KEY TAKEAWAYS

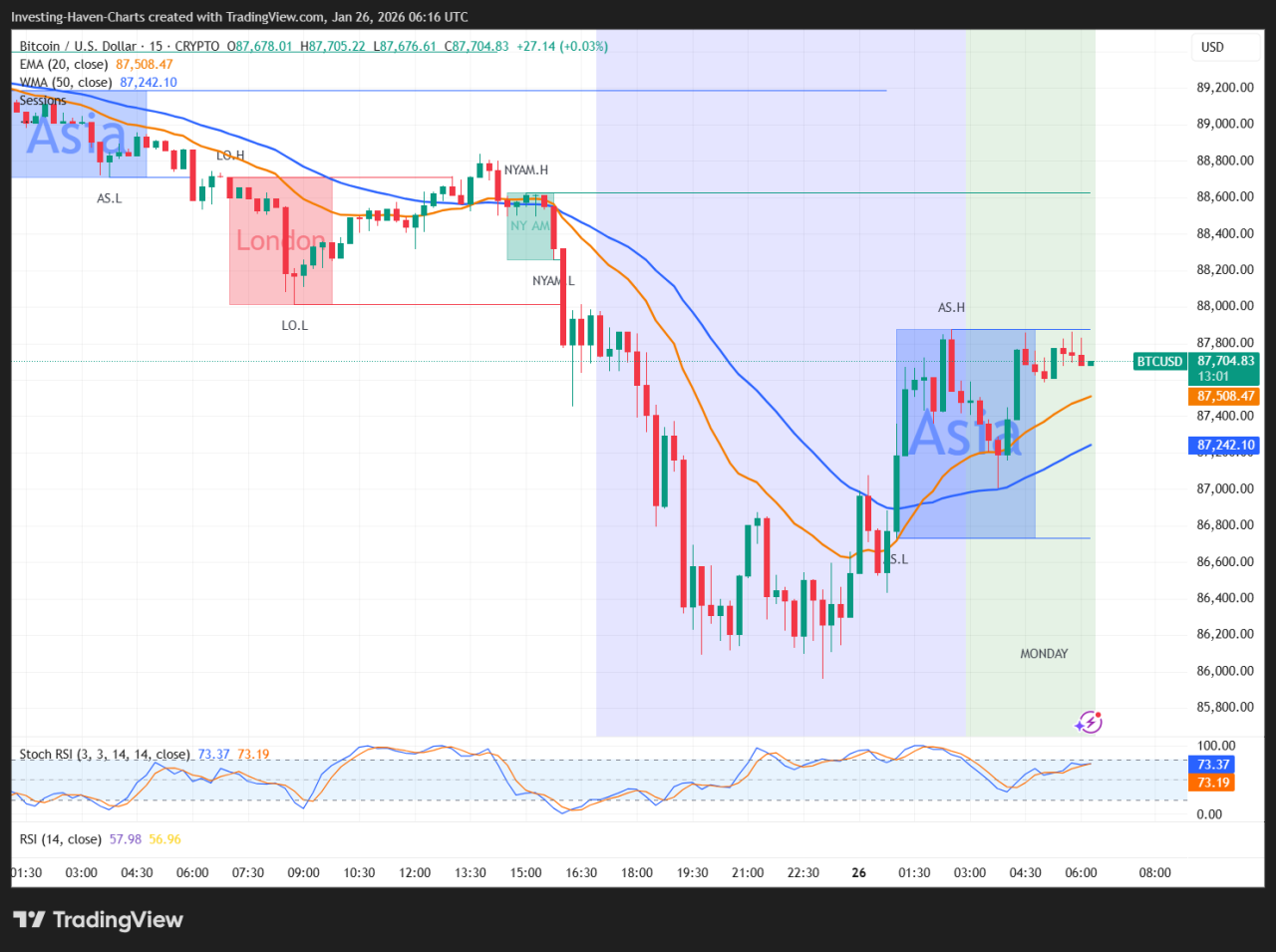

- Bitcoin dropped close to $85,000 on Jan 25–26 before recovering to the high-$87,000 range.

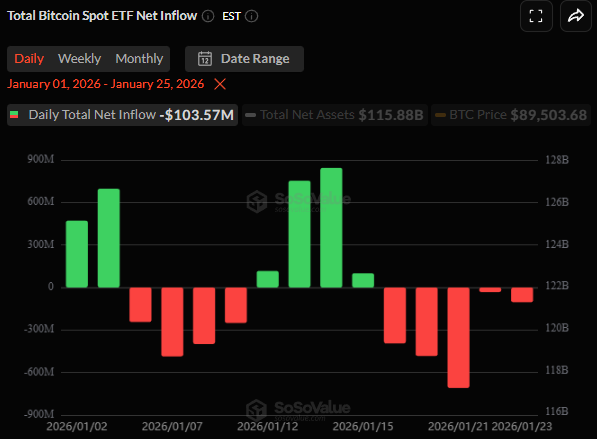

- Spot Bitcoin ETFs recorded about $1.7B in outflows over five days, adding pressure to prices.

- Large futures liquidations intensified the decline and increased short-term volatility.

Bitcoin briefly fell down close to $85,000 on Jan 25–26 before rebounding above $87,000, as ETF outflows and liquidations accelerated losses.

Bitcoin is trading just above $87,000 after a sharp pullback that pushed prices down to $86,000 on Jan 25 and again on Jan 26.

CoinMarketCap data shows the dip happened during a period of heavy selling, rising volatility, and strong reactions to global political developments.

This marked Bitcoin’s lowest level so far in 2026 and ended a relatively calm start to the year.

RECOMMENDED: This Company Spent $2.13B On Bitcoin Despite The Downturn

Bitcoin Price Reaction And Market Volatility

Bitcoin slid from the upper-$88,000 range into the low-$86,000s within hours, triggering stop losses and forced liquidations.

Price data shows strong trading volume during the decline, a sign that traders rushed to exit leveraged positions.

Liquidation trackers reported tens of millions of dollars wiped out from long positions in short time frames, with total crypto liquidations climbing into the hundreds of millions.

This type of fast move usually reflects leverage unwinding rather than a broad change in long-term investor views.

Buyers stepped in once Bitcoin tested the $86,000 level, helping prices rebound above $87,000.

ALSO READ: Wall Street Strategist Dumps Bitcoin, Goes All-In on Gold

Why Bitcoin Fell: Geopolitics And ETF Outflows

Global political tension played a major role in the drop.

News tied to tariffs and international trade disputes pushed investors toward safer assets and away from risk-heavy markets.

Bitcoin moved in line with this shift, behaving like other risk assets during periods of uncertainty.

At the same time, U.S. spot Bitcoin ETFs saw roughly $1.7B leave the market over five trading days.

These outflows added steady selling pressure, which became more visible once prices started to slide.

Futures liquidations then added fuel, turning a controlled pullback into a sharp sell-off.

Key Levels Traders To Watch

The $86,000 area now stands out as a short-term support level.

A clear break below it would raise the chance of further downside.

On the upside, Bitcoin needs to reclaim the $90,000–$94,000 zone to regain momentum and stabilize sentiment.

RECOMMENDED: Analysts Predicts 50% Bitcoin Surge – But Not Without Warning

Conclusion

Bitcoin’s dip to $86,000 shows how fast prices can move when geopolitical stress, ETF flows, and leverage align.

While the rebound above $87,000 offers relief, short-term direction will depend on whether selling pressure truly fades.

Should You Invest $1,000 In Bitcoin Today?

Before you buy BTC, you’ll want to read our latest premium crypto alert where we will reveal the crypto assets you may want to consider for 2026 with explosive potential.