KEY TAKEAWAYS

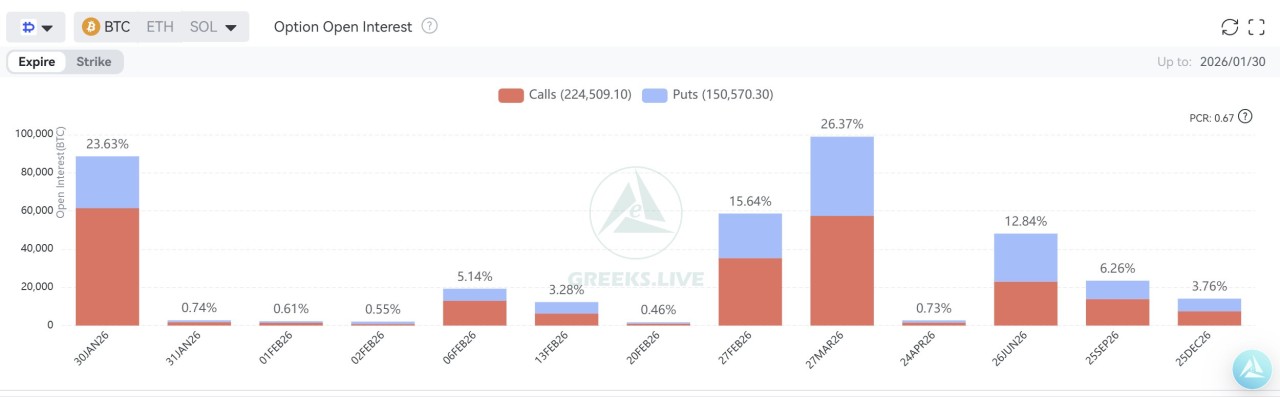

- Roughly $8.8 billion in BTC and ETH options expire today, with Bitcoin making up most of the notional value.

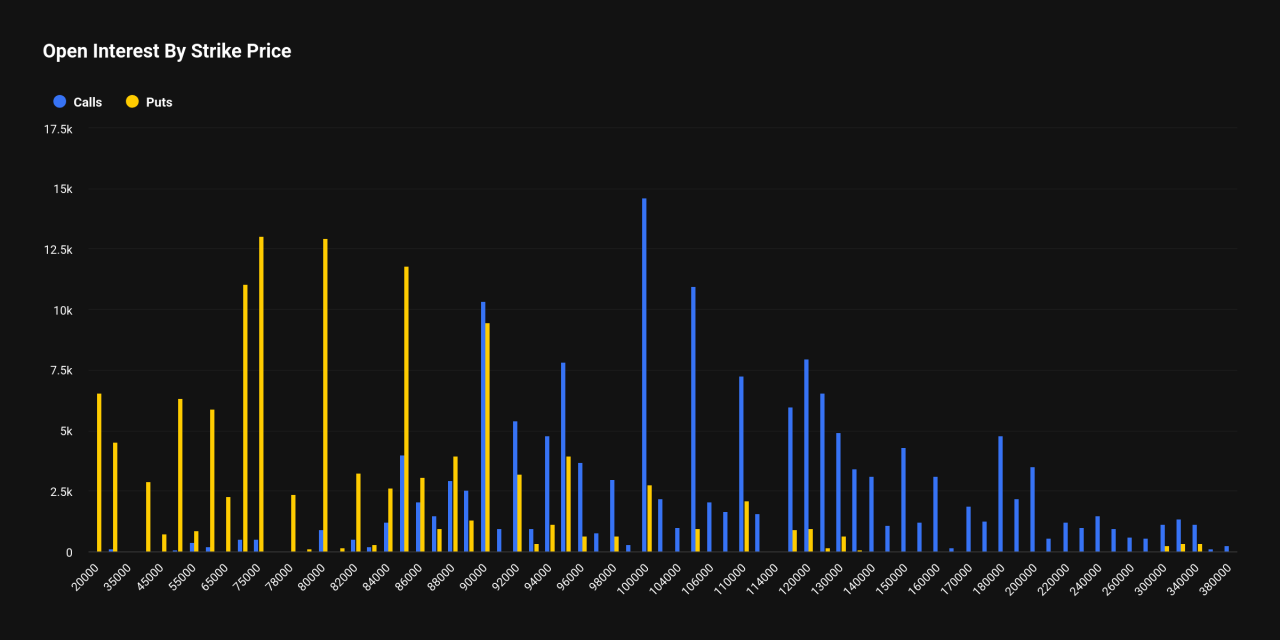

- Large call interest sits at $100,000, while put exposure concentrates between $80,000 and $85,000.

- Dealer hedging and leverage adjustments can increase volatility around the expiry window.

- Should you invest $1,000 in Bitcoin or Ethereum now?

About $8.8 billion in crypto options settle today, with Bitcoin carrying most exposure. Heavy positioning at key strikes could fuel sharp price swings.

A large block of crypto derivatives rolls off the market today as options worth about $8.8 billion expire at 08:00 UTC.

Bitcoin dominates the exposure, while Ethereum accounts for only a small share in the low hundreds of millions.

Open interest data shows positions clustered around a narrow range of strikes, creating conditions where even modest price moves can trigger fast hedging activity.

RELATED: $7B Leaves Crypto Markets: Can Bitcoin Still See A Real Bounce?

Why This Options Expiry Matters

This expiry ranks among the largest this year. Most of the risk sits in Bitcoin options, which means price reactions will likely center on BTC.

When a large amount of open interest clusters at a few strikes, the market can struggle to absorb adjustments smoothly.

As positions settle, traders and dealers must rebalance exposure, which can move prices faster than usual.

RECOMMENDED: Why BlackRock Is Bullish On Ethereum Despite The Price Stall

How A Squeeze Can Form

Dealers who sold call options often hedge by buying futures or spot Bitcoin as price rises toward those call strikes. That buying pressure can lift prices further and trap short positions.

On the downside, a move toward heavy put strikes can force rapid selling as protection kicks in.

Funding rates often shift quickly during these periods, raising costs for leveraged traders and pushing weaker positions out of the market.

Key Levels And Signals To Track

The main upside focus sits at the $100,000 call strike. On the downside, $80,000 to $85,000 marks the area with the largest put exposure.

Volatility usually increases in the two hours before and after the 08:00 UTC settlement. Sudden changes in funding rates, futures open interest, or spot ETF flows often confirm whether hedging pressure leans bullish or bearish.

RECOMMENDED: Analysts Predicts 50% Bitcoin Surge – But Not Without Warning

Conclusion

With so much exposure packed into a narrow range, this expiry creates a setup for sharp and fast moves.

Short term direction will depend on how dealers hedge and how price reacts around the largest option strikes.

Should You Invest $1,000 In Bitcoin or Ethereum Now?

Before you invest in Bitcoin, you’re going to want to read our next premium crypto alert which will be published in the coming days. We will reveal key crypto assets to consider in 2026 with explosive potential.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.