Two bullish chart patterns face off as Bitcoin completes a mature breakout and Ethereum shows early reversal momentum.

We are witnessing an interesting technical showdown between Bitcoin and Ethereum. Bitcoin recently exited a well‑formed cup and handle breakout, while Ethereum shows an early falling wedge breakout pattern.

In this BTC vs ETH technical analysis, we compare both setups to assess which one looks stronger this week.

ALSO READ: Bitcoin vs Solana: BTC Bull Flag vs. SOL Critical Zone

Bitcoin: Cup and Handle Breakout

Bitcoin completed its cup and handle breakout after breaking above the key $69,000 resistance, pushing past $118,000 and past $123,000 mid last month.

Analyst Katie Stockton forecasts an upside target of $134,500. That is about 16% above current levels, with MACD confirming bullish momentum and former resistance at $108,300 now serving as firm support.

Other Bitcoin price predictions range higher. That is $150,000 and even $230,000 to $320,000 depending on model and pattern interpretation. Volume confirmed the handle break and current price retested support without slipping below critical zones.

RELATED: Bitcoin News: ETFs and Central Bank Crypto Reserves Are Altering Liquidity Dynamics

Ethereum: Falling Wedge Reversal

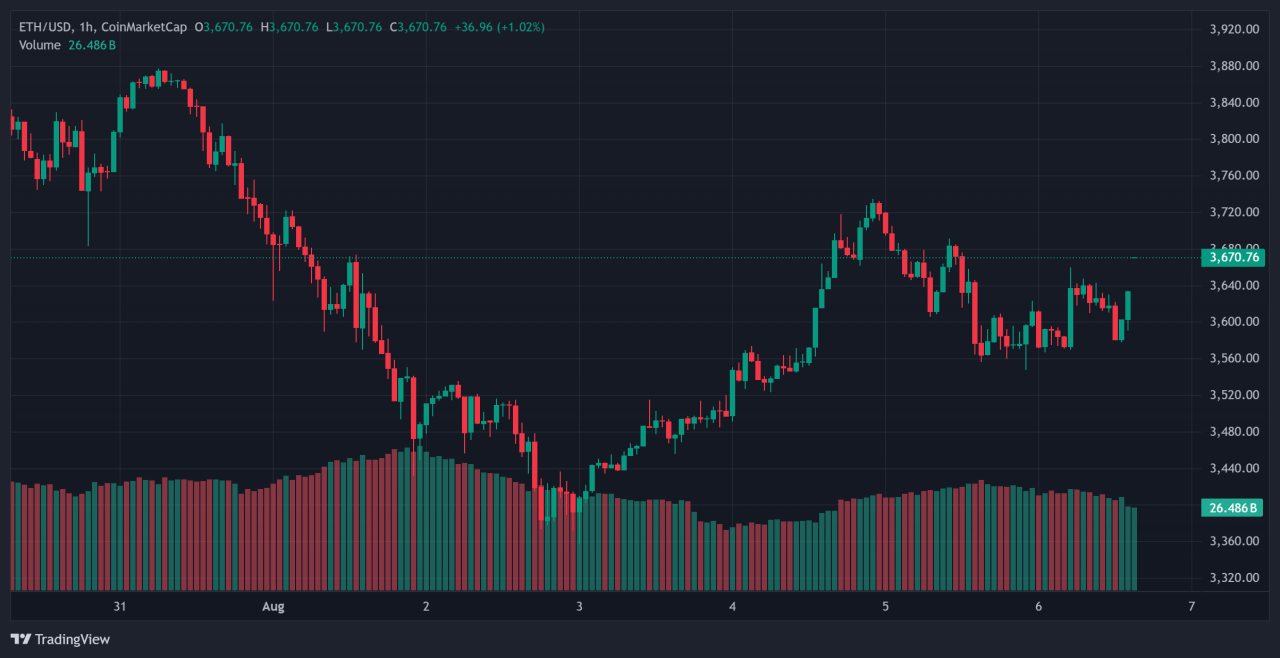

Ethereum broke out of a multi‑year falling wedge structure recently and now trades between $3,600 and $3,700. Chart studies show RSI tapping its downtrend three times and now making a bullish crossover, mimicking Bitcoin’s 2021 dynamics.

ETH tests support near $3,580–$3,600. Several Ethereum price predictions suggest the crypto could rally toward $6,000–$10,000 if momentum continues and volume confirms. Ether’s RSI structure remains constructive but market sentiment still lags behind the move.

RELATED: Best Crypto To Buy For Short Term: Ethereum Shows Clear Upside Potential

Head‑to‑Head Comparison

Bitcoin’s setup shows pattern maturity, strong MACD confirmation, and timely volume validation. Ethereum displays earlier trend shift with ETH RSI reversal signal and falling wedge breakout, but lacks the same volume strength so far.

BTC trades above new support, while ETH remains near resistance and could retest trendline support. BTC upside near 14–115 percent appears clearer. ETH upside remains speculative until it breaks $3,700 with conviction.

Conclusion

Bitcoin presents a more developed cup and handle breakout with defined targets and volume support. Ethereum shows early signs of reversal via falling wedge breakout but needs validation. Which setup holds stronger for your trades this week? Let’s wait and see.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):