KEY TAKEAWAYS

- Most forecasts point to continued growth, but outcomes depend heavily on macro liquidity, interest rates, ETF flows, and regulatory clarity across major markets.

- BTC and ETH are expected to drive overall market direction in 2026, with six-figure Bitcoin targets widely discussed and Ethereum supported by staking, Layer-2 growth, and institutional use.

- Large-cap alts like SOL, BNB, XRP, LINK, and AVAX show strong upside in bull scenarios, but performance will depend on real adoption, network stability, and fee-generating activity.

- Metrics such as ETF inflows, staking ratios, active addresses, stablecoin supply, and transaction volumes provide earlier and more reliable signals than sentiment-driven news.

- High volatility is likely to persist, making position sizing, diversification, disciplined rebalancing, and clear bull/base/bear planning essential for navigating the next crypto cycle.

Crypto prices in 2026 will depend on money flows, interest rates, regulation, and real usage, with Bitcoin and Ethereum leading while altcoins show very different results based on adoption.

As we enter 2026, cryptocurrency price predictions show there is a wide range of expectations in the coming year.

Standard Chartered recently revised its Bitcoin price target for 2026 to $150,000, roughly half of its original projection but still in line with many institutional models that expect large crypto capital inflows through ETFs.

Meanwhile, CMC Research anticipates a possible bull market kickoff in Q1 2026 for major coins including Bitcoin, Ethereum, XRP and Cardano, indicating cyclical timing matters.

Broader predictions signal that the bull cycle could continue in 2026 with new all-time highs for Bitcoin and major altcoins if institutional flows remain strong and regulatory clarity improves.

That side, altcoin forecasts differ widely, with some models picking potential multi-bag gains and others projecting flat or modest growth depending on adoption and network activity.

Recent news coverage indicates that some forecasters see a possible bull run kicking off early in 2026, though not all agree.

In this article, we cover the 15 top cryptocurrency forecasts for 2026.

1. Bitcoin (BTC)

Bitcoin remains the dominant crypto asset with the largest share of total market capitalization.

Recent institutional forecasts exhibit caution but maintain positive 2026 price expectations.

Standard Chartered cut its forecast for BTC in 2026 to $150,000, citing slower accumulation from corporate holders and a heavier reliance on ETF inflows.

Our forecast model suggests a more moderate path compared with earlier hyper-bullish figures, targeting Bitcoin around $99,910 to $200,000 in 2026.

Some institutional models (including Bernstein and VanEck) placed prior 2026 forecasts near the $150,000–$200,000 range before recent revisions, indicating that six-figure prices are widely discussed.

Standard Chartered’s reduction reflects changing market structure, but the affirmation of ETF importance suggests continued institutional relevance.

You should, therefore, weigh these figures against on-chain demand and trading volume as liquidity conditions evolve.

Bitcoin (BTC) 2026 Price Scenarios

- Bear: $60,000–$90,000. Market remains range-bound or weak macro conditions pressure risk assets, and BTC struggles to attract new inflows.

- Base: $100,000–$150,000. Continued ETF demand and institutional interest support moderate gains in line with revised analyst forecasts.

- Bull: $180,000–$250,000+. Strong recovery in risk appetite, renewed institutional buying, and improved macro liquidity drive BTC well above mid-range targets.

2. Ethereum (ETH)

Ethereum forecasts for 2026 vary, but most credible views sit within a clear and reasonable range.

InvestingHaven places ETH between $3,125 and $6,420, a band that reflects combined input from institutional research and market data.

This range assumes steady network use rather than extreme growth.

Feel free to check our Ethereum price prediction for 2026.

Citi is also moderately bullish with a $4,300 ETH target for the end of 2025, noting that stronger application usage and higher on-chain demand could support further gains into 2026.

Other analysts point to hard data such as staking levels and rollup activity.

More than 30% of ETH supply remains staked, which reduces liquid supply and has historically supported price stability during demand expansions. Some technical models project much higher outcomes, including $11,000+ scenarios, but these rely on aggressive assumptions around adoption and fee growth that have not yet materialized.

Ultimately, these forecasts suggest a balanced outlook. If Ethereum continues to grow as the main settlement layer for crypto applications and institutions maintain exposure, prices can stay well above current levels.

Ethereum (ETH) 2026 Price Scenarios

- Bear: $2,500–$4,000. Lower network activity or broader crypto contraction keeps ETH near the lower end of many forecasts.

