Bitcoin offers stability, Ethereum brings smart-contract growth, and XRP holds explosive upside—each suits different risk profiles for $10K investment.

Investing $10,000 in crypto today means weighing the familiar safety of Bitcoin (BTC, ~$108 K) against Ethereum’s (ETH, ~$2.52 K) smart-contract utility and XRP’s (XRP, ~$2.22) high-risk, high-reward potential.

With institutional river currents and on‑chain whale signals shaping markets, let’s look at how you can allocate your investment wisely.

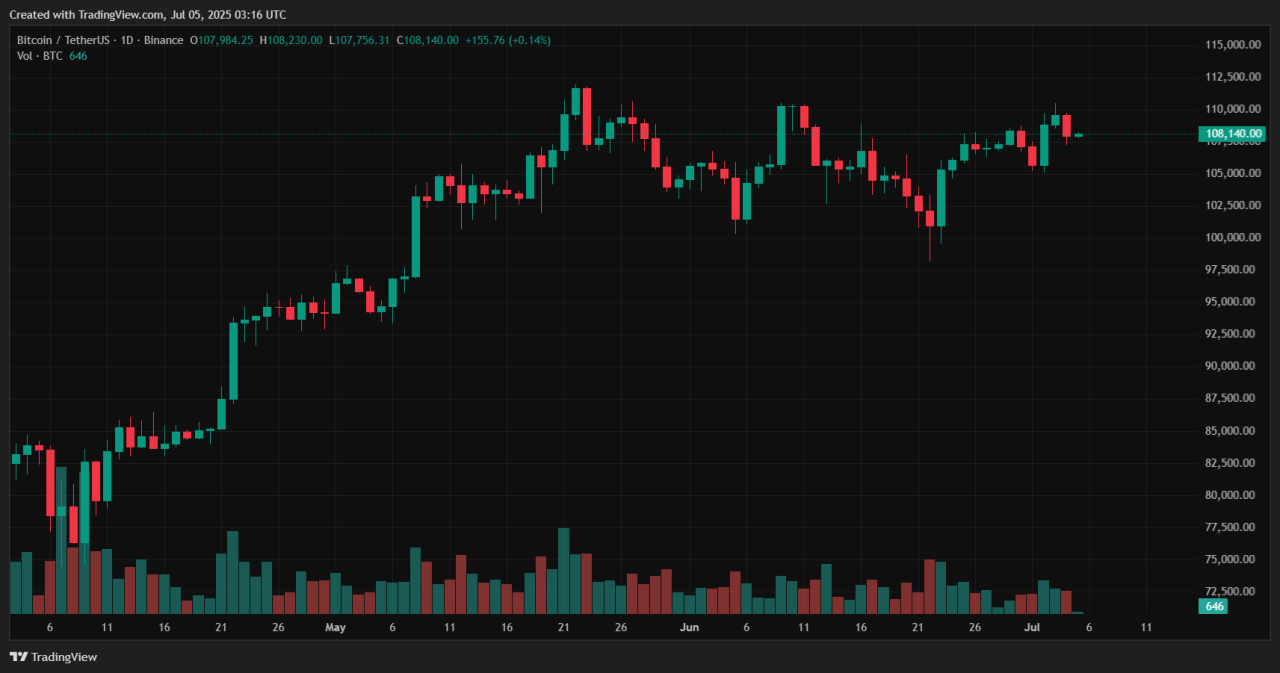

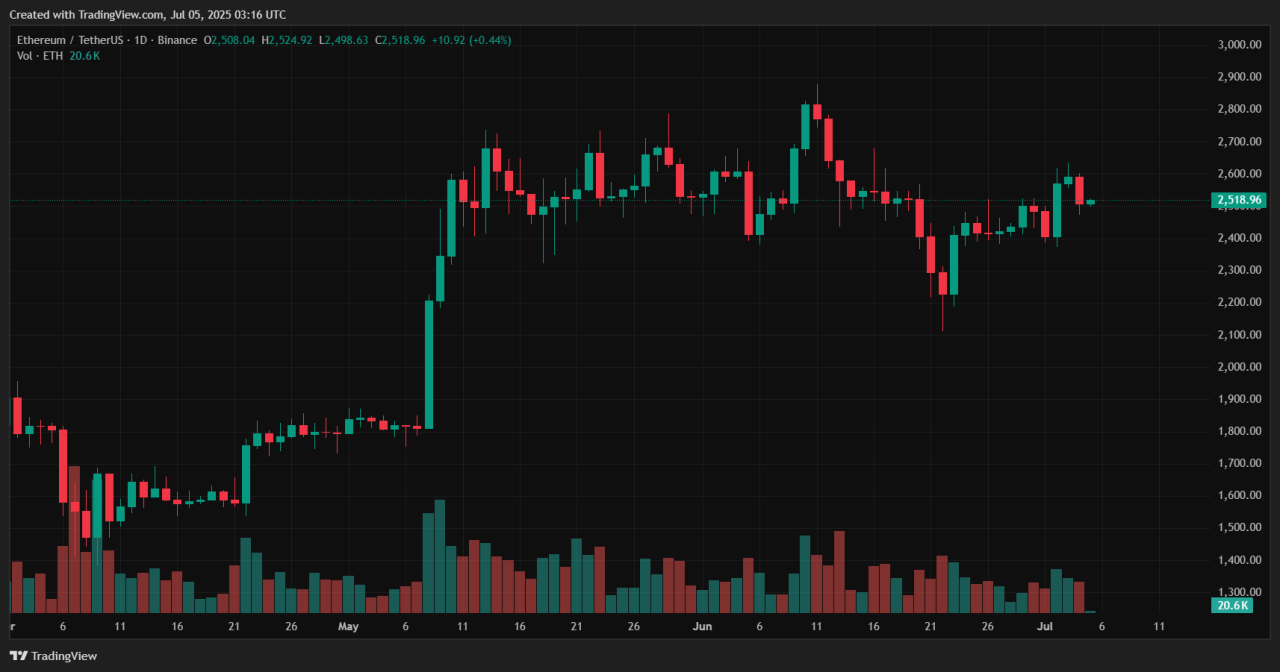

Price & Performance Overview

Bitcoin is up roughly 50% since April, consolidating between $100–110 K as ETF inflows surge—83% of a $2.7B fund influx went into BTC last week. Meanwhile, dormant wallets holding $2 b worth woke after 14 years, hinting at volatility.

Ethereum has gained nearly 6% recently, trading in the $2.5–2.6 K range amid expanding DeFi and upgrade expectations.

XRP has rallied to $2.22, leaning on increasing whale activity and network use—on‑chain data shows >2700 wallets now holding over 1 M XRP each—and is hovering near $2.25 resistance.

Analyst Forecasts & Upside Potential

Analysts see bullish paths ahead. According to Business Insider, Bitcoin could climb 25% to $143 K if breaking $114 K resistance. On the other hand, Standard Chartered and Bitwise forecast year‑end targets up to $200 K.

Ethereum may reach $4.5–5 K, benefiting from utility growth post-Merge. XRP carries explosive upside, with some predicting a breakout toward $3.40, even $5–10, if ETF approval and regulatory clarity arrive.

