KEY TAKEAWAYS

- Bitcoin ETFs bring short-term, high-impact institutional cash that can shift price direction within days.

- Ethereum attracts slower-moving institutional allocations tied to yield, custody, and network participation.

- Futures and on-chain data show Bitcoin positioning reacts faster, while Ethereum builds gradually.

Bitcoin ETFs attract large, fast inflows that move prices quickly. Ethereum sees steadier institutional capital through staking, custody, and long-term positioning.

Early January 2026 opened with sharp institutional activity.

Spot-Bitcoin ETFs recorded about $1.2B in inflows within 48 hours, followed by uneven days that included a $243M net outflow.

Ethereum, in contrast, continued to see steady growth in institutional staking and custody accounts built through late 2025.

We will be covering Bitcoin and Ethereum in detail in our next Premium Crypto Alert along with a crypto that we believe has 10X potential in 2026

How Much Institutional Money Is Flowing Into Bitcoin?

Spot-Bitcoin ETFs remain the clearest channel for institutional cash.

The early-2026 inflows arrived in large blocks, with more than $1.2B added in two days.

That surge aligned closely with Bitcoin price gains, showing how ETF demand can influence markets quickly.

The flow did not stay one-directional. A later $243M outflow showed how easily institutions can pause or reduce exposure. This pattern suggests Bitcoin ETFs function as a tactical allocation tool, suited for fast shifts rather than slow accumulation.

RECOMMENDED: Bitcoin Rallies Today as Markets React to Fresh Crypto News

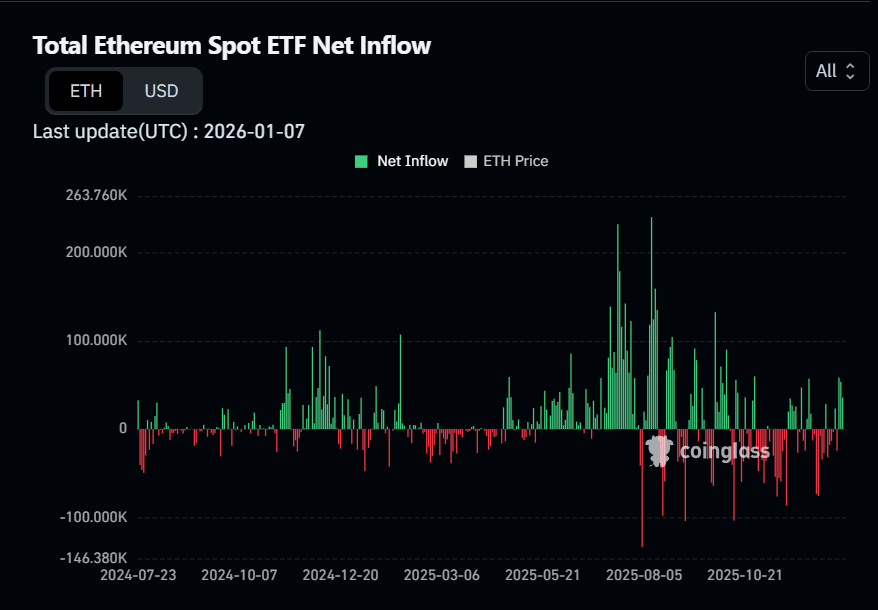

How Institutions Are Allocating To Ethereum

Ethereum tells a different story. Instead of headline ETF flows, institutions focus on custody services, staking programs, and liquid staking products. These positions generate yield and support longer holding periods.

Data from late 2025 into early 2026 shows consistent increases in staked ETH and institutional custody usage.

Price reactions tend to be smoother, reflecting gradual capital placement rather than sudden buying waves.

RECOMMENDED: Who Owns The Most Ethereum (ETH)? Revealed

What Futures And On-Chain Data Reveal

ETF data shows intent, but futures and on-chain metrics confirm follow-through.

Bitcoin futures open interest often rises within one to three trading days after strong ETF inflows, reinforcing short-term positioning.

Ethereum metrics behave differently. Large-wallet transfers and staking balances grow steadily, while futures positioning remains more stable.

This supports the idea that institutions treat ETH as a longer-term balance-sheet asset.

Conclusion

In early-2026, Bitcoin leads institutional flows in speed and size through ETFs. Ethereum leads in depth, with capital spreading across staking and custody.

Together, they show how institutions separate short-term exposure from long-term crypto allocation.

We just covered Bitcoin and many others Cryptocurrency assets in this week’s premium members crypto alert

Latest Crypto Premium Alert: The Bounce Is Here, As Expected. A Few Alts That Look Tremendously Powerful. (6th January 2026)

In our next premium crypto alert we will identify the crypto that we think has 10x potential