Learn how to start investing in crypto with seven simple, smart tips that help reduce risk and build long-term confidence.

Cryptocurrency is no longer fringe, it’s attracting serious interest from both individuals and institutions.

In July 2025, Bitcoin climbed past $120,000, achieving a fresh record high after strong inflows into spot‑Bitcoin ETFs and corporate treasury investments from firms like MicroStrategy and Tesla.

Year‑to‑date, Bitcoin is up more than 20%, placing its total market value in the multi‑trillion‑dollar range and the broader crypto market at around ~$3.3 trillion.

For anyone new to crypto, this environment offers huge opportunity—but also high volatility. That’s why before investing in the crypto, you need to make smart and cautious decisions.

This guide gives you 7 practical, up‑to‑date tips to begin investing in crypto, helping you avoid common mistakes and build confidence as you go.

Let’s dive in!

1. Understand the Basics & How Crypto Works

Our first top tip for investing in Crypto is to start by learning what crypto really is; things like blockchains, how networks are secured with proof‑of‑work (Bitcoin) or proof‑of‑stake (Ethereum), and the difference between coins and tokens. Knowing these helps you avoid scams and noise around flashy projects.

Take time to dig into simple explanations. Many tokens exist without clear use cases or teams behind them. Understanding a coin’s real tokenomics, who’s building it, and what problem it’s solving gives you clarity.

When you see price spikes or hype, you’ll know whether it’s real value or empty noise. That’s the foundation for smart investing rather than chasing trends.

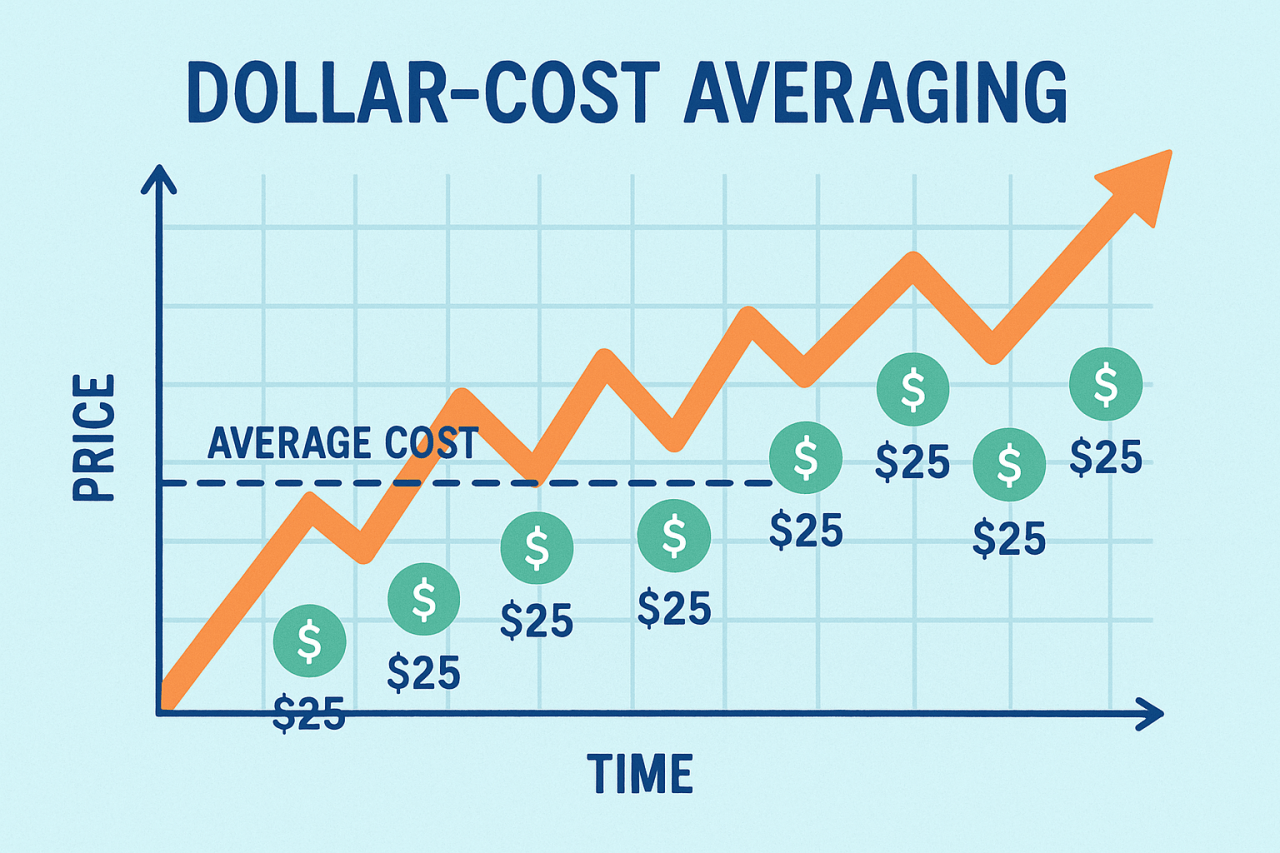

2. Start Small & Use Dollar‑Cost Averaging

Our second tip for investing in Crypto is that you don’t need to invest a lot to begin. Many experts say starting with just $50–100 is enough to get your feet wet without risking too much . Even better: invest a set amount regularly, like $25 per week. This is a strategy called dollar‑cost averaging (DCA).

