Ray Youssef says corporate treasuries are reallocating into ETH and SOL. He forecasts ETH $5,200 and SOL $250 by year-end.

NoOnes CEO Ray Youssef, in his commentary, says corporate treasuries now treat blue-chip altcoins as reserve assets, naming BitMine, SharpLink, Galaxy Capital, Pantera, and Trump Media.

He highlights that Bitcoin dominance has fallen below 60% and that more than 45 altcoins outperformed BTC over the past 90 days.

For a full in-depth analysis you can check out Investing Haven’s ETH price prediction here and SOL price prediction here.

Institutional Stage Of Altseason

Youssef frames the current phase as the institutional stage of altseason. He reports billions have moved into ETH, SOL, BNB, and CRO treasuries and calls this a clear rotation from BTC.

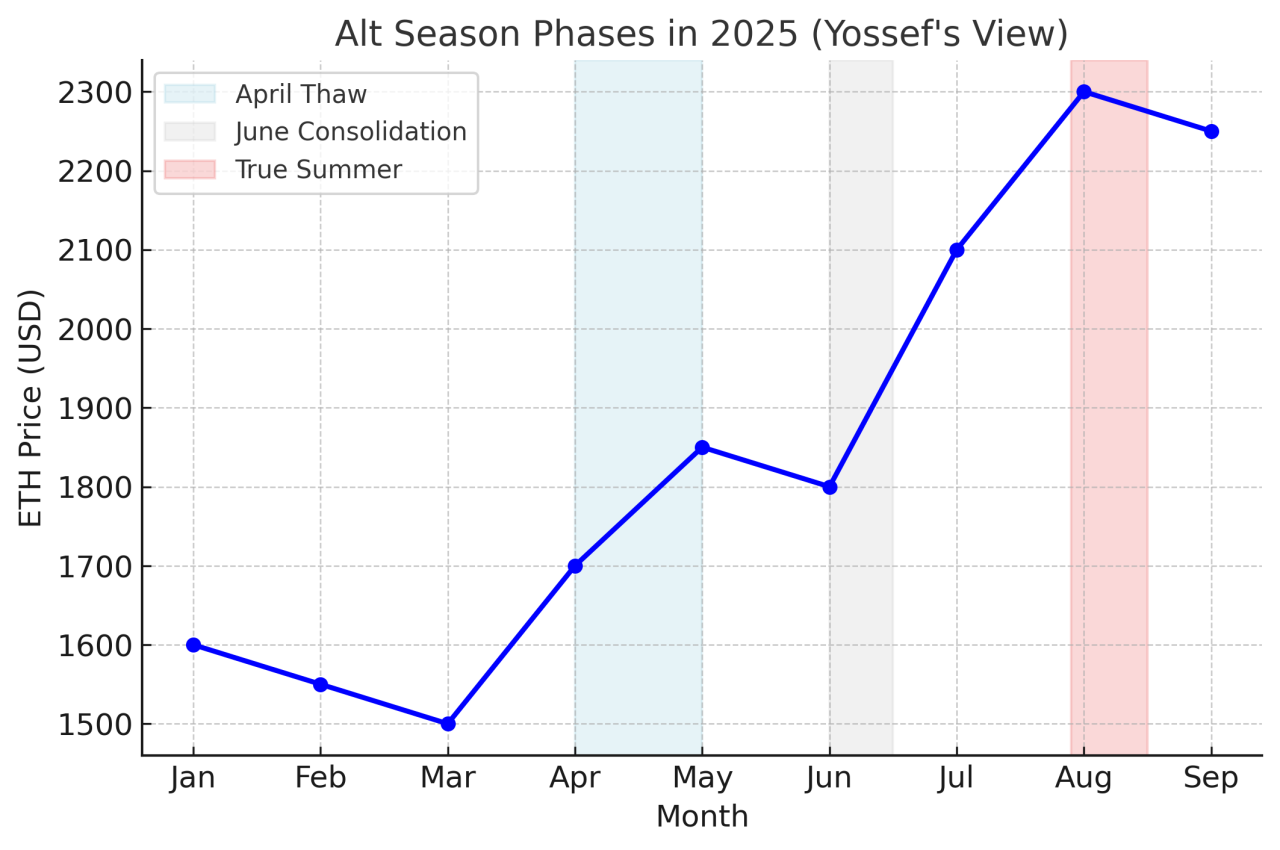

He notes altseason began when ETH fell to $1,500 and opened an accumulation window, a move that invited institutional allocation into select networks.

