KEY TAKEAWAYS

- Bitcoin ETFs recorded about $3.79B in net outflows in November, pushing BTC lower before stabilizing in the high $80,000 range.

- Ethereum’s Fusaka upgrade is scheduled for December 3, 2025, with changes aimed at improving Layer 2 performance and network efficiency.

- XRP gained momentum after U.S. spot ETFs launched on November 21, attracting hundreds of millions in early inflows for the token.

- Solana ETFs pulled in about $531M in their first week, even as Bitcoin products saw heavy withdrawals.

- Chainlink strengthened its long-term outlook through new compliance and institutional partnerships, not short-term price speculation.

Institutional outflows hit $3.79 B, but protocol upgrades and fresh ETF launches opened clear buying windows. Choose wisely.

Let’s review the some of the best crypto’s to buy in December but before we do, what happened in November?

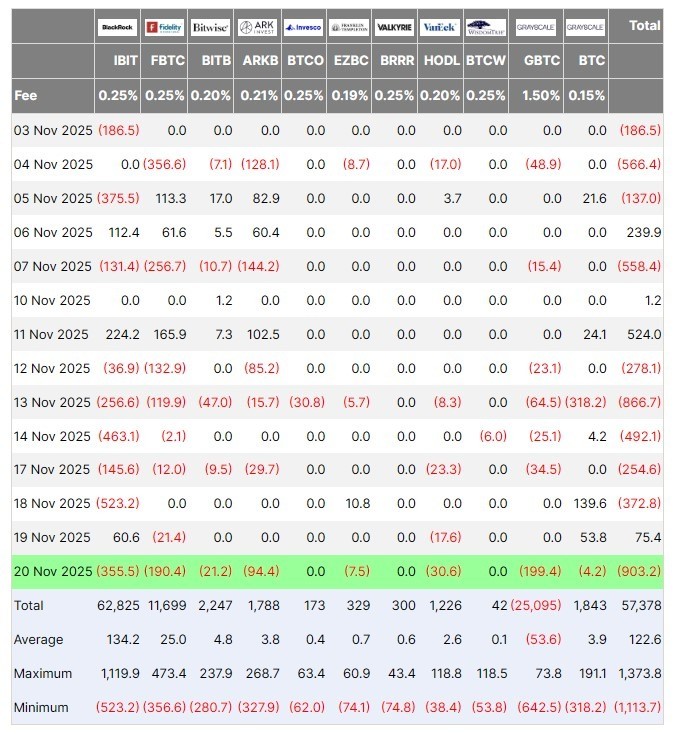

November brought heavy selling pressure in crypto markets. U.S.-listed spot Bitcoin (BTC) ETFs recorded a record $3.79 billion in net outflows by November 21. On November 20 outflows reached about $903 million. That wave weakened Bitcoin and also weighed on broader sentiment.

At the same time, major developments offered fresh opportunities. The upcoming Fusaka upgrade for Ethereum (ETH) is scheduled for December 3, potentially improving fees and Layer-2 performance. New spot ETFs for XRP and Solana (SOL) began trading with SOL ETFs drawing $531 M in their first week.

Meanwhile, Chainlink (LINK) struck a compliance-oriented partnership that may attract long-term institutional interest.

With volatility high but catalysts in place, November offers selective crypto entry points. Below are five crypto picks for November that balance stability, innovation, and opportunity.

RELATED: 3 Best Meme Coins To Buy in November With Real Activity

Top Cryptos For December 2025

1. Bitcoin (BTC)

Bitcoin Is currently trading around 65247.5 USD and remains crypto’s bedrock. Despite 2025’s earlier rally to new highs, November saw BTC slide as ETF demand dried up.

The $3.79 B in November net outflows among U.S.-listed spot Bitcoin ETFs marks the worst monthly performance since their debut.

Some may see these as an opportunity to buy Bitcoin at a price we have not seen in recent months and quite a considerable discount from it’s all time high of $126,000.

Bitcoin’s deep liquidity and large market share still make it the most stable option. Institutional demand could return and a single event or macro shift could trigger renewed buying. Since prices have corrected from recent highs, there’s a lower-risk entry zone now compared with mid-2025.

BTC is at the core of most cryptocurrency portfolios. Avoid over-allocating and treat it as the foundation. Be especially cautious if ETF outflows continue or macro stress returns.

RECOMMENDED: Will Bitcoin Break Out in November? What ETF Flows and CPI Trends Reveal

2. Ethereum (ETH)

Ethereum is trading around 1920.46 USD today and remains the leading platform for smart contracts, DeFi, and NFTs.

Crucially, the Fusaka upgrade is locked in for December 3, 2025. Fusaka includes the PeerDAS update, reducing bandwidth demands for validators and lowering costs for Layer-2 networks.

With Ethereum already trading below its summer highs, the upcoming upgrade presents a comparatively low-risk, high-upside window. If Fusaka works as expected, Ethereum could attract more L2 activity and renewed developer interest.

Consider adding ETH for medium-term exposure rather than quick trades. Monitor network activity, validator health, and L2 adoption metrics as the activation date approaches.

RECOMMENDED: Is It Too Late To Buy Ethereum (ETH) in 2025?