- Base: $5,000–$8,000. Steady Layer-2 adoption, fee growth, and institutional interest align ETH with mid-range analyst projections.

- Bull: $9,000–$14,000+. Elevated usage, strong macro tailwinds, and breakout technical momentum push ETH toward higher long-range estimates.

3. BNB (BNB)

BNB serves as the core utility token for Binance’s exchange and the BNB Chain ecosystem.

Our analysts list a 2026 price target of $1,380, extending from a 2025 range of $581 to $1,000.

This projection assumes stable exchange activity and continued relevance of BNB Chain applications.

RECOMMENDED: BNB (BNB) Price Prediction 2025 – 2030

Other market estimates remain more cautious. Some models cap BNB below $1,200 for 2026, while more optimistic views suggest higher levels if on-chain activity accelerates.

The difference comes down to execution, not sentiment.

For BNB to approach InvestingHaven’s target, Binance needs consistent trading volumes, regular token burns, and sustained user activity on BNB Chain.

You can follow Monthly active addresses, burn announcements, and regulatory updates for clear signals.

Regulatory pressure that limits Binance’s operations would weigh on price. Clear compliance paths and steady user growth would support higher valuations.

BNB (BNB) 2026 Price Scenarios

- Bear: $700–$1,000. Exchange volumes cool and regulatory headwinds weigh on BNB Chain utility.

- Base: $1,200–$1,500. Continued steady on-chain activity and consistent token burn rates keep BNB near core forecast levels.

- Bull: $1,800–$2,500+. Strong ecosystem growth and expanding use cases across DeFi and BNB Chain push BNB to new cycle highs.

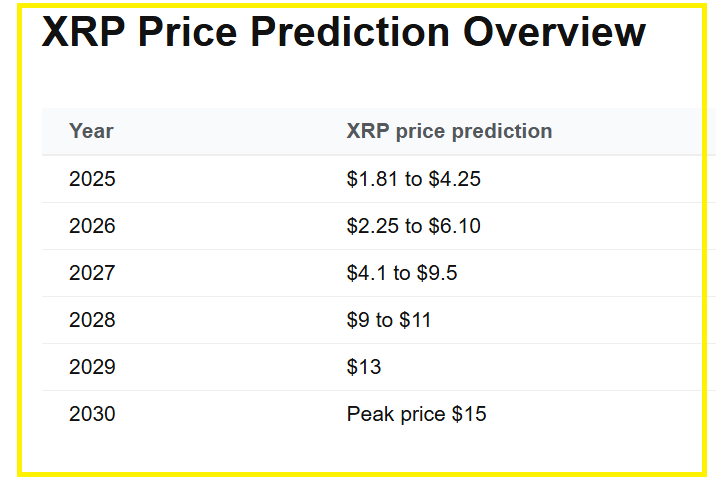

4. XRP (XRP)

We see Ripple/XRP as a chart-sensitive asset with potential for a strong rebound if prior support holds.

The token could trade between about $2.12 and $4.48 in 2026, depending on adoption patterns and broader market conditions.

A stretched outcome of $6 is also possible for scenarios where institutional adoption strengthens.

Binance-linked forecasts show XRP’s 2026 prices clustering between roughly $2.04 and $4.89, with the average closer to mid-single digits.

Similarly, Standard Chartered’s research suggests a higher upside, estimating that XRP could reach as much as $8 by the close of 2026 if cross-border payments momentum increases and regulatory clarity continues to improve.

RECOMMENDED: XRP Price Prediction 2025 – 2030

XRP 2026 Price Scenarios

- Bear: $1.80–$2.50. In a muted market with persistent regulatory uncertainty or slow institutional onboarding, XRP may stay in the lower end of forecasts.

- Base: $2.50–$4.50. This range corresponds to steady expansion of RippleNet usage and gradual uptake in remittance corridors.

- Bull: $5.00–$8.00. Clear regulatory frameworks and wider institutional channels – including potential ETP listings that hold XRP – could support prices in the higher band.

Track real-world payment usage, Ripple partnership announcements, and exchange flow data as leading indicators of where XRP’s price may settle in 2026. These metrics provide clearer signals than sentiment alone.

5. Solana (SOL)

We project a 2026 SOL range with a minimum around $215 and resistance targets near $644, and a best-case scenario that pushes SOL into a top-three market-cap spot with a price target near $900.

