With Bitcoin (BTC) experiencing a sharp drop, active traders are watching key price levels (as usual) for a potential bounce or further fall.

Long-term holders will likely try to see if this weekend’s trading will lead to a real recovery or more selling. Either way, in volatile markets, what happens over the Bitcoin weekend forecast may very well determine the next big move. Speaking of forecasts, feel free to read our assessment on Bitcoin reaching $1 million.

RELATED: Do Not Invest in Bitcoin or XRP Before You Know This

Bitcoin Weekend Forecast

Over the weekend, Bitcoin will likely oscillate between approximately $105,000 and $110,000, so a breakdown below this support zone could make the drop even worse.

The primary focus will be on the US PCE inflation data, which is expected to be released today. A higher-than-expected figure could hurt Bitcoin by suggesting fewer rate cuts, while low numbers might help.

Also, the settlement of monthly options contracts could cause sudden price swings, and due to recent liquidations, any quick price bounce might be temporary before the downward trend continues.

The bottom line for the Bitcoin weekend forecast is that without notable positive news, Bitcoin will likely drift and test its lower supports. A clear break below these levels would be a strong signal for next week’s trend, though.

That said, we’ve written a long-term forecast (up to 2030) in our full Bitcoin prediction, so be sure to check it out.

Bitcoin Recap of the Week

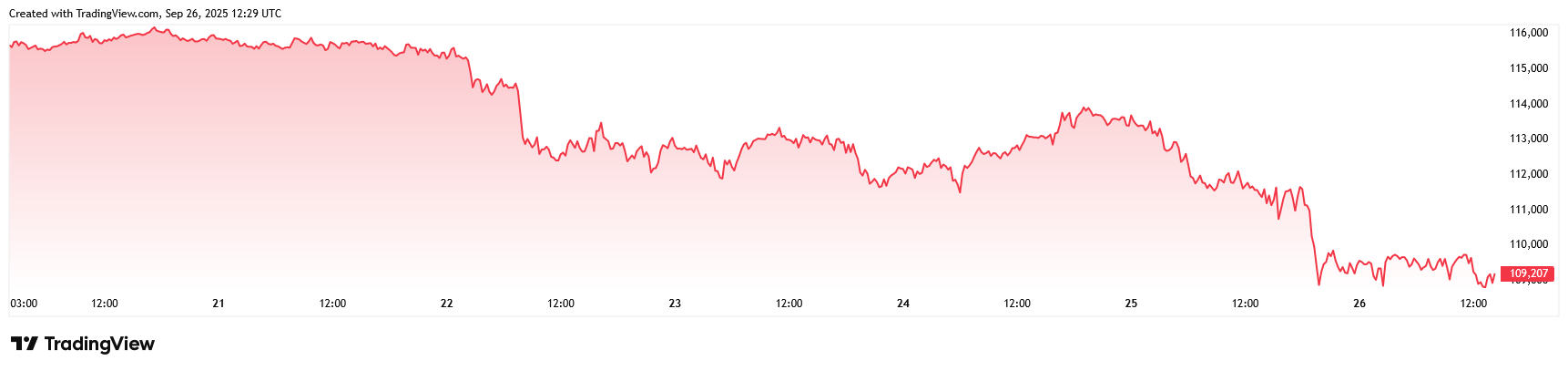

The week saw massive liquidation waves, as traders closed out leveraged long positions amid a market downturn. As such, Bitcoin dropped by approximately 5% over the week, dragging many cryptocurrencies down.

(Bitcoin weekend forecast and recap September 25, 2025)

For the most part, the king of cryptocurrencies hovered around the $112,000 – $113,000 zone and struggled to push decisively above it, before dropping to below $110,000 today.

Some view this pullback as being more about overleverage rather than a sign of deeper problems, suggesting it might create a healthier foundation for the next potential rally.

RECOMMENDED: Should Investors Worry About the Future Of Bitcoin?

Conclusion

Bitcoin is starting the weekend on a down note, dropping roughly 2.35% in the last 24 hours. As for the Bitcoin weekend forecast, in the absence of strong catalysts, the price is likely to test key support levels within a range-bound pattern. Some good news from the upcoming US PCE inflation data could help with the positive momentum. Still, the primary focus should be on how Bitcoin interacts with the support and resistance zones, which may provide more valuable insights than attempting to predict a definitive short-term direction.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Which Crypto Should You Invest In Right Now?

For alerts on the key crypto assets that are primed for investment right now you should consider Join the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’ll be following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)