KEY TAKEAWAYS

- BCH is testing the $600 zone, and a break above it could open targets at $800–$1,000, while a rejection may send it back to $520–$560.

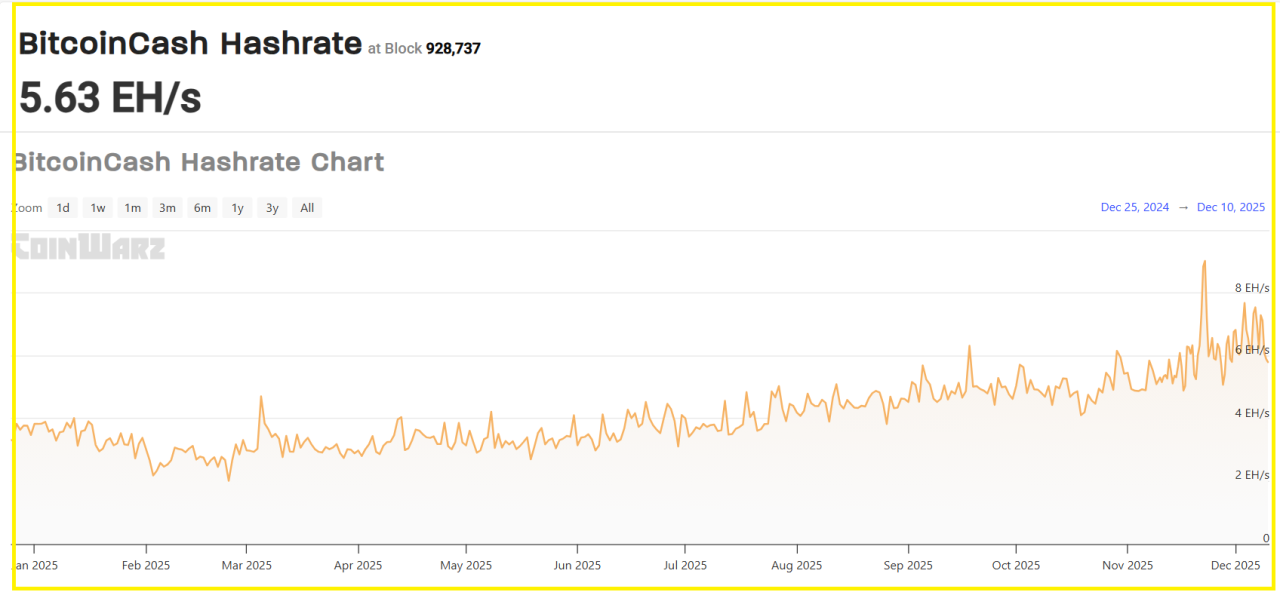

- On-chain activity has grown since the May upgrade, with stronger hashrate and steady usage giving the rally more support.

- Bitcoin’s movement and macro conditions will heavily influence whether BCH continues its 2025 momentum or pauses this month.

BCH holds solid YTD gains and now trades around a key decision zone. Network upgrades and stronger activity continue to support its momentum.

Bitcoin Cash is trading around 459.03 USD and is up roughly 35% YTD and recently pushed into the $590–$620 range after a steady climb in late November.

Activity on the blockchain has grown since the May 15 upgrade, and this has helped BCH maintain stronger participation than many other L1s.

Let’s look at a quick overview of Bitcoin Cash outlook for December.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

RECOMMENDED: 5 Reasons to Buy Bitcoin Cash (BCH)

Bitcoin Cash Outlook for December: Price Levels To Watch This Month

BCH is testing the important $600 area, which traders see as the first major barrier.

A strong move above this zone could open the way toward $800 and possibly $1,000 based on recent technical projections.

Based on our Bitcoin Cash price prediction, the coin could go up to $799 by the close of the year.

But if BCH fails to hold its footing, the chart points to a pullback toward $520–$560, a region that has acted as a cushion several times this year.

Momentum signals like RSI, trend channel strength and trading volume will show whether buyers still have control or if the market is slowing.

RECOMMENDED: Is Bitcoin Cash Still a Good Buy? Or Is It Too Late? (2025 Guide)

On-Chain Activity And Network Health

The May 15 upgrade improved BCH’s virtual machine functions and added better BigInt support, making development smoother.

Since then, data shows higher network use and steadier hashrate, which suggests consistent miner and user participation.

BCH has also outperformed many L1s in 2025, thanks to rising on-chain activity. These real network trends give the current rally more substance, even though they don’t guarantee immediate price gains.

How Bitcoin And The Macro Environment Affect BCH

Bitcoin continues to set the tone for BCH. Any strong surge or sharp drop in BTC can pull BCH in the same direction.

Macro factors – including Fed comments and overall liquidity – can influence how much risk major traders are willing to take.

These broader conditions will play a big role in whether BCH builds on its recent gains or pauses.

ALSO READ: 5 Reasons to Invest in Bitcoin Cash (BCH) and 1 Reason Not To

Conclusion

BCH performance in December is supported by solid technical structure and real on-chain strength behind it.

A clear move above $600 could extend the rally toward $800–$1,000, while rejection at this level may send it back to the $520–$560 zone.

The next few weeks will show whether buyers can keep the momentum going.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

- A Crucial Week & One Critical Level (Dec 7th)

- How We Think About The Current Bounce And What Matters in December (Nov 30th)

- Why This Bounce Matters (30 Crypto Charts) (Nov 23rd)

- What’s Going On With Bitcoin & Alts? (Nov 16th)

What Our Readers Say

“I got to tell you, you guys and your charting and your predictions are AMAZING! I don't know how people can even give you a hard time when you make pullback predictions. Markets cannot go up forever!”

“I LOVE how you talk about the ‘buy the dips’ times vs the ‘sell for profit’ times to get more free coins. You have been right sooo many times — it’s actually amazing!”

— Newsletter Subscriber

“Your team puts a huge amount of work into the newsletters and the analyses. You’ve been doing this for so many years already, and the passion is still there. Respect.”

“Because of your research, I’ve become a much more patient investor. And ‘more patient’ basically means ‘better.’ Over the past few years, my capital has often just stayed unused rather than constantly invested — and it has paid off.”

“Now that my perspective is strictly long term, I have far more peace in my life. Nothing is more stressful than constantly wondering what your crypto might do the next day. After seeing firsthand that long-term investing outperforms trading, the difference is night and day.”

— Crypto Research Subscriber

“As a faithful follower, I really miss the commentaries — the wisdom, the thoughts, the analysis. Truly appreciate the knowledge you share.”

— Long-Time Follower