CHECK IT: Solana (SOL) Price Prediction 2025 – 2030

Other analysts offer lower single-hundred estimates or modest growth paths depending on assumptions about network uptime and developer adoption.

SOL’s upside depends on two factors: sustained throughput (no repeat network outages) and growth of real-use apps that generate fees and activity.

Solana has high on-chain capacity and if projects increase user counts and fee capture, revenue metrics will validate higher price bands.

The main risk is technical instability.

Repeated downtime erodes developer confidence and user activity quickly.

So, monitor average daily transactions, median confirmation times, and major dApp TVL to see whether price targets match on-chain health.

Solana (SOL) 2026 Price Scenarios

- Bear: $100–$180. Some projection models based on simple linear growth or technical stagnation show SOL near lower triple-digit levels if adoption falters or network issues persist. For example, algorithmic projections place possible 2026 values near $128–$140 under muted growth assumptions.

- Base: $215–$400. This aligns with your projected range and mid-tier analyst views, assuming continued ecosystem growth, increasing fees, and solid throughput without major outages.

- Bull: $450–$900+. Strong real-use adoption, fee capture, and institutional interest combined with robust uptime could propel SOL toward the higher end of optimistic forecasts.

6. Litecoin (LTC)

Litecoin’s forecasts for 2026 generally show moderate long-term upside compared with established large caps.

Technical regression often centers around base levels near $150–$200 as plausible targets if broader crypto market conditions improve and Litecoin holds relevant support bands.

This is close to our 2026 price target of about $221.91, which aligns with a Fibonacci retracement level and suggests a meaningful rise if LTC breaks above key resistance levels.

RECOMMENDED: Litecoin (LTC) Price Prediction 2025 – 2030

There are also less ambitious models, placing LTC at an average of roughly $111–$122 based on technical indicators without strong momentum.

Others suggest price channels between $102 and $233 under mixed sentiment environments.

Litecoin (LTC) 2026 Price Scenarios

- Bear: $80–$120. Simple growth forecasts and some conservative models show Litecoin trading near or slightly above current levels if broader market momentum stalls. Several price prediction tools project 2026 prices closer to ~$84–$90 in low-growth scenarios.

- Base: $150–$230. This range aligns with your target and mid-tier technical estimates, forecast by models that factor in moderate market recovery and resistance breakouts.

- Bull: $240–$300+. Under stronger market conditions, favorable cycles, and breakout momentum, Litecoin could push above key resistance and enter higher valuation bands consistent with more optimistic cyclical projections.

7. Dogecoin (DOGE)

Dogecoin has become a speculative staple with high social interest and wide exchange listings.

Our prediction model shows a broad 2025 range with upside scenarios that could extend into 2026.

We see DOGE trading between $0.449 and $1.71 in 2026, with the minimum price expected to stay above key Fibonacci support levels and the upper band implying a notable rally if market conditions permit.

This 2026 band reflects a mixture of technical patterns (especially the triple W-reversal scenario that needs to resolve higher) and historical meme-coin price behavior.

DOGE must hold above roughly $0.255 to validate this support base and maintain the lower end of the forecast; failure below that level would weaken the bullish case.

Other models that rely on conservative technical indicators suggest a lower possible range near $0.80–$1.30 for 2026.

Dogecoin 2026 Price Scenarios

- Bear: $0.255–$0.449. Broader markets weaken and speculative interest drops, with strong support around the 38.2% Fibonacci retracement level according to chart analysis.

- Base: $0.449–$1.00. Average meme coin demand combined with occasional momentum linked to larger crypto rallies.

- Bull: $1.00–$1.71. Breakouts above psychological levels and renewed retail sentiment or payment integrations could push DOGE into this territory, though such moves require sustained volume growth.

RECOMMENDED: Dogecoin (DOGE) Price Prediction 2025 – 2040

8. Cardano (ADA)

Cardano’s growth remains mixed: it has delivered solid development milestones, strong staking participation, and a steadily expanding ecosystem, but decentralized app (dApp) traction still lags some peers.

On price, many long-term models suggest notable upside through 2026 if core resistance levels break decisively.

Forecasts show ADA could trade in the $2.75–$3.30 range next year, with average projections near $3.03 and upside targets above $3.12 if broader adoption accelerates.

However, less aggressive models foresee ADA lingering closer to $1.40–$1.65 if momentum stalls and network activity does not expand materially.

