Crypto Billionaire Yat Siu says tokenization increases Ethereum’s utility in 2025. On-chain RWAs exceed $21B and institutions are testing tokenized instruments now.

In a CNBC interview, Yat Siu explained how tokenization shifts asset settlement and liquidity to smart contract platforms, naming Ethereum and several altcoins as primary beneficiaries.

As of mid-2025, on-chain tokenized real-world assets exceeded $24 billion, up nearly 380% from three years earlier.

Why Tokenization Favors Ethereum

Ethereum supports broad token standards such as ERC-20 and ERC-721, which allow issuers and marketplaces to interoperate.

Developers use mature tooling, audited libraries, and a dense DeFi and NFT stack that reduces integration time for real-world asset projects.

Those features produce deeper liquidity pools, reusable composable modules, and faster product iteration, which encourage issuers to choose Ethereum as a settlement layer.

Yat Siu noted that tokenization workflows map naturally to smart contracts, making fractional ownership and permissioned issuance straightforward to implement on-chain.

Network effects matter because lending, market making, custody, and secondary markets already connect to Ethereum rails more than to many alternative chains. That improves market depth and pricing.

RECOMMENDED: Where will Ethereum (ETH) Be in 5 years?

Tokenization Growth, Liquidity and Institutional Interest

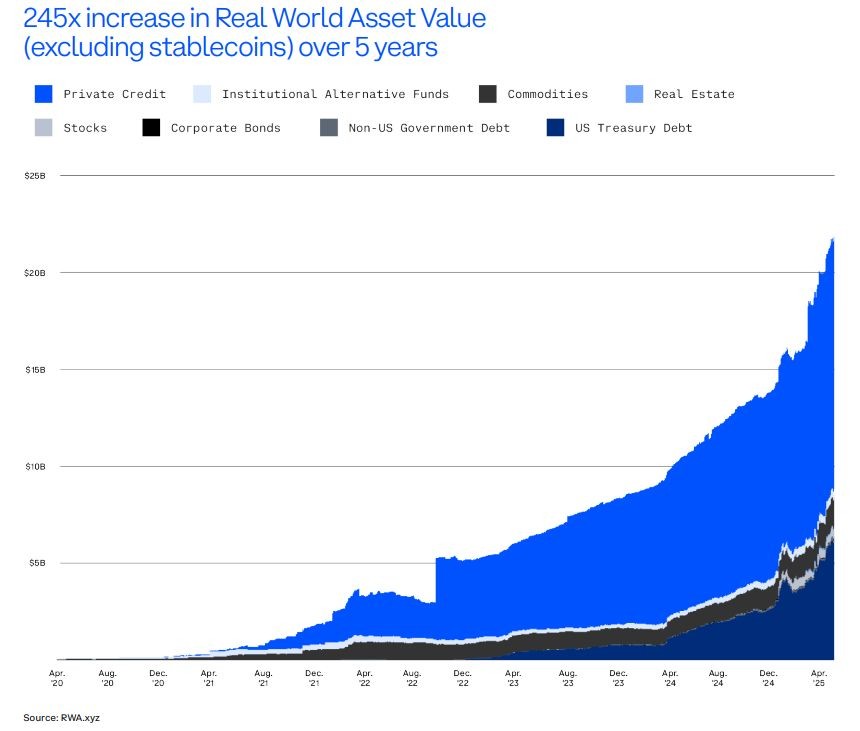

On-chain evidence shows rapid adoption. Coinbase reports RWA tokenization grew from $85m in April 2020 to over $21B by April 2025, a roughly 245x increase.

