KEY TAKEAWAYS

- About $2.4B in Bitcoin options and $430M in Ethereum options expire today.

- Deribit hosts most of the open interest in these contracts.

- Dealer hedging near popular price levels can create short-term price pressure.

About $2.8–$2.9B in Bitcoin and Ethereum options settle today.

Big strike levels could steer short-term price moves, and dealer hedging adds extra momentum around key levels.

Roughly $2.8–$2.9B in crypto options expire today, making this one of the busiest settlement days of the quarter.

About $2.4B of that total comes from Bitcoin options, while around $430M comes from Ethereum.

Most of these contracts trade on Deribit, the largest crypto options exchange, with final settlement centered around 08:00 UTC.

That timing is important because trading activity often slows around expiry, which can make prices move more sharply than usual.

RECOMMENDED: $21M Liquidations Hit Crypto Markets – Fed Chair Jerome Powell Is Subpoenaed

How Big This Expiry Is

Today’s total expiry of $2.8–$2.9B is large by recent standards.

Bitcoin accounts for most of it at roughly $2.4B, with Ethereum making up about $430M.

While options trade on several platforms, Deribit holds the majority of these positions, with smaller amounts spread across other exchanges and institutional venues.

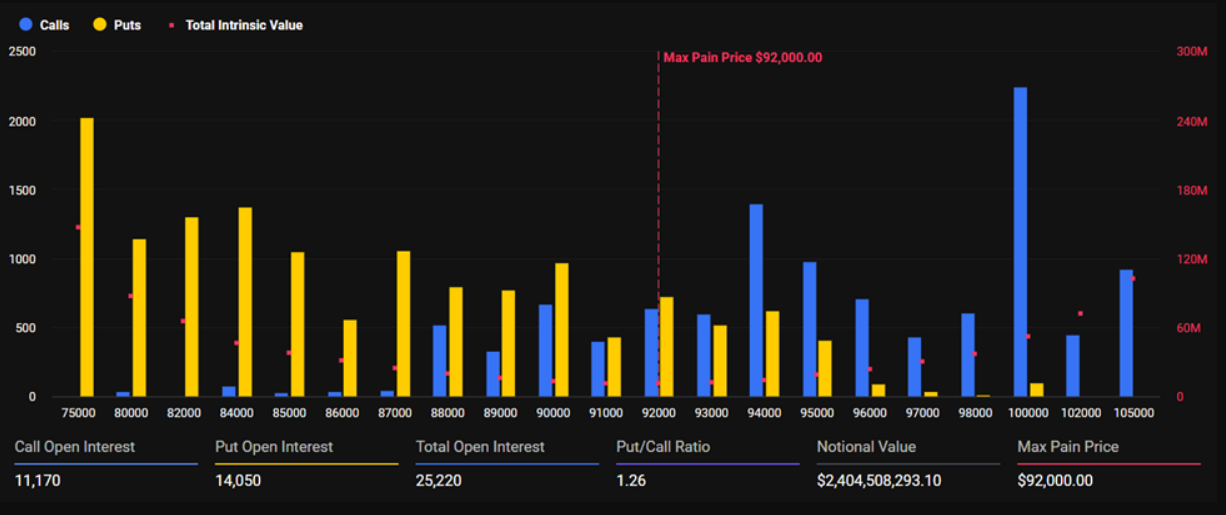

A lot of open interest sits at specific price levels, known as strikes.

For Bitcoin, the biggest clusters fall between $40,000 and $55,000. For Ethereum, the most active strikes range from $2,500 to $4,000.

At some of these levels, more traders bought calls (bets prices will rise), while at others more traders bought puts (bets prices will fall).

This mix influences how market makers manage their positions.

Most retail-focused exchanges settle options around 08:00 UTC, though a few institutional products use slightly different cutoffs.

These timelines are crucial because they determine when trading desks adjust, close, or roll their positions as expiry approaches.

ALSO READ: $1B Frozen – Sui Network Suffers Disastrous Outage

Why This Can Move Prices

When options expire, dealers often buy or sell spot Bitcoin or Ethereum to keep their risk balanced.

These trades can push prices toward heavily traded strike levels, especially if there is limited liquidity in the market.

If liquidity drops around settlement, even small trades can move prices several percentages in a short time.

Today’s large expiry increases the chance of brief but noticeable price swings. Still, the broader market environment plays a role.

If trading is calm, the impact may be mild. If markets are already shaky, expiry-related flows can add to the turbulence.

RECOMMENDED: Crypto Scams Hit A Staggering $17B In 2025 – How To Protect Yourself In 2026

What Traders Are Doing

Over the past week, larger traders have leaned more bullish.

Many bought calls at higher price levels, while others sold selected puts.

Several whale trades paid high premiums for out-of-the-money calls, showing confidence in upside potential.

At the same time, many smaller traders are rolling or closing positions before 08:00 UTC to avoid last-minute surprises.

Market depth around key strikes gives clues about how aggressively dealers adjust their books as settlement nears.

Conclusion

The $2.8–$2.9B expiry could spark short-term volatility and pull prices toward popular strike levels.

The settlement around 08:00 UTC will reveal where the strongest pressure lies as expiring contracts roll off and new positions take their place.

Before you invest in Bitcoin, our next premium crypto alert for Investing Haven members will be publishing in the coming days, we will reveal the crypto assets to consider in 2026 with explosive potential.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here