DCA helps by smoothing out ups and downs in price. Instead of trying to buy at the perfect dip (which is nearly impossible in crypto), you steadily build your position.

Some people even keep a small reserve (about 20% of their plan) to buy more during big drops, lowering their average cost over time. This makes it less stressful and helps you keep investing consistently.

3. Choose Established Coins First

One of most important top tips we can offer for investing in Crypto is that when you’re just starting out, lean toward well-known cryptocurrencies like Bitcoin and Ethereum. These two dominate the market and offer greater liquidity and trust compared to smaller tokens.

Bitcoin alone holds over $2.3 trillion in market cap, making it far more stable than newer coins. Ethereum adds value through its smart contract ecosystem, powering DeFi, NFTs, and more.

That’s not to say all altcoins are bad for your portfolio. Projects like Solana or Polkadot may offer promise, but they require deeper research into use cases and teams.

For beginners, though, starting with established coins helps minimize early mistakes—and provides a strong foundation before branching out.

4. Select a Trustworthy Exchange and Platform

This tip for investing in Crypto should not be ignored because where you buy and manage crypto matters. We recommend that you stick to reputable, well-regulated crypto exchanges.

Names like Coinbase, Kraken, Binance, and in certain regions, eToro or Gemini, consistently win high ratings for reliability, user experience, and security. These platforms support identity verification, two-factor authentication (2FA), and secure storage protocols.

If a site seems sketchy – offering unrealistic guarantees or refusing to verify identities – steer clear. Fees vary widely between exchanges, so compare deposit, trading, and withdrawal costs before diving in. Once you make a small test trade, build your trust gradually before committing larger sums.

5. Secure Your Crypto Wisely and Manage Risk

Keeping your crypto safe involves both digital and real-world caution. Most experts now recommend using self‑custody through cold wallets (offline hardware wallets), especially for long-term holdings, while using hot wallets only for daily spending.

Always enable two-factor authentication, and make offline backups of recovery seed phrases, not storing them digitally or in cloud storage.

Meanwhile, protect your capital by using stop-loss or take-profit orders, and follow position-sizing rules—never risk more than 1–5% of your portfolio on a single trade.

Be vigilant: new threats like “wrench attacks”, where thieves physically coerce holders to surrender keys, have been reported. So maintain a low public profile about your holdings and split keys across secure locations.

6. Know and Manage Tax & Regulation Risks

Taxes and rules around crypto are tightening fast. In the U.S., brokers must now report crypto sale proceeds and cost bases to the IRS using a new Form 1099‑DA starting in 2025, with expanded requirements in 2026.

The IRS treats cryptocurrency as property, so sales—even trades between coins—or using crypto to buy goods can trigger taxable events. Short-term gains (holding less than a year) are taxed as ordinary income, while long‑term gains can be taxed at preferential rates of 0%, 15%, or 20%, according to CoinTracker.

Outside the U.S., the EU is enforcing its MiCA framework, and the OECD’s global Crypto‑Asset Reporting Framework (CARF) will require crypto service providers to disclose user identities and transactions beginning in 2026.

For these reasons, staying compliant with regional rules and keeping precise records is now essential for responsible investing.

7. Keep Learning & Monitor Sensibly

Crypto moves fast. There are always new regulations, global events, ETF approvals, or even algorithmic trends. So, it helps to keep tabs on the market. Platforms like CoinStats, Delta, or CoinMarketCap help track your portfolio, but avoid obsessively refreshing price charts. Instead, schedule weekly check-ins to review fundamentals and trusted news sources.

Follow market updates such as the U.S. SEC’s new ETF guidance to reduce approval times for crypto funds—from 240 days to as little as 75.

Also watch regulation shifts like the EU’s MiCA or U.S. “Crypto Week” bills aiming to clarify industry oversight. This kind of thoughtful monitoring helps you adjust strategies based on credible changes, not fleeting price mania.

Conclusion

Getting started in crypto investing doesn’t require a lot of money—but it does demand discipline, smart planning, and ongoing learning.

By understanding the fundamentals, starting small with a consistent approach, picking reputable platforms, securing your holdings, managing tax and regulatory risks, and staying informed, you’ll build a solid and sustainable strategy.

The crypto ecosystem is evolving rapidly, and while volatility remains, informed investing can bring opportunity. Follow these seven practical tips, stay cautious and curious, and you’ll have a strong start in navigating crypto confidently and responsibly.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Crypto Charts Are Improving, Just Have A Look At These 3 Leading Indicators (July 6th)

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)