee estimates to customers without fearing sudden fee spikes common on some other networks. This predictability helps teams plan costs.

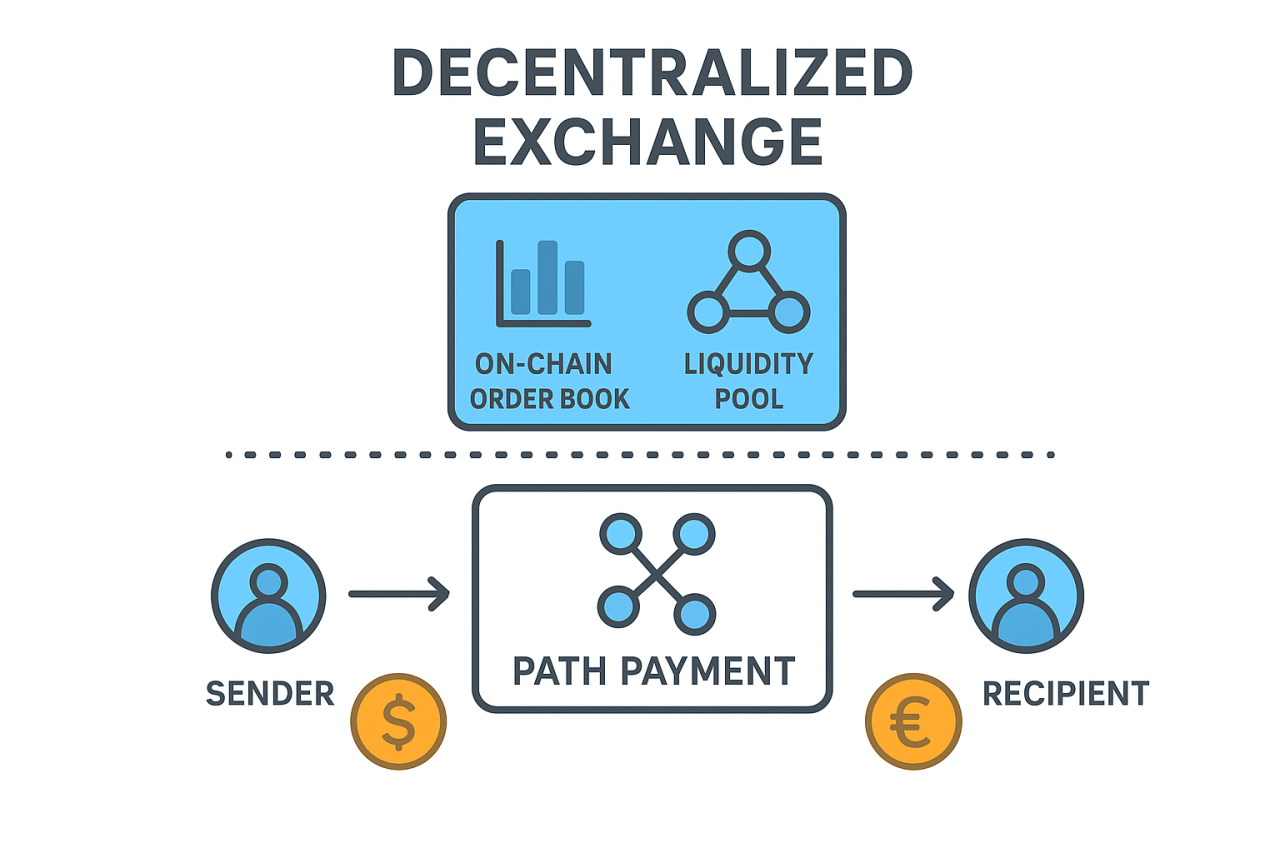

2. Built-In Decentralized Exchange And Path Payments

Stellar runs a ledger-level decentralized exchange with on-chain order books and liquidity pools. Path payments let a sender state the asset they want to send and the asset the recipient should receive, and the network finds a route of offers to complete the swap in one transaction.

That atomic conversion reduces manual steps and lowers settlement risk because the exchange and payment happen together. For wallets and remittance services, this simplifies integration, removes separate conversion reconciliations, and shortens time to settlement.

Market makers and liquidity providers can earn fees inside the Stellar DEX, which helps depth and useful prices for real-world flows. Developers can build multi-currency features faster today.

RECOMMENDED: Stellar Lumens (XLM) Price Prediction 2025 – 2030

3. Real Fiat On/Off-Ramps And Proven Partners

Anchors serve as regulated on and off ramps that tokenize fiat and stablecoins on Stellar and link the blockchain to bank accounts and cash networks.

These Anchors hold reserves and issue matching on-chain tokens, so users can deposit local currency and receive a reliable token representation quickly.

Stellar maintains an anchor directory and a growing set of partners that operate these rails. Companies and retail outlets now offer cash-to-USDC and USDC-to-cash conversions in certain regions, which brings blockchain balances into everyday use.

MoneyGram has integrated Stellar rails to provide cash-to-crypto and crypto-to-cash services at retail locations, showing the model works at scale. Those rails make XLM usable for remittances, merchant payouts, and cash access and beyond.

4. Smart Contracts With Soroban And Tokenization

Soroban, Stellar’s smart contract platform, moved to mainnet on February 20, 2024 and opened programmable finance on Stellar. The Stellar Development Foundation set up an adoption fund to encourage teams to build on Soroban and accelerate developer activity.

SDF committed roughly $100m to Soroban adoption, grants, and tooling to support real projects. With smart contracts, developers can issue tokenized bonds, programmable stablecoins, automated payment flows, and other services that require on-chain logic.

Soroban uses Rust and WebAssembly, which appeals to teams familiar with modern tooling, and it brings Stellar closer to common DeFi patterns while preserving low-cost settlement.

Early projects and tooling improvements aim to reduce development time and lower deployment costs for live products.

5. Mature Network, Predictable Supply, And Market Liquidity

Stellar launched in 2014 and has built a multi-year history of integrations and usage. In 2019 the Stellar Development Foundation burned roughly 55 billion XLM, leaving a maximum supply around 50 billion and clarifying future emissions.

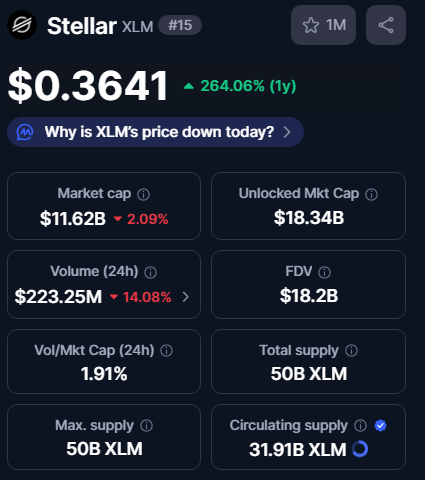

Major trackers list circulating supply at about 31.9 billion XLM, and CoinMarketCap reports a circulating supply of 31,913,419,169 XLM with a market cap around $11.6 billion. XLM ranks among the top 20 tokens by market metrics and appears on major exchanges, which aids liquidity.

That scale helps institutions and payment services move meaningful amounts with less slippage than smaller tokens. This reduces execution risk for large transfers significantly.

Conclusion

Taken together, XLM’s tiny fees, fast settlement, built-in conversion, fiat onramps, and Soroban smart contracts give the token steady utility, making it one of the best cryptos to buy.

If you need cheap, quick cross-border transfers or tokenization, evaluate XLM against alternatives and do your own research before investing.

Which Crypto Should You Invest In Right Now?

For alerts on the key crypto assets that are primed for investment right now you should consider Join the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’ll be following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)