KEY TAKEAWAYS

- VeChain has real enterprise usage, including supply chain, compliance, and product verification across major industries.

- Its dual-token system keeps fees stable because VET generates VTHO, which businesses use for transactions.

- The total supply of about 86.7 billion VET is fixed and transparent, which removes dilution concerns.

- VeChain supports long-term use cases in food, pharma, luxury goods, and ESG reporting, where trusted data is essential.

- VeChainThor delivers low-cost transactions and strong uptime, which makes it reliable for daily business operations.

Stable fees, clear supply, real enterprise usage, targeted industry value, and strong uptime make VET a practical choice for investors looking to diversify their portfolio.

VeChain which is trading around 0 USD today, focuses on practical supply chain solutions that businesses can use today. It uses a simple dual-token system, a fixed supply of about 86.7 billion VET, and a long list of enterprise pilots.

These traits make VeChain easy to understand and reliable to evaluate. If you are looking for new coins to add to your portfolio, here are five reasons to buy VeChain today.

Reasons to Buy VeChain

If you are still looking for reasons to invest in VeChain, the five below might change your mind.

1. Enterprise First Blockchain

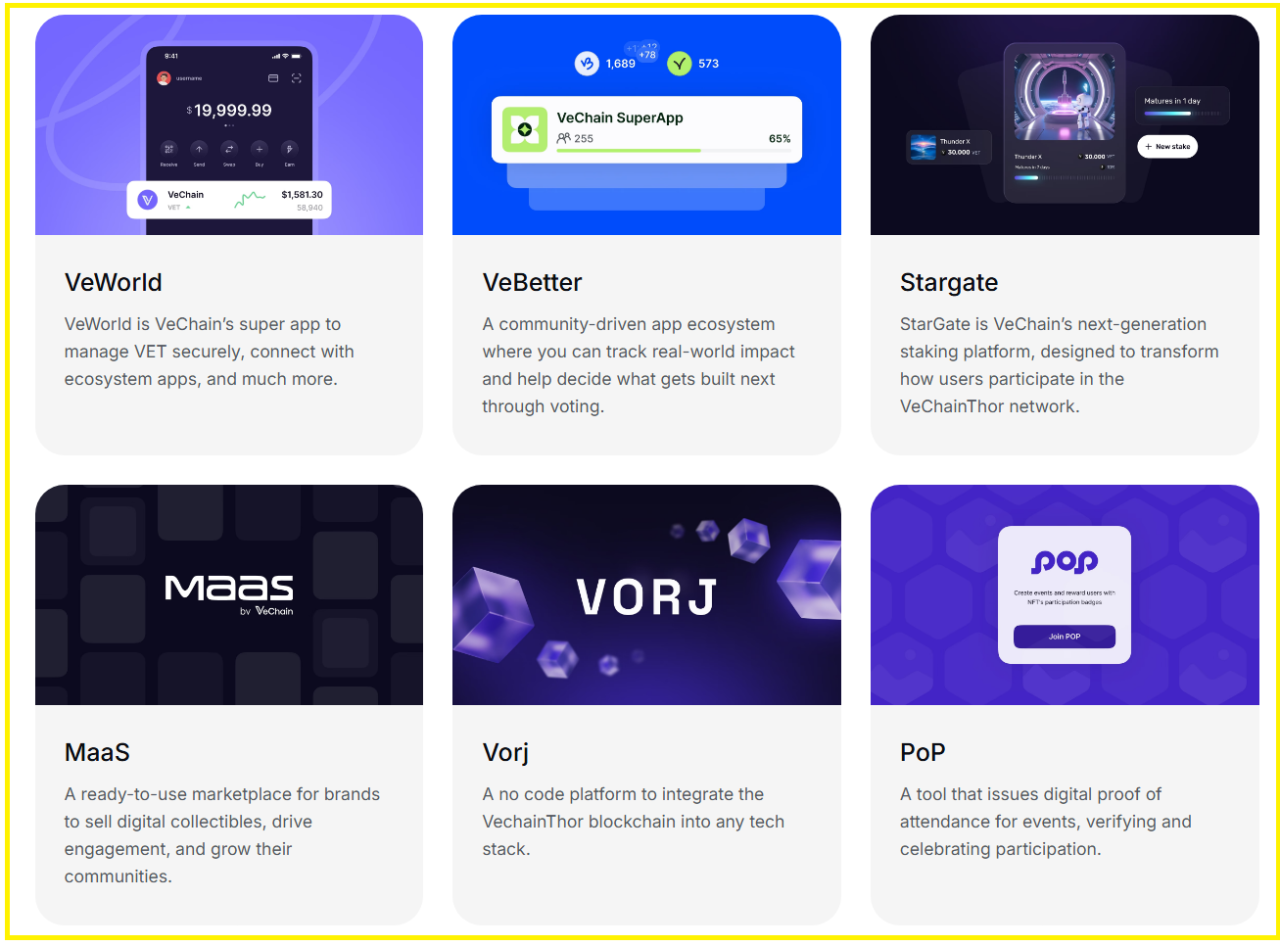

VeChain builds tools that help companies track products, verify quality, and share trusted data.