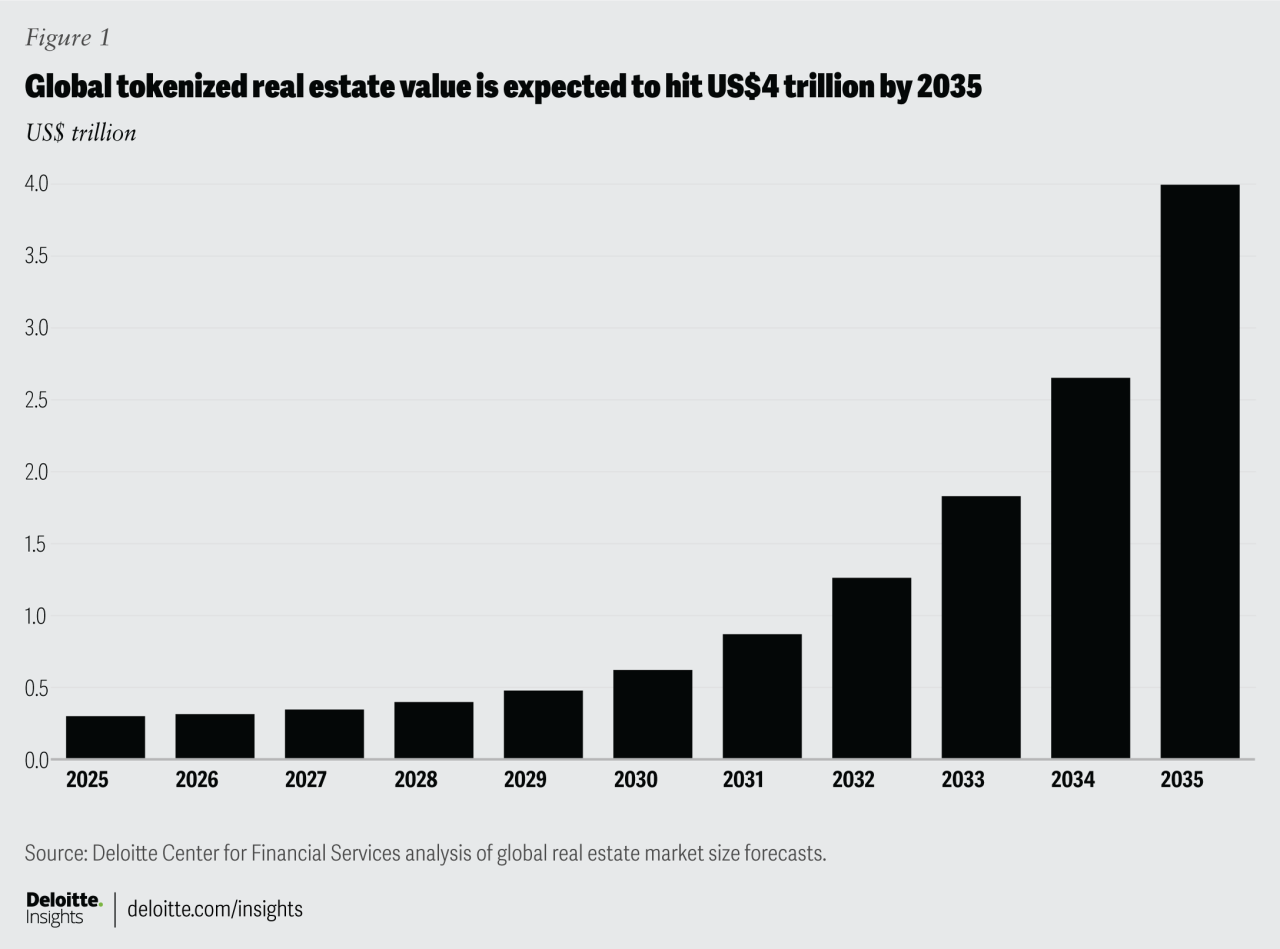

RWA.xyz lists about $24B on-chain by mid-June 2025, led by private credit and tokenized treasuries. Large asset managers and banks run pilots for custody, tokenized funds, and settlement rails, and Deloitte projects up to $4T of tokenized real estate by 2035.

These flows matter because they translate issuer demand into tradable secondary markets and institutional counterparties.

The data shows tokenization is moving from proofs of concept into live product tests across custody, lending, and trading.

Volume and issuer diversity increase market resilience over time.

RECOMMENDED: Is It Still Worth Buying Ethereum In 2025?

Tokenization Challenges, Oversight and Animoca’s Approach

Regulatory frameworks and custody standards remain the principal constraints, with central bankers warning about stablecoin risks and banking rules changing.

Animoca responds with a three-pronged approach: native Web3 projects, advisory services for token economics, and strategic investments to capture tokenization opportunities in core markets globally.

RECOMMENDED: How to Buy Ethereum (ETH) in 2025: A Step-by-Step Guide for Beginners

Conclusion

Tokenization is tangible in 2025, Ethereum leads settlement and liquidity, but regulation and custody standards will shape long-term adoption ahead.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service, live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)