Risk & Regulatory Profile

Bitcoin’s decentralized, ETF-backed structure positions it as a stable core holding. However, reactivation of old wallets could trigger price swings.

Ethereum continues grappling with classification concerns around staking and network congestion, though protocol upgrades are expected this year .

XRP has made major strides following SEC suit resolution—retail markets are no longer considered securities—but the engine behind institutional ETF is still pending. Centralization and legal/regulatory bottlenecks persist .

Potential Allocation Strategy

If you value stability, consider a 60% BTC / 30% ETH / 10% XRP split—Bitcoin anchors your portfolio, while ETH and XRP chase utility-driven and regulatory upside.

For a balanced approach, 40/40/20 keeps strong core exposure with meaningful growth potential. If you are an aggressive investor, you may opt for 50% XRP, prioritizing its asymmetric return possibility, tempered with 30% ETH and 20% BTC.

Conclusion

Bitcoin offers institutional-grade stability, Ethereum delivers balanced utility and upside, and XRP stands out as a speculative lottery ticket with disproportionate ROI potential if catalysts fall into place.

Choose your mix according to your comfort with volatility—and monitor key resistance levels: $114 K for BTC, $4 K+ for ETH, and $2.25+ for XRP to signal momentum shifts.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Crypto Charts Are Improving, Just Have A Look At These 3 Leading Indicators (July 6th)

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)