Scaramucci keeps a $180k to $200k year-end Bitcoin target. He cites tight supply and growing institutional ETF demand.

Anthony Scaramucci reiterated SkyBridge’s $180k to $200k Bitcoin target for year-end 2025, saying he holds significant BTC.

Bitcoin currently trades around $112k and needs to gain 60% to reach $180k and 78% for $200k.

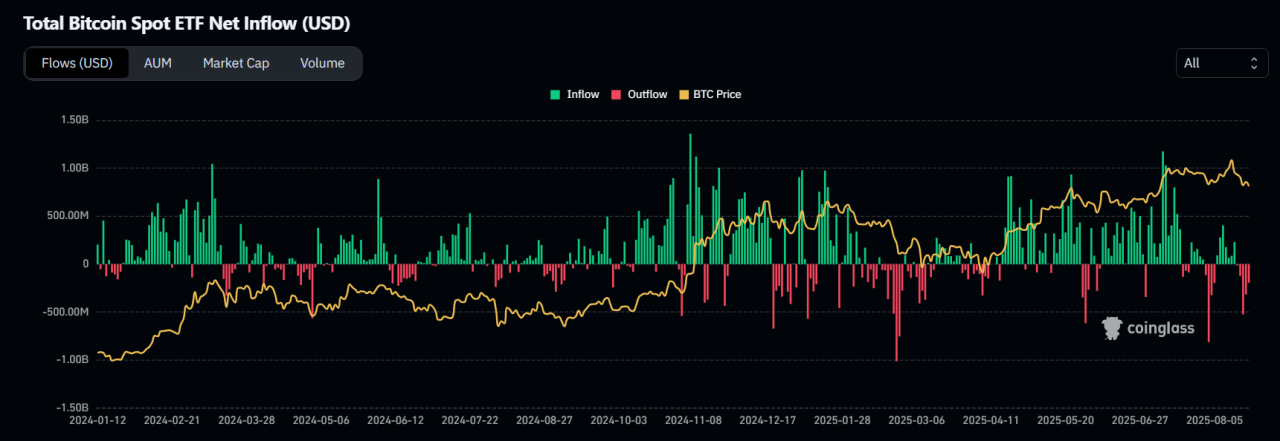

Spot ETF inflows continue to add tens of billions in demand year to date and flows are large.

RELATED: Bitcoin Price Forecast 2025-2030

Scaramucci’s Bitcoin Price Forecast And Thesis

During an interview on CNBC’s Squawk Box, Scaramucci reaffirmed SkyBridge’s $180k to $200k year-end 2025 Bitcoin target and said he owns large amounts of BTC personally and through SkyBridge.

He framed his forecast around tight new issuance, roughly 450 BTC added daily after the 2024 halving, and rising institutional allocation via spot ETFs.

Scaramucci noted that attendance at recent conferences shifted from retail to institutions, and he pointed to ETF inflows as a concrete source of demand.

He called the $180k to $200k band conservative compared to models that include ETF accumulation growth.

RECOMMENDED: Want to Make $1M with Bitcoin? Here’s How in 10 Years

Market Evidence: Flows, Price And Scarcity Math

Market data gives context to Scaramucci’s claim. Spot Bitcoin ETFs now hold roughly $148 billion in assets, and many recent days show net inflows that compare with or exceed new supply.

Bitcoin currently trades around $112k, up about 20% year to date from early 2025 levels, and the market hit an August all-time high above $124k.

New issuance stands near 450 BTC per day after the April 2024 halving, so ETF demand can outpace fresh supply on busy inflow days.

Charts from ETF flow trackers and exchange data show recurring multi-hundred million dollar inflows on top inflow days, making the supply gap measurable.

Flow aggregators show cumulative spot ETF net inflows above $50B in 2025, concentrated at major issuers including BlackRock.

RECOMMENDED: 5 Reasons To Buy Bitcoin (BTC) Today

Conclusion

Scaramucci’s $180k to $200k Bitcoin price forecast reflects quantifiable supply constraints and institutional ETF demand.

While it is a plausible thesis, there are no guarantees. Success depends on sustained inflows and sentiment. For now, the forecast stands as credible, yet markets must deliver to uphold it.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service, live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)