Much of Cardano’s future price performance will depend on real-use growth.

Boosts in enterprise use or payments integrations could tilt the odds toward higher forecasts, while continued competition and slower dApp rollout may keep ADA near the lower end of its range.

Cardano 2026 Price Scenarios

- Bear: $1.50–$2.10. Network usage remains slow, broader altcoin demand weakens.

- Base: $2.75–$3.30. Gradual ecosystem growth and steady adoption push ADA toward mid-range forecasts.

- Bull: $3.50–$8.00+. Strong adoption, improved utility, and sustained fee activity drive ADA well above core targets.

RECOMMENDED: Cardano (ADA) Price Prediction 2025 – 2030

9. Bitcoin Cash (BCH)

Bitcoin Cash (BCH) heads into 2026 still focused on being a fast, low-cost way to make everyday payments.

However, it now faces tough competition from stablecoins and newer payment rails that are cheaper, faster, and easier to use. As a result, most forecasts for BCH remain cautious.

According to our 2026 outlook, price expectations sit within a wide but mostly conservative range.

There may be gains pushing the price to as high as $1,099. But for this to happen, BCH must hold a crucial support at $234.

Bitcoin Cash 2026 Price Scenarios

- Bear ($45–$120): If users and developers continue moving to other networks, BCH could struggle to attract demand.

- Base ($120–$420): This scenario assumes steady transaction activity, some merchant adoption, and occasional interest from retail traders.

- Bull ($500–$1,400): Strong upside would likely require a renewed push by merchants or a clear real-world use case that highlights BCH’s low fees.

Generally, BCH’s future depends less on hype and more on real payment usage. In 2026, its performance may move independently of Bitcoin during major network-specific developments.

RECOMMENDED: Bitcoin Cash (BCH) Price Prediction 2025 – 2030

10. Stellar (XLM)

XLM’s short-term technical models project modest trading ranges near current levels, while broader trend and fundamental models suggest meaningful upside if Stellar achieves wider network use and breaks critical resistance points.

Analysts at InvestingHaven forecast Stellar could trade roughly between $0.61 and $1.44 in 2026, assuming bullish breakout conditions are met.

Other price models also show varied outcomes: more conservative estimates keep XLM under $1, while some more optimistic long-term forecasts project prices above $1 based on stronger adoption and improved sentiment.

Stellar (XLM) 2026 Price Scenarios

- Bear: $0.30–$0.45. Weak macro conditions, limited adoption, and subdued trading keep XLM near current or slightly lower ranges.

- Base: $0.60–$1.00. Gradual network adoption and moderate crypto market recovery lift prices toward mid-range forecasts (aligned with InvestingHaven’s mid-case).

- Bull: $1.10–$1.50+. Stellar breaks key technical resistance and sees strong fundamental growth, potentially approaching or surpassing some of the higher analyst projections.

RECOMMENDED: Stellar Lumens (XLM) Price Prediction 2025 – 2030

11. Polkadot (DOT)

Our 2026 projection suggests DOT could trade between about $10.22 and $27.20, with a potential peak near $36.25 if network development and adoption accelerate sharply.

Other analysts are more conservative, with forecasts placing DOT near the $7–$8 range if growth is steady but not explosive, and some models even predicting values closer to current levels ($3–$5) under slower growth assumptions.

DOT’s outlook largely depends on interoperability growth, parachain ecosystem expansion, and whether upgrades like Polkadot 2.0 drive broader usage.

Sustained development progress could differentiate bull outcomes from more muted scenarios.

Polkadot (DOT) 2026 Price Scenarios

- Bear: $4–$7. Broader crypto weakness or delays in ecosystem growth keep Polkadot near conservative forecasts.

- Base: $10–$15. Moderate adoption and utility gains.

- Bull: $20–$36+. Strong network effects, improved tokenomics, and positive macro momentum push DOT toward the higher end of analyst projections.

RECOMMENDED: Polkadot (DOT) Price Prediction 2025 – 2030

12. Avalanche (AVAX)

Based on our analysis, AVAX promises a bullish peak up to about $100 in 2026 if the network clears key technical levels and adoption grows substantially.

Other forecasts are more modest but still bullish relative to current prices, with some analyst ranges placing AVAX between roughly $38 and $66 or higher as part of broader crypto growth assumptions.

Ultimately, AVAX’s price performance will depend on real economic activity across subnets, transaction volumes, and ecosystem usage.

