Avalanche posts larger daily activity and higher chain liquidity. Polkadot offers on-demand blockspace and strong validator security.

The Layer-1 competition now measures adoption with users, TVL, and protocol economics rather than raw throughput. We compare Avalanche vs. Polkadot, focusing on Avalanche’s recent user and liquidity gains and Polkadot’s Coretime-era infrastructure.

Our analysis relies on on-chain metrics and protocol reports to judge which ecosystem currently attracts builders and capital.

User And Liquidity Traction

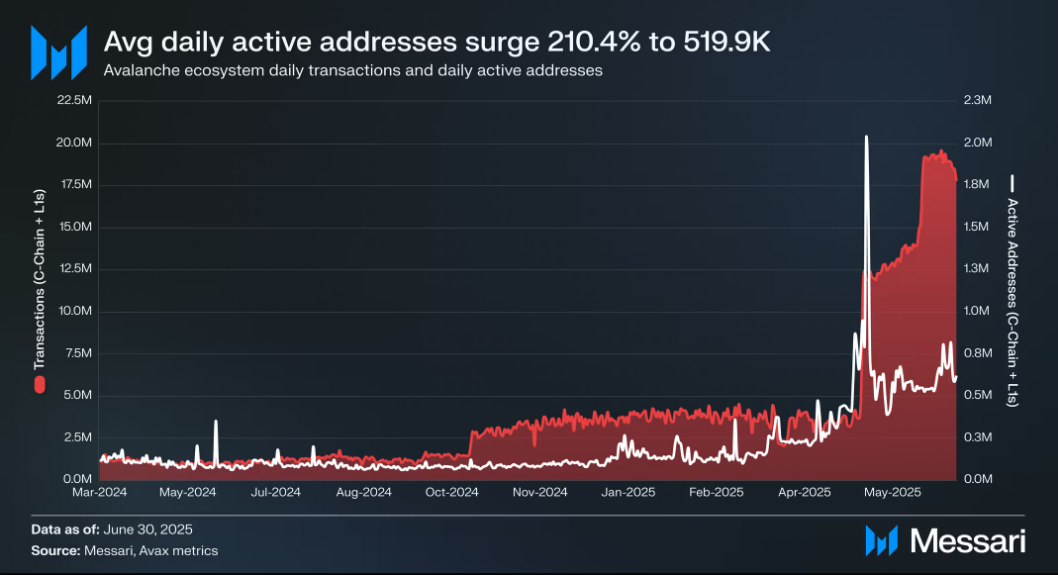

Avalanche recorded average daily active addresses of about 520,000 in Q2 and average daily transactions of 10.1 million, increases of roughly 210% and 170% QoQ respectively, while average C-Chain fees fell to $0.03, according to a report by Messari.

These moves coincide with new L1 launches and high-profile app rollouts.

Live chain metrics show Avalanche’s on-chain TVL and trading activity remain substantial, with a chain TVL in the low billions and 24h DEX volume above $400m, plus around 1.9 million transactions over 24h on the chain dashboard.

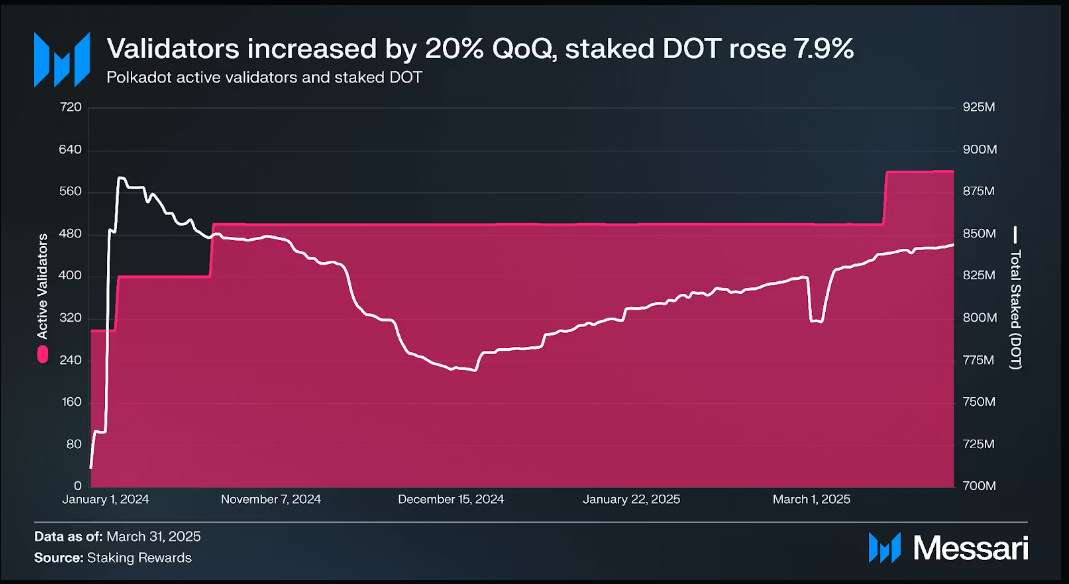

Polkadot’s ecosystem reported 137.1 million total transactions in Q1 and about 529,900 monthly active addresses, while active validators rose to 600 and staked DOT reached roughly 844 million.

DeFi liquidity is concentrated in specific appchains, for example Hydration with roughly $295m TVL on chain trackers.

RECOMMENDED: Can Avalanche (AVAX) Ever Hit $1,000? Here Is A Rational Answer.

Blockspace Economics And Developer Signals

Avalanche’s April Octane upgrade added dynamic fee mechanics and flexible subnet options, lowering average fees and letting teams isolate high-traffic apps. These protocol changes correspond with the spike in daily activity and greater DeFi TVL on the C-Chain.

Polkadot moved from auctioned slots to Agile Coretime, delivering on-demand coretime that lets projects buy blockspace as needed while relying on shared security. That model reduces long term commitment friction for builders and keeps Polkadot attractive for specialized appchains.

RECOMMENDED: Polkadot Price Prediction 2025 – 2030

Avalanche vs. Polkadot: Where Builders Go Next

If builders prioritize immediate liquidity and high daily use cases, Avalanche shows stronger signals today, with larger DEX turnover and rising DeFi TVL.

However, if they need elastic, composable blockspace and unified security for many appchains, Polkadot’s Coretime model offers a clearer path, provided DeFi liquidity spreads beyond a few leading parachains.

RECOMMENDED: Avalanche Price Prediction 2025 – 2030

Conclusion

For adoption measured today, Avalanche leads on capital and daily usage. For long term, multi-chain composition and elastic blockspace, Polkadot remains a compelling infrastructure play. Watch whether Polkadot’s DeFi liquidity broadens, or whether Avalanche sustains user growth after its Octane changes.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)