That is why you see it used in supply chain programs, food tracking projects, and certification workflows. Enterprise pilots usually take a long time to test and approve, so seeing VeChain used again and again is meaningful.

Companies use it to reduce recall mistakes, confirm product authenticity, and keep clean audit trails. These are real VeChain use cases supported by public case studies. When a business needs reliable tracking and clear compliance records, VeChain often fits that need.

RECOMMENDED: VeChain Vs Cardano: Which Shows A More Convincing Breakout?

2. Dual Token Model

VeChain uses VET for value and VTHO for gas. Holding VET generates VTHO, which pays for transactions. This design protects businesses from unpredictable fees. For example, a company can buy VET once, earn VTHO daily, and use it to run scans, logs, and product updates.

Protocol adjustments over time have helped balance VTHO demand and generation, which keeps fees stable. That stability is important to businesses that run thousands of transactions each day.

They can track VTHO usage on public dashboards and plan their budgets with real numbers instead of guessing.

3. Predictable Capped Supply And Transparent Tokenomics

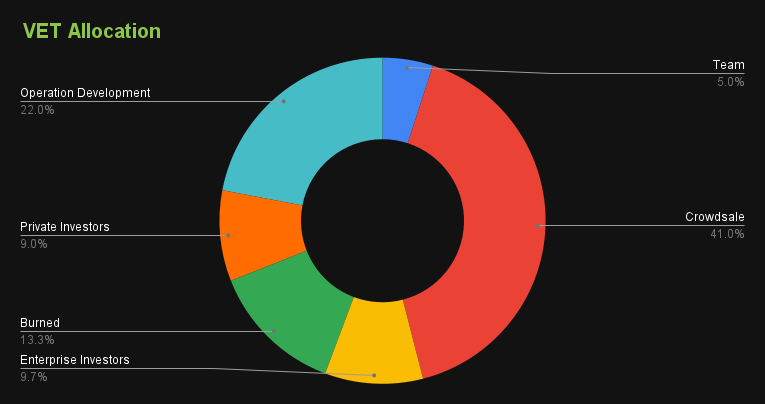

VeChain’s supply is easy to verify. The total supply is about 86.7 billion VET, and the circulating supply sits at roughly 86 billion. A fixed supply removes the worry of sudden inflation or surprise issuance. Anyone can confirm these numbers on major exchanges and blockchain explorers.

Clear supply data helps investors and companies calculate market value and set their own holding plans. Treasury teams that need predictable numbers for long-term modeling find this structure useful.

The lack of hidden variables also helps users trust the system and make informed decisions.

4. Solving Real Industry Problems

VeChain focuses on problems that appear again and again in real industries. For example:

- Food producers rely on it for freshness tracking and recall accuracy.

- Pharmaceutical teams use it for chain-of-custody records that protect patient safety.

- Luxury brands use it to prove authenticity and reduce counterfeits.

- ESG teams use it to verify recycling data and carbon reporting.

These industries face strict rules, high risk, and regular audits. They need data that cannot be altered later, and VeChain provides that. Several pilots report quicker recall responses, fewer counterfeit cases, and stronger brand trust.

These ongoing needs make VeChain’s value steady rather than trend-based.

5. Scalable, Low Cost Technology And Strong Uptime Credentials

VeChainThor runs with an authority-style consensus that supports fast and low-cost transactions. It has processed large volumes in production and maintained consistent uptime. This reliability is crucial when companies rely on it for daily operations.

Frequent scans, IoT logs, and compliance checks only make sense if the network stays available and affordable. VeChain has delivered on that. Regular security reviews and protocol updates help the network remain stable.

Public data shows high availability and large transaction counts, which gives users confidence in long-term performance.

Conclusion

VeChain stands out because it focuses on real business value instead of speculation. It offers a simple cost model, a fixed supply, clear industry use cases, and proven reliability. These traits make it a practical option for anyone who wants a project with steady, measurable utility.

Always check current VTHO rates, circulating supply, and partnership updates on official dashboards before making investment decisions.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.