KEY TAKEAWAYS

- Bitcoin Prices moved above $95K within hours as spot buying increased and volatility picked up.

- The bill redraws who regulates crypto markets and points most spot-market oversight to the CFTC and sets clearer token categories.

- Paying interest just for holding stablecoins would stop, forcing changes across yield platforms.

A Senate draft clarified crypto oversight and restricted stablecoin interest. Bitcoin jumped above $95K as traders reacted to clearer rules.

Bitcoin climbed past $95,000 on Jan 13, 2026, as U.S. lawmakers released a long-awaited crypto market bill that signals clearer oversight and tighter stablecoin rules.

Trading volumes rose quickly as uncertainty eased and short positions closed.

ALSO READ: Bitcoin Trading In A Danger Zone – Will Trump’s Credit Card Policy Help?

What The Senate Crypto Bill Proposes

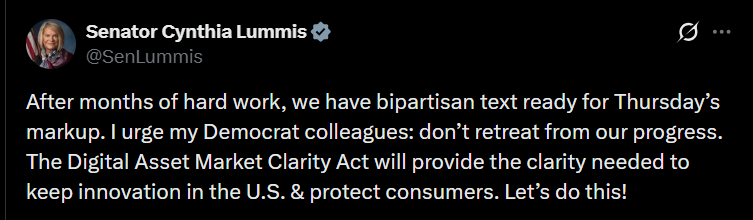

The Digital Asset Market Clarity Act outlines how the U.S. plans to regulate crypto markets.

It separates digital assets into clearer groups, with many tokens treated as digital commodities rather than securities.

Under the draft, the CFTC would oversee spot trading for these assets, while the SEC would continue to regulate securities.

The bill also introduces a single disclosure framework written jointly by both agencies, aiming to reduce overlapping rules.

Lawmakers framed the draft as a way to give firms legal certainty after years of court cases and enforcement actions.

RECOMMENDED: $750M Left Bitcoin And Ether ETFs – Institutions Abandoning BTC?

Why Bitcoin Jumped Above $95K

Bitcoin reacted fast once the draft became public.

Prices pushed above $95,000 as traders increased spot exposure and closed short positions.

Funding rates shifted as leverage reset, adding to upward momentum.

Ethereum activity also rose, with higher wallet creation and transaction counts.

For many traders, the bill reduced a major unknown: how the U.S. plans to supervise crypto markets.

That clarity encouraged risk-taking after weeks of cautious positioning.

RECOMMENDED: Did The U.S Steal $15B Bitcoin From A Chinese Scam King? Here Is The Truth

Stablecoin Rules And Industry Impact

The bill places strict limits on stablecoin interest. Issuers would no longer pay yield simply for holding a balance, but they could still offer rewards tied to usage, such as payments or settlement activity.

Exchanges and custodians welcomed clearer rules but warned of higher compliance costs.

Yield platforms began reviewing products that rely on passive returns, signaling likely redesigns if the bill advances.

Institutions showed renewed interest as custody and reporting standards became clearer.

Conclusion

Bitcoin’s move above $95K shows how sensitive markets remain to U.S. policy signals.

Whether the rally holds depends on amendments and the bill’s path through Congress.

Before you buy Bitcoin, make sure to read our latest premium members crypto alert which will be releases in a few days, we will identify key crypto assets to consider in 2026 with explosive potential.