KEY TAKEAWAYS

- Bitcoin dropped below $100K, falling about 21% from its October highs and triggering a sharp market-wide sell-off.

- Over $1B in leveraged positions were liquidated as traders exited losing bets, adding to downward pressure.

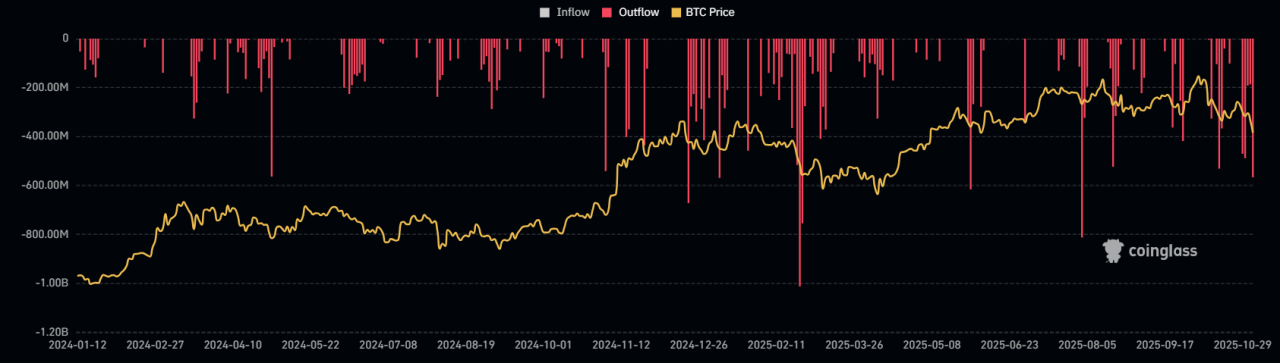

- U.S. spot Bitcoin ETFs saw around $799M in outflows, signaling weaker institutional demand.

- Investor caution grew after central banks hinted that interest rates may stay higher for longer.

Large sell-offs, ETF outflows, and investor caution pushed Bitcoin below $100K, sparking a wider drop across the crypto market.

Bitcoin crashed below $100,000 on November 5, ending its recent rally and falling about 21% from its October highs. The quick decline triggered a wave of selling across exchanges, sending prices of major altcoins and crypto stocks lower.

Many traders were caught off guard as the market turned sharply from optimism to fear. So, why is Bitcoin down? Let’s find out.

RECOMMENDED: Top 3 Cryptos That Could Outperform If Bitcoin Pulls Back

Bitcoin Crash: What Caused Bitcoin’s Price Drop?

Bitcoin briefly touched lows around $99,100 before bouncing slightly. Within hours, more than $1 billion in leveraged positions were wiped out as exchanges automatically closed losing trades.

Spot Bitcoin ETFs also saw heavy withdrawals, signaling that both retail and institutional investors were pulling back. As a result, altcoins like Ethereum and Solana followed Bitcoin lower, deepening the market-wide correction.

ALSO READ: Will Bitcoin Ever Hit $1 Million?

Why The Market Is Falling

Several factors came together to push crypto prices down:

- Investors became cautious after central banks signaled that interest rates might stay higher for longer. That made riskier assets, like crypto, less attractive.

- U.S. spot Bitcoin ETFs recorded about $799 million in outflows over the past week, reducing demand from large investors.

- Heavy leverage in the market made the drop worse. When Bitcoin slipped below $100K, exchanges liquidated thousands of long positions, creating a chain reaction of selling.

The $100K level itself played a big role. Many traders had placed stop-loss orders around that mark, so once it broke, automated selling pushed prices down even faster.

RECOMMENDED: The ETFization Of Bitcoin: How Flows Reshape Macro Sensitivity

What Comes Next?

Most investors are now watching ETF flow data, exchange reserves, and on-chain activity for signs of stabilization. If Bitcoin regains and holds above $100K with stronger volume, confidence could return.

But if outflows and liquidations continue, the market may face more pressure in the days ahead.

YOU MIGHT LIKE: Bitcoin Price Target: Michael Saylor Is Sticking With $150k By Year-End – Here’s Why

Conclusion

While Bitcoin’s sharp drop below $100K has shaken short-term confidence, it could also represent an opportunity for strategic investors.

Major corrections often reset overheated sentiment and allow for reaccumulation at more attractive levels.

If Bitcoin stabilizes above key support zones and ETF flows turn positive again, this phase may be remembered as a healthy pullback within a broader bullish cycle.

Overall, the long-term outlook remains constructive, large sell-offs like this one tend to clear excess leverage, paving the way for a more sustainable uptrend once market confidence returns.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here