KEY TAKEAWAYS

- AVAX trades around $13, and most short-term analyst targets point to a mid-teens price range this month.

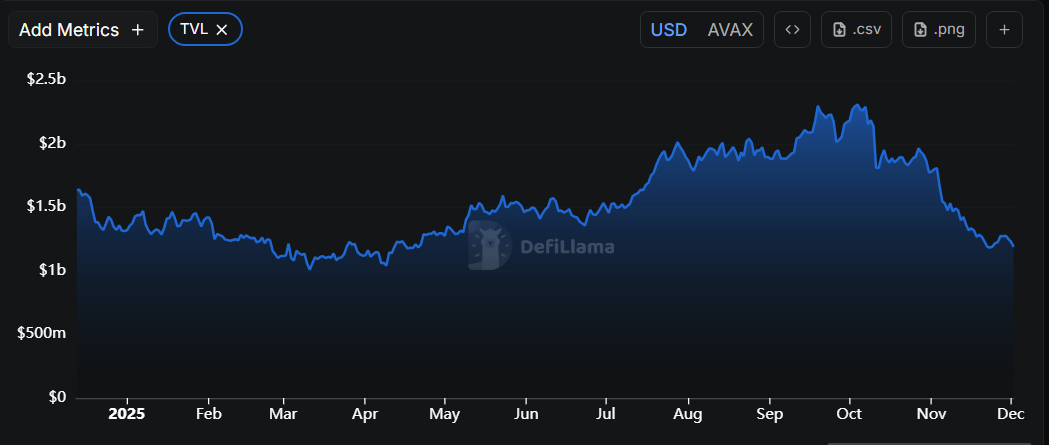

- Network activity remains strong, with TVL at about $2.1 billion and daily transactions above 2 million.

- December outcomes depend on macro conditions and whether treasury buyers follow through with planned large-scale AVAX purchases.

AVAX holds steady in the low-teens while network activity grows. December movement depends on TVL strength and institutional buying plans.

December starts with AVAX at about $13, and the network shows steady usage and solid liquidity across DeFi platforms. In this article we take a clear look at current price levels, on-chain strength, and simple scenarios to help you understand how AVAX could move this month.

RECOMMENDED: Is It Too Late to Buy AVAX? Updated Key Indicators to Know

AVAX Outlook in December

Current Price, Momentum And Analyst Targets

AVAX trades around $13 as of December 2, 2025, after a recent move between $12 and $15. Volume remains stable, and the chart shows clear support in the low-teens.

AVAX price predictions remain modest, with most short-term targets sitting in the mid-teens and only a few long-range projections suggesting moves above $25 in stronger conditions.

Our experts at InvestingHaven are a little more ambitious, predicting a range of $17.7 to $91.1 by the close of the year.

That said, you should watch price behavior and volume reactions to news, since those usually give quicker signals than long-term forecasts.

RECOMMENDED: 5 Compelling Reasons to Buy Avalanche (AVAX) in 2025

TVL, Activity, And Institutional Moves

Avalanche continues to record high usage. TVL stands at about $1.8 billion, and daily transactions exceed 2 million. Lower fees after recent improvements help keep activity high, and DeFi remains a major part of the ecosystem.

Another factor gaining attention is institutional interest. The Avalanche Foundation has been pursuing a $1 billion fundraising plan to support treasury companies, and new treasury vehicles aim to buy large amounts of AVAX.

If these purchases proceed as planned, they could influence market supply and create fresh demand.

ALSO READ: How to Buy Avalanche (AVAX) in the USA: Simple Guide

AVAX December Scenarios: Bull, Base, And Bear Cases

- Bull case – AVAX climbs into the mid-teens if TVL holds and treasury buyers stay active.

- Base case – AVAX trades between $10 and $15 with occasional bursts of volatility.

- Bear case – Weaker macro conditions or falling DeFi usage push the price below support.

If you plan to trade, follow TVL, active addresses, daily volume, and treasury updates before adjusting positions.

Conclusion

AVAX shows strong network usage and steady fundamentals while trading in a manageable range. December outcomes will depend on macro conditions and whether institutional buyers continue their plans.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here