These factors could differentiate scenario outcomes materially.

Avalanche (AVAX) 2026 Price Scenarios

- Bear: $20–$35. Weak network activity or general crypto downturns limit upside and keep prices near lower forecast bounds.

- Base: $40–$70. Continued development and reasonable market recovery align AVAX with mid-range analyst expectations.

- Bull: $80–$100+. Strong adoption growth, institutional interest, and breakout technical momentum push AVAX toward higher long-range forecasts.

RECOMMENDED: Avalanche (AVAX) Price Prediction 2025 – 2030

13. TRON (TRX)

TRX benefits from huge stablecoin activity since TRON processes a large share of the world’s USDT transfers due to low fees and fast transactions.

This creates natural demand for the token.

TRX could trade in a moderate range around $0.40–$0.60 next year, assuming steady network activity and continued dominance in stablecoin transfers.

Some models show TRX averaging near $0.50–$0.60, with highs around $0.67 based on historical price patterns and regression analysis.

More optimistic forecasts see TRX climbing even higher by 2026. Under bullish assumptions – including increased adoption of stablecoin rails, broader ecosystem use, and strong macro conditions – TRX could push above $0.80 and even approach $1.10 by year-end in some long-range models.

At the same time, more conservative models that emphasize short-term technical indicators project TRX remaining near $0.28–$0.30, reflecting slow growth in broader crypto markets.

TRON (TRX) 2026 Price Scenarios

- Bear: $0.25–$0.35. Slow market conditions, regulatory headwinds, or weak on-chain growth keep TRX near lower forecast levels.

- Base: $0.40–$0.60. Continued stablecoin volume and steady network activity support a mid-range outcome common to many forecasting models.

- Bull: $0.80–$1.10+. Strong adoption, wider ecosystem use, and positive market sentiment lift TRX toward higher forecast bands.

14. Hyperliquid (HYPE)

Hyperliquid’s native token HYPE has seen explosive growth due to heavy trading volume, rising adoption in decentralized finance, and strong market interest.

Forecasts show a wide range of possible 2026 price outcomes, indicating both bullish institutional interest and lingering volatility uncertainties.

Several models place HYPE in a conservative range near $30–$55 next year, showing moderate growth from current levels.

Others suggest a stronger performance, with the average around $80–$105 and optimistic scenarios nearing $115–$125 if adoption and trading volume expand significantly.

Longer-term forecasts show potential average prices above $180 with highs approaching $240+ under very bullish conditions. Still, HYPE’s volatility and dependence on broader crypto market sentiment mean these figures could shift,

So track network activity and trading trends to better understand where HYPE lands in 2026.

Hyperliquid (HYPE) 2026 Price Scenarios

- Bear: $20–$40. Under weak crypto conditions or prolonged consolidation, HYPE could trade near lower forecast bounds, roughly between about $20 and $40 for most of 2026. Several forecast models show HYPE dipping into this range if adoption slows or market sentiment fades.

- Base: $40–$90. A neutral growth outcome sees HYPE stabilizing and gradually rising, with average predictions clustered around the $37–$50 zone and potential mid-range values near $80–$90 if moderate adoption continues.

- Bull: $100–$240+. In a strong bullish market with robust adoption, some models project HYPE averaging near $185+ and even reaching highs above $240 by the end of 2026.

15. Chainlink (LINK)

Chainlink is one of the most important infrastructure projects in crypto. It provides trusted data feeds that power DeFi platforms, Web3 apps, and an increasing number of enterprise use cases.

Looking ahead to 2026, most forecasts expect LINK to trade higher than today, mainly due to growing adoption of Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and deeper integration with traditional systems.

Under steady adoption trends, LINK could trade around the $50 level in 2026. Broader forecast ranges vary depending on how quickly CCIP is adopted and how much fee revenue Chainlink generates from oracle services.

If usage accelerates, we may see higher double-digit prices by the end of the year.

Chainlink (LINK) 2026 Price Scenarios

- Bear: $10–$20. Slower DeFi growth, rising competition, or reduced demand for oracle services limit upside.

- Base: $30–$50. Gradual DeFi growth, early enterprise CCIP use, and a stable crypto market support moderate gains.

- Bull: $60–$100+. Widespread CCIP adoption, strong institutional use, and higher fee revenue push LINK well above base expectations.

