Bitcoin hits a new all-time high above $118K, driven by ETF inflows and institutional demand—yet strategic entry opportunities remain.

Bitcoin has surged to a new record high above $122,000 (peaking around $118,755 on July 11, 2025), outpacing major indices likely due to steep institutional demand and a crypto‑friendly regulatory climate.

But with soaring valuation, is it too late to invest in Bitcoin today?

Here’s our analysis and breakdown.

What’s Fueling the Bitcoin Rally?

A key driver is massive Bitcoin ETF inflows, with U.S. spot ETFs pulling in over $1 billion in a single day and surpassing $50 billion in total assets.

BlackRock’s IBIT alone amassed $80 billion AUM – the fastest in ETF history. Meanwhile, on‑chain signals show institutions and long‑term holders accumulating amid growing corporate adoption, with companies like MicroStrategy and Trump Media adding BTC reserves.

Regulatory headwinds from the Senate‑passed GENIUS Act and a new U.S. strategic Bitcoin reserve via executive order are also reinforcing confidence among investors. Macro factors such as a soft U.S. dollar and risk‑on sentiment in broader markets could further be triggering the surge.

Is It Too Late to Buy Bitcoin?

Historically, Bitcoin bull runs last about three years, and this cycle began in late 2022 – suggesting we may still be in a mature phase rather than at the end . Analyst forecasts are bullish: Standard Chartered expects BTC to reach $135,000 by Q3, $200K by year‑end, and as high as $500K by 2028.

CoinCodex outlines a 2025 trading range between $102K–$144K. However, volatility remains intense: BTC doubled year‑to‑date but dipped below $75K earlier—highlighting imminent risk factors.

Strategic Investment: Now Or Wait?

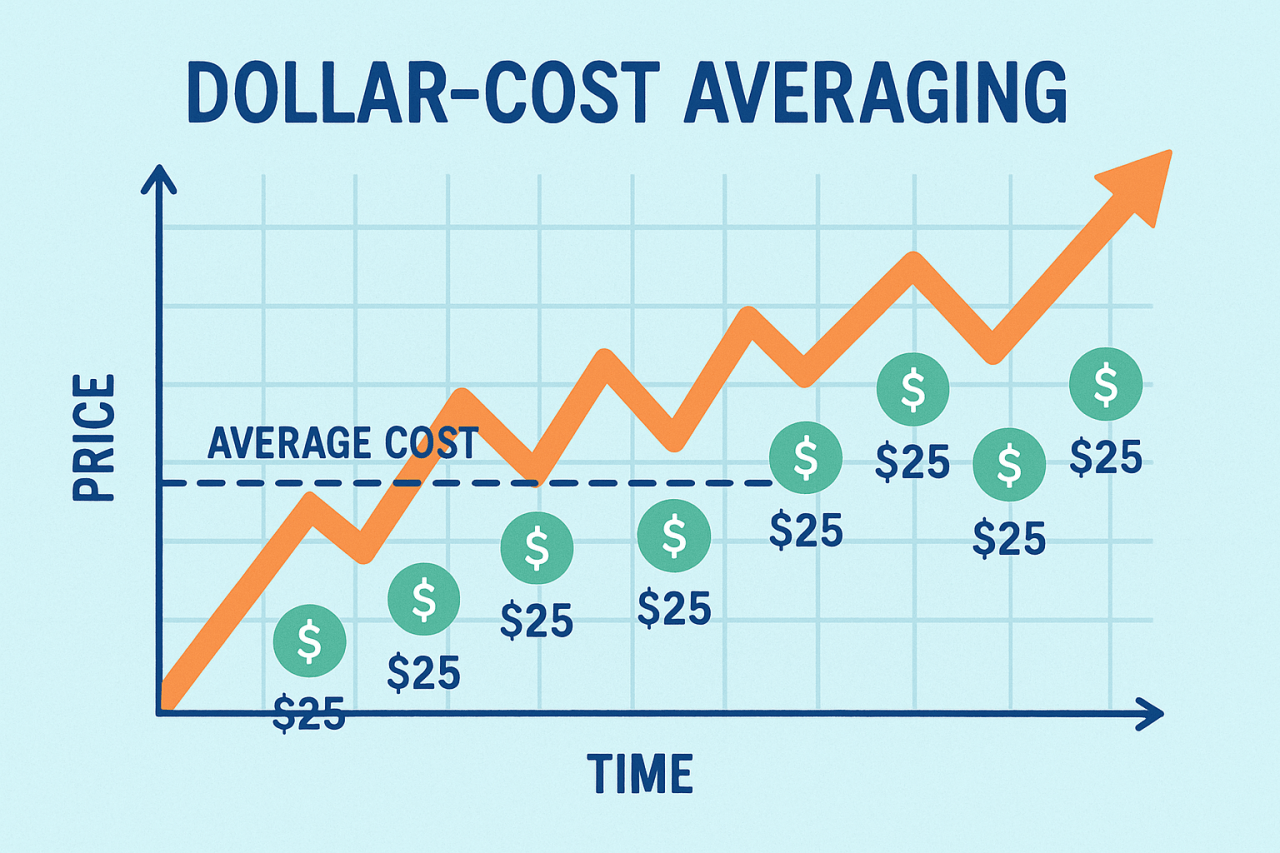

If you are wondering whether now is a good time to buy, we recommend using a strategic approach like dollar-cost averaging – regularly investing small amounts. This can reduce the risk of buying at a peak while still gaining exposure.

Even at all-time highs, Bitcoin remains a viable asset for long-term portfolios, with many advisors recommending a modest allocation of 1–5%.

Conclusion

With institutional demand growing, strong ETF inflows, and a favorable regulatory climate, there’s reason to believe the current rally may continue. However, volatility remains a key risk, so it’s essential to invest only what you’re willing to lose and stay informed on market-moving developments.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Crypto Charts Are Improving, Just Have A Look At These 3 Leading Indicators (July 6th)

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)