3. XRP

XRP’s price is currently around 1.27 USD and gained renewed interest after new U.S. spot ETFs listed in November. That gave institutions a renewed path to exposure. According to flows tracked by major data providers, the recent ETF listing for XRP helped channel substantial capital into the token.

As of mid-November, some alternative funds recorded net inflows, while Bitcoin and Ethereum saw the opposite. For investors willing to take on more risk, XRP offers an entry tied to renewed institutional access and broader adoption ambitions.

However, XRP remains volatile. Its supply is relatively concentrated, and large holders or ETF redemptions could trigger rapid price swings. Treat any position as tactical, size carefully, and watch inflows, volume, and headline news.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

RECOMMENDED: Is XRP A Buy This November?

4. Solana (SOL)

Solana is trading around 77.97 USD and presents one of the more interesting contrast cases; despite a rough 2025, November brought signs of renewed strength. SOL’s spot ETFs drew $531 M in their first week, even while Bitcoin ETFs suffered heavy withdrawals.

On November 28, trading data shows SOL around $140, offering a near-term entry point after a sizable drawdown from prior highs. Some analysts highlight improving on-chain activity, rising DEX volume, and growing developer confidence as signs that Solana could recover.

Solana’s speed, low fees, and active ecosystem make it attractive for investors comfortable with elevated risk. Keep position sizes modest. Watch network reliability, staking trends, and ETF AUM growth before scaling in.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

RECOMMENDED: Solana: Is It Too Late to Buy? Latest Market Analysis (2025 Update)

5. Chainlink (LINK)

Chainlinks price today is around 8.11 USD and is one of the best cryptos to watch for December.

It works behind the scenes, supplying data to smart contracts and tokenized assets. On November 3, Chainlink announced a strategic deal with SBI Digital Markets, giving the firm access to Chainlink’s cross-chain compliance tools.

This raises the odds that LINK will attract serious institutional demand.

LINK’s value doesn’t depend on hype cycles or speculative money. Instead, growth depends on real use; more tokenized assets, more compliance-driven contracts, more smart contracts needing reliable data.

If blockchain adoption grows, and regulatory compliance becomes more important, LINK could benefit. But token economics, staking rules, and supply unlock schedules make it risky. For now, treat LINK as a long-term infrastructure play.

RECOMMENDED: How To Buy Chainlink in the USA

How To Build A Balanced Crypto Portfolio For December

For key alerts and actionable insights, consider checking out our Premium Crypto Alerts Here

Here’s how a balanced Crypto portfolio may look based on the above mentioned crypto assets.

Choose based on purpose:

- BTC for liquidity and size.

- ETH for potential upside from upgrades and ecosystem growth.

- XRP and SOL as selective opportunities tied to ETF flows or adoption catalysts.

- LINK for long-term infrastructure exposure.

Monitor three main metrics: ETF flows, protocol upgrades or network milestones, and real-world usage (on-chain activity, partnerships, staking stats). Finally, limit position sizes to manage risk.

RECOMMENDED: Top 3 High-Risk, High-Reward Cryptos For November

Conclusion

November’s crypto markets show that volatility and risk remain high, but so do chances for informed gains. Record outflows from BTC ETFs wiped out earlier momentum, but upgrade timelines, fresh ETFs, and strategic partnerships reopened selective windows.

A balanced portfolio with Bitcoin and Ethereum at its core, paired with targeted exposure to XRP, Solana, and Chainlink, could combine stability with potential upside. Stay alert to ETF flow reports, network developments, and adoption news.

In current conditions you need patience, data, and discipline to make good decisions.

Regardless of the cryptocurrencies you choose to invest in this December, whether it be the ones mentioned in this article or others, gains are not guaranteed and you should understand the risks of capital loss before making your decisions.

No gains come without potential risks so it is important that you make educated decisions to give yourself the best chance of success.

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

- Why This Bounce Matters (30 Crypto Charts) (Nov 23rd)

- What’s Going On With Bitcoin & Alts?(Nov 16th)

- This Is What We Want To See The Next 72 Hours(Nov 9th)

- The Next 2 To 3 Weeks …(Nov 2nd)

- A Successful Test of Bitcoin’s 200 dma? (Oct 26th)

What Our Readers Say

“I got to tell you, you guys and your charting and your predictions are AMAZING! I don't know how people can even give you a hard time when you make pullback predictions. Markets cannot go up forever!”

“I LOVE how you talk about the ‘buy the dips’ times vs the ‘sell for profit’ times to get more free coins. You have been right sooo many times — it’s actually amazing!”

— Newsletter Subscriber

“Your team puts a huge amount of work into the newsletters and the analyses. You’ve been doing this for so many years already, and the passion is still there. Respect.”

“Because of your research, I’ve become a much more patient investor. And ‘more patient’ basically means ‘better.’ Over the past few years, my capital has often just stayed unused rather than constantly invested — and it has paid off.”

“Now that my perspective is strictly long term, I have far more peace in my life. Nothing is more stressful than constantly wondering what your crypto might do the next day. After seeing firsthand that long-term investing outperforms trading, the difference is night and day.”

— Crypto Research Subscriber

“As a faithful follower, I really miss the commentaries — the wisdom, the thoughts, the analysis. Truly appreciate the knowledge you share.”

— Long-Time Follower