RECOMMENDED: Chainlink (LINK) Price Prediction 2025 – 2030

Macro Outlook & Market Drivers for 2026

Global Economy and Interest Rates

Big economic trends will shape crypto prices in 2026.

When central banks make it easier to borrow money by lowering interest rates, investors often take more risks and put money into assets like stocks and cryptocurrencies.

If rates stay high or go up, people may prefer safer investments, which can slow crypto price growth.

You should closely watch inflation, jobs data, and policy decisions because they influence investor confidence and risk appetite.

Institutional Demand and ETFs

Institutional investors still matter a lot for Bitcoin and Ethereum prices. Products like spot ETF funds make it easier for big investors to buy crypto legally and safely.

When these ETFs get money flowing in, it can push prices up, and when money flows out, prices can weaken.

Role of Stablecoins

Stablecoins are digital dollars that traders use to move in and out of crypto quickly. When more stablecoins are available, trading can grow, which supports price discovery and market activity.

Regulation and Rules

New laws and clearer rules about crypto can help attract more big investors by reducing uncertainty.

For example, regulators in many countries are working on clearer frameworks for stablecoins and exchanges, which could boost confidence in the market.

Adoption and Network Activity

On-chain data like the number of active users, transactions, and new big wallets helps show how many people are actually using crypto. Higher activity usually supports higher prices over time.

Three Market Scenarios for 2026

Bear Scenario (Weak Market)

In a bear case, risk-on assets like crypto face pressure from weak economic conditions, slow investor demand, and cautious money flows. If central banks keep interest rates high or global growth slows, Bitcoin could drift lower.

Some analysts suggest Bitcoin might fall toward $40,000–$75,000 in a stronger downturn due to continued selling and reduced ETF demand, with smaller altcoins dropping even more sharply.

In this scenario, lower trading and fewer buyers could push investors into safer assets like cash or government bonds. Trading volumes often shrink, and stablecoins may make up a larger share of the crypto market, since traders use them instead of holding more volatile tokens.

Base Scenario (Steady Growth)

In the base case, macro conditions improve gradually, and institutional interest stays steady. Bitcoin might trade roughly in a $80,000–$160,000 range by early 2026, supported by steady ETF inflows and healthy on-chain signals like lower exchange supply and long-term holder demand.

Ethereum and major altcoins could see moderate gains too, backed by staking growth and broader adoption. Total crypto market cap could grow from current levels toward $4–$5 trillion if demand holds steady.

Bull Scenario (Strong Market)

Under a strong bull case, liquidity increases and risk appetite rises. Large institutional allocators could pour capital into crypto, pushing Bitcoin possibly above $170,000 or more.

Altcoins with real use cases might outperform, and growing DeFi usage and network activity would support extended gains. In this scenario, total market cap might move toward $6–7 trillion or higher as adoption expands.

Key Takeaways For Investors

Treat The 2026 Outlook As Scenario-Based

The market’s size – about $3.05 trillion with Bitcoin at about 57% dominance – means moves in BTC and ETH will shape overall direction.

Plan for Bear, Base and Bull outcomes and size positions to match each scenario’s probability.

Prioritize Liquidity And Clear Stop Rules

Volatility will remain high; trade only with capital you can afford to lose. Keep any single crypto position modest. For long-term allocation, hold a core of Bitcoin and Ethereum and use a small sleeve for select alts.

Watch On-Chain Signals, Not Headlines

Metrics such as ETH staking share (over 30%), L2 TVL, stablecoin circulation and exchange flows give early, actionable evidence of demand.

Those figures often move before prices follow.

Treat Stablecoins As Utility, Not Alpha

USDT and USDC serve settlement and margin needs. Monitor market-share shifts and reserve disclosures, since changes there affect trading liquidity across the market.

Respect Regulation And Custody

Use regulated venues and audited custodians for sizeable allocations.

Regulatory change can alter market access quickly and cause material price moves.

Rebalance With Discipline

Revisit allocations on set dates or after defined price moves rather than reacting to every headline. Use explicit rebalancing targets and document exit rules for speculative positions.

Keep Timeframe Clear

Short-term trading and long-term holding need different rules. Match tactics to goals, keep risk controls simple, and avoid large leveraged bets.

Which Cryptocurrency Has 10X Potential in 2026?

Our next Premium Crypto alert for Investing Haven Members will be published in the coming days, We will outline key coins to focus on in 2026 with 10x potential along with other key insights for crypto investors in 2026.