Bitcoin is surging above $105K on strong ETF inflows and the Senate’s passing of the GENIUS stablecoin bill. With institutional momentum and bullish technical signals, it’s positioned for a potential breakout toward $120K–$150K.

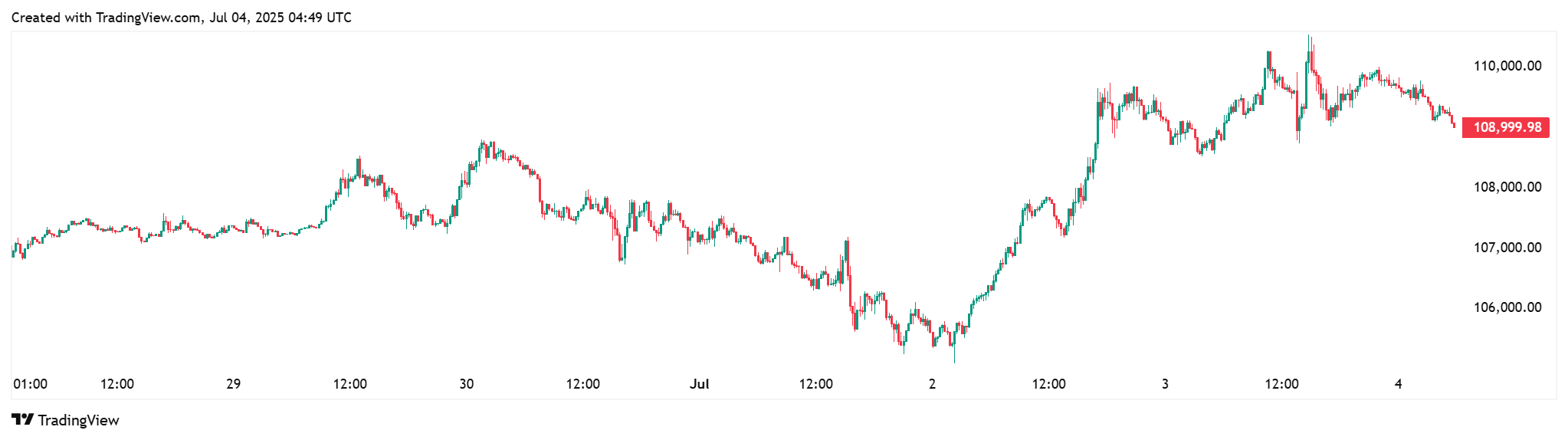

Bitcoin is currently trading in the $105,000–$108,000 range, propelled by a surge in institutional flows and a major regulatory milestone.

Over the weekend, it reclaimed a foothold above $105k after strong ETF inflows and news that the Senate passed the GENIUS Act—a historic stablecoin framework—on a bipartisan 68–30 vote.

Let’s see why Bitcoin is the best crypto to buy today.

Bitcoin Price Action Boosted by Institutional Tailwinds

Following the Senate’s action, Bitcoin touched a new 2025 high near $111,900, surpassing its January peak of $109,588. Futures open interest has reached a record $72 billion, indicating growing confidence among institutional players.

A golden cross—where the 50-day moving average crosses above the 200-day—has also formed, a signal historically followed by rallies of 43%–157%. Volume surged by an estimated 74% alongside an 8% uptick in futures interest, suggesting substantial investor participation rather than speculative noise.

Regulatory Clarity Sparks Infrastructure Expansion

With the GENIUS Act now passed, stablecoin issuers must maintain 1:1 dollar reserves, undergo monthly audits, and hold clear federal or state licenses—while getting relief from SEC securities oversight.

This certainty is already spurring institutional infrastructure: JPMorgan, Bank of America, and Circle are moving ahead with stablecoin strategies, while major banks prepare custody services. As stablecoins gain stability, broader ecosystem trust grows, reinforcing Bitcoin’s strength.

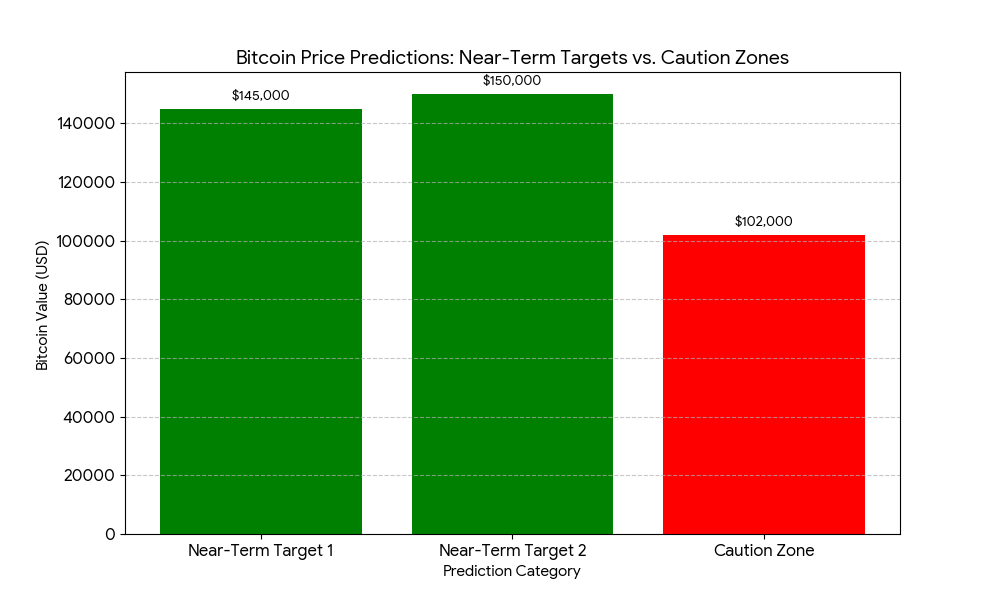

Bitcoin Near-Term Targets vs. Caution Zones

Analysts eyeing ongoing momentum are forecasting Bitcoin climbing toward $120k–$170k, with some models even targeting $150k+. Bullish bets dominate across options and futures markets, with call option interest highest at the $100k+ strikes.

However, risks remain: an overbought RSI suggests possible pullbacks toward $101k–$103k, and the bill still needs approval in the House—delays could disrupt sentiment.

Conclusion

Bitcoin now stands at a pivotal moment, with strong ETF demand, favorable policy direction, and technical support creating a compelling buy case.

The $105k level serves as a solid foundation, while fresh highs in the $120k–$150k range are within reach. Watch for Senate action in the House and any macroeconomic shifts that could validate a sustained rally—or trigger a correction.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):