Youssef believes only projects with real utility and adoption will sustain the next phase, while speculative tokens risk fading.

RECOMMENDED: Top 3 Altcoins Leading Asia-Pacific DeFi Growth in August 2025

Headline Targets And Treasury Evidence

Youssef sets concrete year-end ETH and Solana price predictions; ETH at $5,200 and SOL at $250, conditional on continued treasury accumulation and institutional validator activity. He links the ETH target to expanding on-chain demand, validator economics, and ETF-related flows.

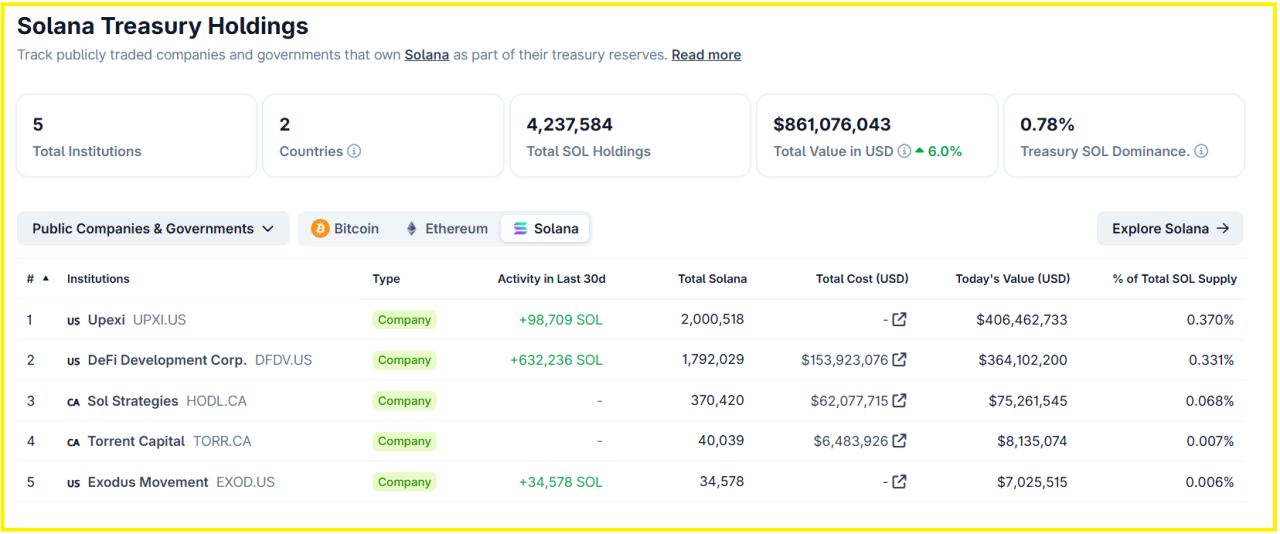

He says Solana treasuries already exceed $800 million in listed firm holdings, and that if Solana follows Ethereum’s path treasuries could scale to tens of billions.

The NoOnes chief points to ETH rallying into the mid $4,000s as the current backdrop and to growing staking and validator activity as reinforcing signals.

RECOMMENDED: 3 Undervalued Altcoins Under $1 With Technical Upside

Near Term Caveats

Youssef qualifies both targets as conditional. He states they assume institutional appetite and market breadth remain intact through Q4 and that macro shocks do not reverse the rotation.

He warns that if Bitcoin dominance re-accelerates the targets would be less likely to materialize.

RECOMMENDED: Why Bitcoin’s Stagnation Indicates Altseason

Conclusion

Youssef’s case is direct; he provides an Ethereum price prediction of $5,200 and SOL at $250 by year-end if corporate treasuries keep accumulating. Watch treasury flows, Bitcoin dominance, validator activity, and ETF-related flows as the primary indicators he recommends.

Don’t Miss the Next Big Move

Join the original blockchain-investing research service, live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)