KEY TAKEAWAYS

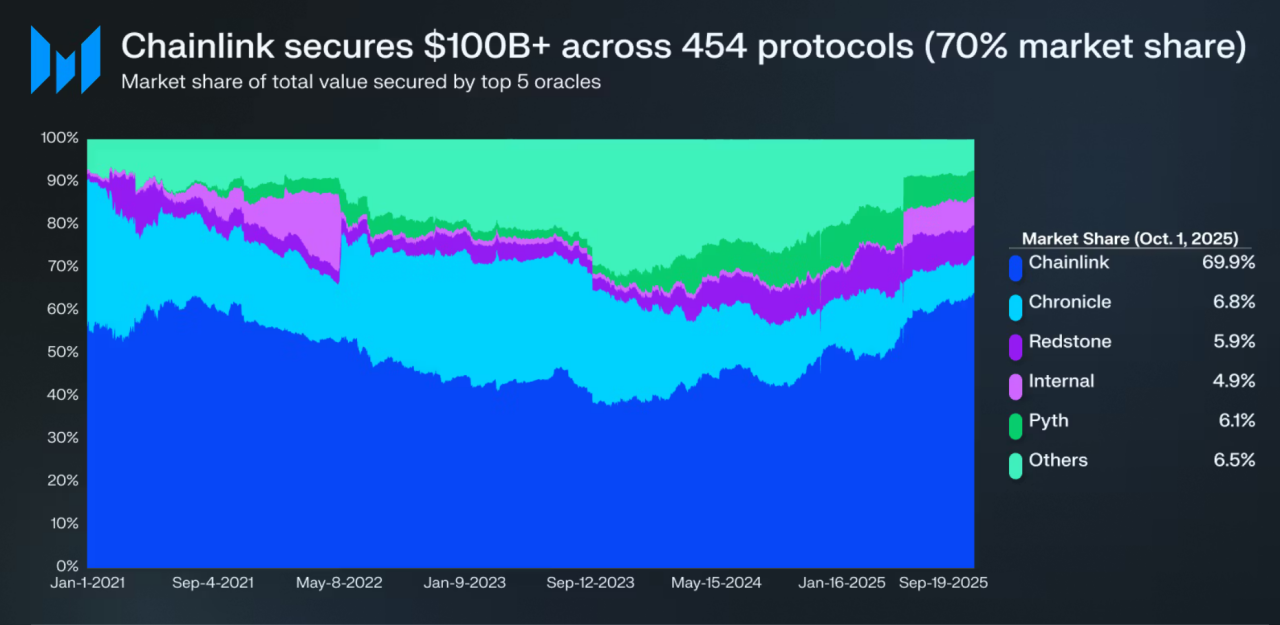

- Chainlink’s scale is clear in hard data, with more than 2,400 integrations, over $100 billion in secured value and close to 70% of the oracle market.

- Major partnerships with SWIFT, Ondo and GLEIF show real progress in tokenized assets, settlement processes and on-chain identity for institutions.

- On-chain activity points to stronger holding behavior, with LINK leaving exchanges and moving into long-term wallets, a sign of improving investor confidence.

Enterprise adoption keeps rising, and Chainlink sits at the center of that growth. Its expanding partnerships show real progress in the industry.

Chainlink is currently trading around 13.35 USD and has has moved from a basic data tool into a key piece of infrastructure for banks, asset managers and global identity networks.

Recent partnerships with SWIFT, Ondo and GLEIF highlight how traditional finance is starting to use Chainlink for tokenized assets and verified data.

With more than 2,400 integrations and strong market share, Chainlink might just be the best crypto to buy today.

ALSO READ: How To Buy Chainlink in the USA

Why Chainlink Could Be The Best Crypto To Buy Today

Chainlink’s growth shows clearly in the numbers. Messari reports the network secures more than $100 billion in secured value and over 2,400 integrations.

Chainlink also holds close to 70% of the oracle market, which makes it the dominant source of verified data in crypto. The ecosystem has processed more than $26 trillion in transaction value.

New features like Confidential Compute and verified data attestors support the privacy and reliability standards large institutions expect. These figures show that Chainlink is not experimental technology but widely used infrastructure.

RECOMMENDED: 5 Reasons to Buy Chainlink (LINK) in 2025

Chainlink Partnerships: Who’s Onboarding And Why It Matters

Recent announcements show the scale of real-world testing. SWIFT and major banks completed pilots that link tokenized fund processes with traditional banking systems, which could simplify settlements across global finance.

Ondo is working with Chainlink to help asset managers and custodians move tokenized securities on-chain with accurate pricing and settlement data. GLEIF is also bringing verified digital identity onto the blockchain to support compliance.

A corporate actions project now includes two dozen participants, all focused on improving data quality for asset servicing.

RECOMMENDED: Where Will Chainlink (Link) Be In 5 Years?

Should You Buy Chainlink? What to Watch

On-chain data suggests more LINK is leaving exchanges, which often signals reduced selling pressure. Exchange balances have dropped to multi-year lows, and millions of tokens moved into long-term holding wallets.

Before buying, pay attention to how SWIFT and Ondo expand their pilots, and also consider price swings and broader market conditions, since these still influence sentiment.

RECOMMENDED: Is Now a Good Time to Buy Chainlink

Conclusion

Chainlink continues to build real adoption through partnerships and proven infrastructure making one of the best crypto to buy today. Before buying LINK focus on usage data, enterprise milestones and market conditions to decide if the current trend supports a stronger long-term outlook.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.