KEY TAKEAWAYS

- A sharp drop in stablecoin balances reduced instant buying power across major exchanges.

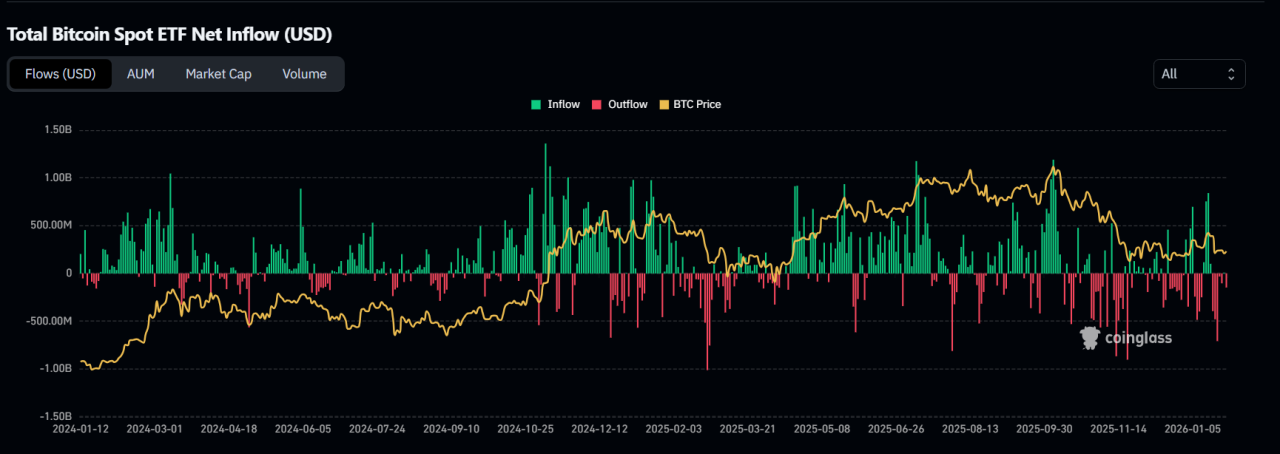

- Spot-Bitcoin ETF outflows removed institutional demand that often supports price rebounds.

- With less cash on both fronts, Bitcoin rallies now require larger, clearer inflows to hold.

Billions have exited stablecoins while Bitcoin ETFs saw heavy redemptions, thinning liquidity and turning rebounds into short-lived rallies.

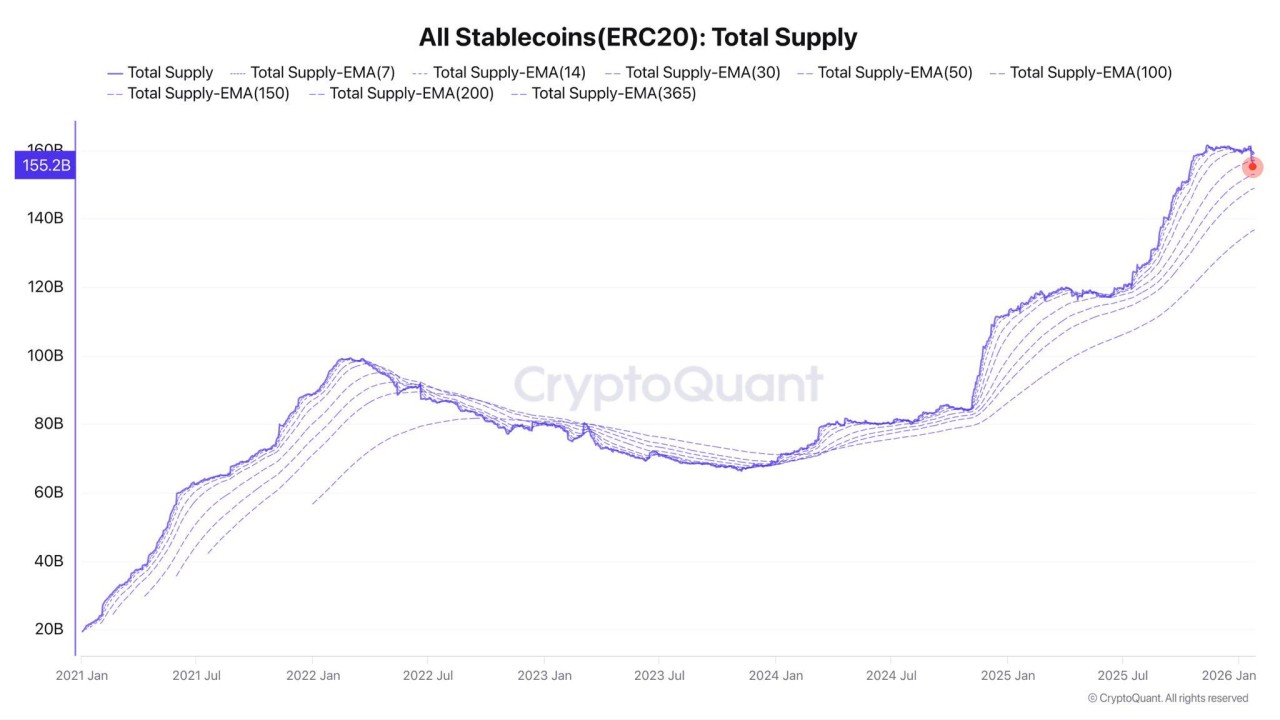

Over the past week, roughly $7B exited ERC-20 stablecoins, shrinking the pool of instant buying power across major crypto exchanges.

At the same time, U.S. spot-Bitcoin ETFs recorded multi-day net outflows estimated between $1.1B and $1.7B, removing a steady source of institutional demand.

With liquidity draining from both sides, can Bitcoin still sustain a meaningful rebound?

RECOMMENDED: Analysts Predicts 50% Bitcoin Surge – But Not Without Warning

Stablecoins Are Shrinking And Liquidity Is Thinning

Stablecoins act like cash inside crypto markets. Traders use them to buy quickly without moving funds back to banks.

When balances fall, fewer buyers stand ready.

Recent data shows ERC-20 stablecoin supply dropped by about $7B in a short period.

That decline means thinner order books and slower price reactions.

Sellers face less support, while buyers need larger orders to move prices.

This setup increases volatility and makes rebounds harder to sustain.

Bitcoin ETFs Are No Longer A Safety Net

Spot-Bitcoin ETFs changed market behavior by adding steady institutional demand.

When money flows in, ETFs buy Bitcoin. When investors redeem shares, ETFs sell or stop buying.

Recent outflows totaling $1.1B to $1.7B across several sessions reduced that steady bid.

Without ETF buying, the market leans more on retail traders and short-term strategies.

These flows often react faster to price swings and rarely support long rallies on their own.

RECOMMENDED: Crypto ETFs Suffer $1.7B Outflow In Five Days

What This Means For Bitcoin Prices Now

Bitcoin can still bounce, but the math has changed. With billions removed from stablecoins and ETFs, the market needs fresh capital to push higher.

Small inflows may spark short rallies, but they struggle to last without stronger support.

If stablecoin balances stabilize or ETF flows turn positive, sentiment could shift quickly.

Until then, price moves are likely to stay choppy, with rallies fading faster than traders expect.

ALSO READ: Massive $150M Bitcoin Buy Plan Could Ignite Next BTC Rally

Conclusion

Bitcoin faces a liquidity squeeze from both retail and institutional sides.

Until new cash returns, rebounds may remain brief rather than the start of a sustained move higher.

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

In just a few days we will publish our latest premium crypto alert, where we will reveal the crypto assets that could have explosive potential in 2026.