KEY TAKEAWAYS

- Arbitrum’s network keeps improving through consistent upgrades like ArbOS 30 and Stylus, which enhance speed, flexibility, and developer reach.

- Liquidity on Arbitrum remains among the highest in the Layer-2 space, with billions in Total Value Locked supporting strong DeFi and trading activity.

- Developer engagement is steady, with thousands of active commits showing ongoing innovation and healthy ecosystem growth.

- ARB’s governance model and token distribution promote long-term ecosystem funding and community-driven decision-making.

- Full Ethereum compatibility gives Arbitrum lasting relevance, allowing users and developers to enjoy low fees without sacrificing Ethereum’s security and reach.

Arbitrum combines low-cost transactions, deep liquidity, active developers, meaningful governance and tight Ethereum compatibility. This makes it a network worth considering adding to your portfolio.

Layer-2 networks exist because the main Ethereum chain has become too slow and expensive for many users. Arbitrum (ARB) stands out because it already moves real capital and users while keeping costs low.

It supports widespread DeFi activity, regular upgrade cycles, and broad developer engagement.

That combination gives Arbitrum a meaningful advantage that makes it one of the best crypto to buy now.

Let’s walk through five solid reasons to buy Arbitrum as 2026 draws near.

ALSO READ: Which Crypto Will Explode Next? Here’s One To Watch

5 Reasons To Buy Arbitrum For Your 2026 Portfolio

Below are the main reasons you should know before investing in Arbitrum.

1. Proven L2 Scaling With Upgrades

Arbitrum’s architecture has evolved steadily. Upgrades like ArbOS 30 and the Stylus/WASM support enable new types of contracts and help improve performance. For example, data from CoinLaw shows the network processed over 2.16 billion transactions as of September 2025.

When a blockchain delivers improvements that attract new developers and apps, it shifts from being a “nice-to-have” to a “must-use” platform. Arbitrum is past the proof-of-concept phase and moving toward real-world scaling.

2. Large DeFi & dApp Liquidity

Arbitrum hosts billions of dollars in locked value. According to data, its Total Value Locked (TVL) stands around $3.01 billion for major DeFi protocols.

This is important because liquidity fuels activity. Higher liquidity means better trade execution, lower slippage, and more attractive conditions for users and developers.

I think this network effect is under-appreciated. Developers tend to migrate where capital goes; users tend to stay where liquidity is healthy. Arbitrum is checking that box now.

