KEY TAKEAWAYS

- Bitcoin ETFs lost about $681M in one week, showing heavy selling by large investors.

- Ether ETFs also saw outflows, but at a much smaller $68.6M.

- Some money moved into XRP ETFs instead of leaving crypto altogether.

Large investors pulled hundreds of millions from Bitcoin and Ether ETFs, showing short-term caution and a shift toward other crypto products.

In the first full week of 2026, U.S. Bitcoin and Ether ETFs saw about $750M leave their portfolios, with Bitcoin funds taking the largest hit and Ether products following behind.

The withdrawals show noticeable shifts in how large investors are managing their crypto exposure.

Are institutions starting to pull back from these flagship crypto funds, or is this just short-term profit taking?

ALSO READ: Bitcoin vs. Ethereum: Which Is Actually Driving Institutional Flows in Early-2026?

Bitcoin ETFs Saw Heavy Selling

Bitcoin ETFs took the biggest hit. Over four trading days, investors pulled about $681M from these funds.

One day alone, January 7, saw $486.1M leave the market, making it the largest single-day withdrawal of the week.

The biggest fund, BlackRock’s IBIT, led the losses.

On January 9, it recorded about $252M in outflows.

Other Bitcoin ETFs also saw money leave, though some, like Fidelity’s FBTC, still attracted small inflows.

Even with this selling, Bitcoin ETFs remain huge. They still hold around $116.9B worth of Bitcoin, which equals about 6.5% of Bitcoin’s total market value.

That shows investors are trimming positions, not abandoning Bitcoin.

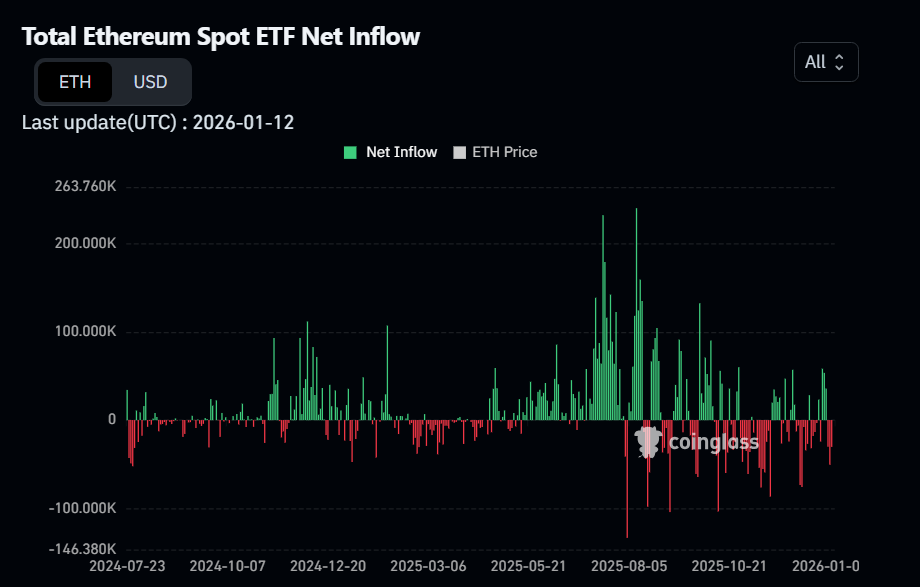

Ether ETFs Also Lost Money

Ether ETFs followed the same trend but on a smaller scale.

These funds lost about $68.6M over the week. Early inflows disappeared as selling picked up later, showing that investor confidence shifted quickly.

Major Ether funds, including products from BlackRock and Grayscale, saw most of the withdrawals.

Still, Ether ETFs manage about $18.7B in total assets, so the recent outflows look more like short-term profit taking than a major exit.

RECOMMENDED: Bitcoin, Ethereum, XRP: The 3 Cryptos Dominating January 2026

Some Money Moved Into XRP ETFs

Not all crypto ETFs lost money. XRP spot ETFs saw about $38.1M flow in and reached record weekly trading volumes.

This shows many investors simply moved funds from Bitcoin and Ether into other crypto bets instead of pulling out completely.

YOU MIGHT LIKE: Spot XRP ETF Debuts With $245M In First-Day Inflows

Conclusion

The $750M outflow from Bitcoin and Ether ETFs points to short-term caution, not panic.

Big investors took profits, reduced risk, and shifted some money into altcoin funds like XRP. Watch ETF flows to understand what investors will do next.

In our next premium crypto alert we will outline some key crypto assets for 2026 and where the opportunities are right now.