In the latest Bitcoin news, the legacy coin has failed to reach $89 despite multiple positive news. However, analysts are self-correcting earlier bearish sentiments and now believe it has a higher chance of breaking above $ 110K than crashing to $75K.

Bitcoin is back to its losing trend after being rejected around the $88.7k level and crashing back to the $86.3k level over the last 24 hours.

The short rally yesterday was triggered by reports that institutional interest in Bitcoin was almost 3 times the mining rate.

The argument was evidenced by the fact that Bitcoin ETFs had purchased 8,775 BTC against the 3,150 mined.

More Positive Bitcoin News

The stream of positive news for the week continued today after it became apparent that Strategy’s BTC stockpile had crossed the 500k mark.

This came about late last week when the Saylor-led company acquired 6.911 more BTC at an average price of $84,529 according to a filing with the SEC. This brings the total number of BTCs owned by the company to 506,137.

In addition to this, Blackrock announced that it had launched its first Bitcoin exchange-traded fund in Europe. They argue that the move to Europe will expose Bitcoin funds to new markets and institutional funds.

It is important to note that similar funds in the US have attracted more than $50 Billion worth of investments and played a key role in helping Bitcoin break a new all-time high of $109K

So … Why Are BTC Prices Falling?

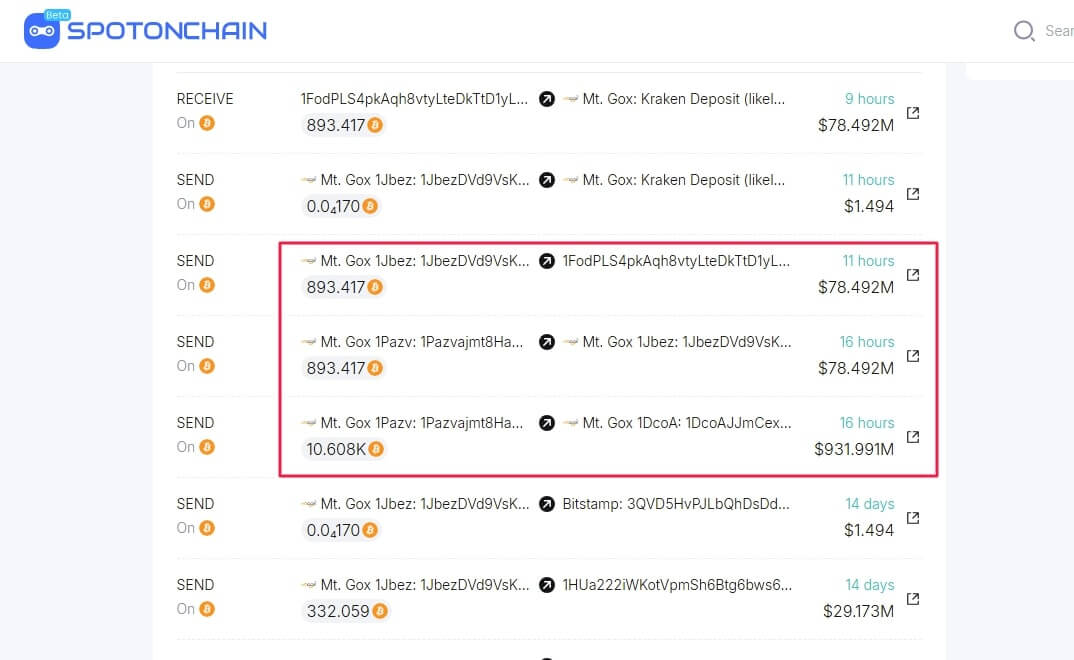

First, the defunct crypto exchange recently executed another big transaction, moving 11,501.4 BTC worth approximately $1 Billion to two new wallets.

This followed another 332 BTC transfer to the Bitstamp exchange, which spooked investors because such a huge dump into the markets would cause massive volatility for the legacy crypto.

Secondly, we are nearing April, and the Trump administration vowed to introduce reciprocal tariffs in April. 2. Previously, tariffs have caused devastation not just for Bitcoin price but for the larger crypto industry.

It is, therefore, likely that investors are booking profits or on a watch-and-wait mood – both of which exert downward pressure on BTC prices.

That said, Bitcoin price is currently up more than 10% versus its low of under $80,000 earlier in March.

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

Get Instant Access to Our Latest High-Potential Crypto Alerts

This is how we are guiding our premium members (log in required):

- A Promising And Welcome Evolution On Crypto’s Leading Indicator Chart (March 24th)

- The Dates & Data Points To Watch In The Next 3 Weeks (March 17th)

- The Time Window as of March 14 Should Bring Relief (March 11th)

- Buy The Dip Is Here (March 1st)