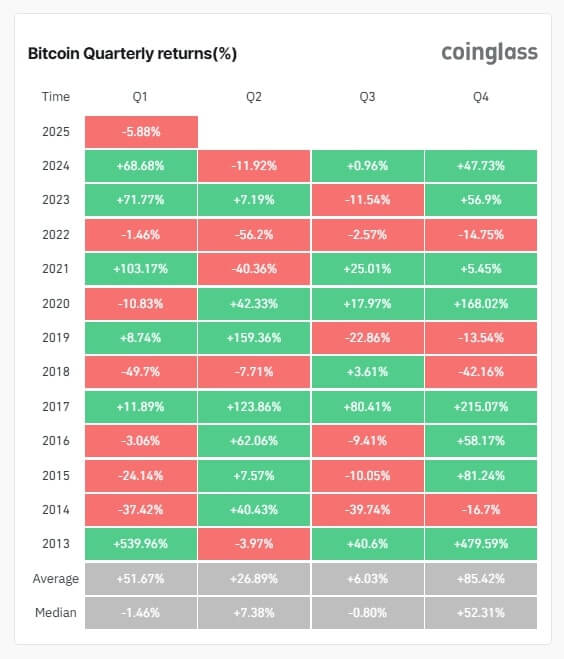

Unless Bitcoin pulls off a dramatic comeback in the next 5 days, it is poised to have the worst first-quarter finish since 2020.

At the time of writing, it is down by close to 6% and trades around $88k. What does the 2nd quarter hold for BTC and can it recover?

Bitcoin charged forward into 2025 with the force of a bull – strong, headfirst, and unstoppable. And in 20 short days, it hit a new all-time high – above $109k.

This ATH coincided with Trump’s inauguration, a befitting turn of events since he had already promised a new dawn for the crypto industry.

However, his actions since taking office have been detrimental to the legacy coin. The tariffs, especially, have not only crashed it to pre-November prices but also threatened to have it post the worst 1st quarter close in 5 years.

Tariffs Delay Bitcoin and Larger Crypto Market Bull Run

Heading into 2025 and for the larger part of January, we believed Bitcoin was on the verge of an unprecedented bullish breakout.

The likes of Standard Chartered even adjusted their prediction for BTC’s peak price in the year to $200,000.

Our analysis also had us convinced the Bitcoin and industry bull run will take shape in the 2nd half of March. After all, on-chain analysis of the coin showed massive bullish momentum.

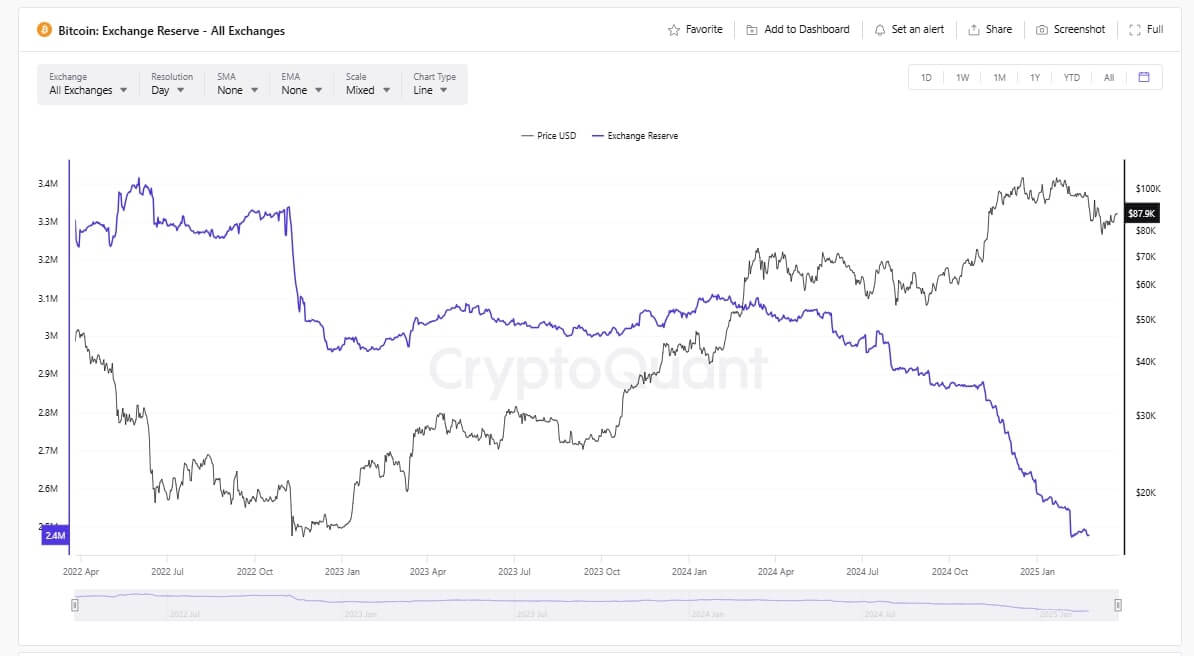

Bitcoin dominance had hit multi-year highs, the crypto-friendly Trump administration had come into force, and institutional investors were competing to sweep BTCs of exchanges.

Even more importantly, exchange and miner reserves had also dipped to multi-year lows.

The first blow to this perfect picture was the late January FOMC meeting. They resolved to not only keep interest rates unchanged but also expressed cautious optimism about the US economy.

Then President Trump decided to make good his promise campaign promise on tariffs, effectively spooking investors and triggering a liquidity crunch.

By the end of February, it became clearly evident that the bull run would be delayed.

Analysts Optimistic About Bitcoin’s Second Quarter Performance

Despite the 1st quarter inconveniences, BTC has started showing signs of recovery.

From a technical perspective, Bitcoin’s bullish momentum has been on a steady uptrend for the last two weeks. During this time, its RSI rose from the oversold region of 31 to the slightly bullish territory of 52.

The MACD line also crossed the signal line 10 days ago and is now poised to escape the negative territory. The MACD histogram has also gone from light red bars to longer deep green bars over the same period. All these suggest we are on the verge of a bullish reversal.

Bitcoin bulls have done a great job defending the $83K support, which has a growing number of analysts that BTC may have hit the cycle bottom. They now believe BTC has a higher chance of breaking out than crashing to lower price levels. One such analyst argues that BTC is more likely to hit $100k (a new ATH) than $75k.

Next important date for Bitcoin?

The next most important day for Bitcoin is Liberation Day on April. 2, when Trump is expected to make a significant announcement on reciprocal tariffs.

The market’s reaction will determine whether BTC starts creating base for a bull run at the end of 2nd quarter or continues with the 1st quarter FUD.

Get Instant Access to Our Latest High-Potential Crypto Alerts

This is how we are guiding our premium members (log in required):

- A Promising And Welcome Evolution On Crypto’s Leading Indicator Chart (March 24th)

- The Dates & Data Points To Watch In The Next 3 Weeks (March 17th)

- The Time Window as of March 14 Should Bring Relief (March 11th)

- Buy The Dip Is Here (March 1st)