3. Strong Developer Activity & Tooling

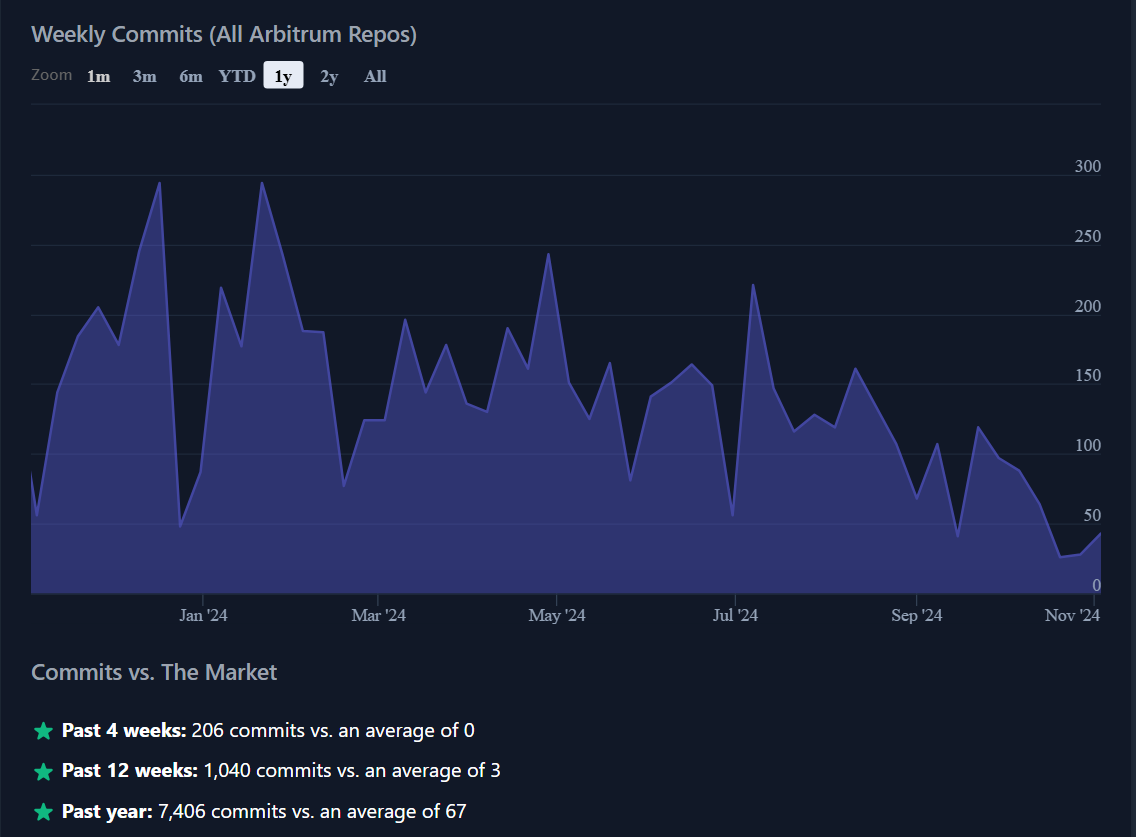

If a blockchain wants to move beyond hype, it needs real developers building usable products. Arbitrum continues to show that strength, recording over 7,400 code commits and consistent updates across its core GitHub repositories in the past year.

The network’s new Stylus framework also opens doors for developers to write smart contracts in Rust, C, and C++, expanding its reach beyond Solidity programmers.

This broader language support and frequent updates lower entry barriers, encourage experimentation, and keep Arbitrum evolving faster than networks that rely solely on marketing or token incentives.

RECOMMENDED: Polygon (MATIC) vs Arbitrum (ARB): Which Will Break Out?

4. Governance & Tokenomics That Work

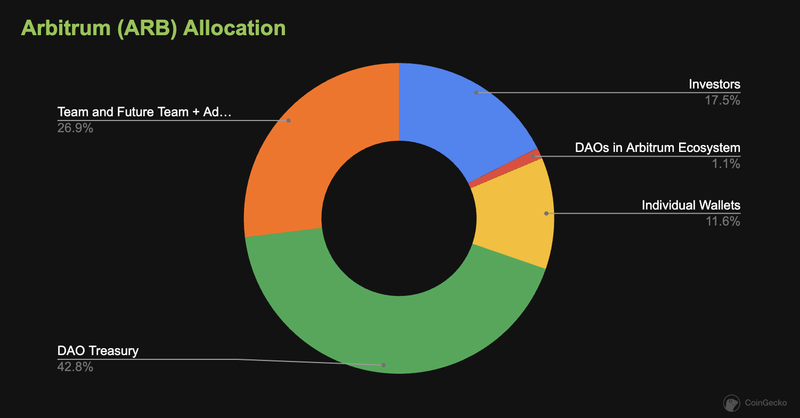

The ARB token does more than trade; it drives governance and funds long-term growth. Out of the 10 billion total supply, about 42% is allocated to the community treasury, 11.6% to early users and DAOs, and the rest to investors and the team, released gradually over four years.

This balanced distribution gives Arbitrum enough resources for grants, audits, and ecosystem programs while keeping decision-making community-driven. Clear treasury oversight and active governance voting make the network more resilient and less dependent on centralized leadership.

5. Native Ethereum Compatibility & Broad Integrations

Arbitrum maintains native compatibility with Ethereum’s smart contracts while enabling lower-cost usage. That compatibility means assets and contracts built on Ethereum can move with fewer frictions. According to metrics, Arbitrum supports millions of users and bridges billions in value.

Now, compatibility might not be a sexy talking point but it is a practical one. When you build on a network whose ecosystem is huge (Ethereum) yet you pay less in fees, you get the best of both worlds.

Arbitrum is meeting that balance now, and that’s a meaningful advantage heading into 2026.

Conclusion

If you have been looking for reasons to buy Arbitrum, I hope this guide helps you make a decision. Its real scaling upgrades, strong liquidity, committed developers, sensible governance and Ethereum-level compatibility makes it a strong crypto investment.

So, if you’re considering exposure or new additions to your portfolio, ARB merits serious consideration as a long-term hold.

Before moving in, check live TVL, developer metrics, upcoming token unlocks and governance proposals.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.