Bitcoin eyes a breakout past $120K with strong institutional backing, while Solana tests critical support at $175 amid weakening momentum.

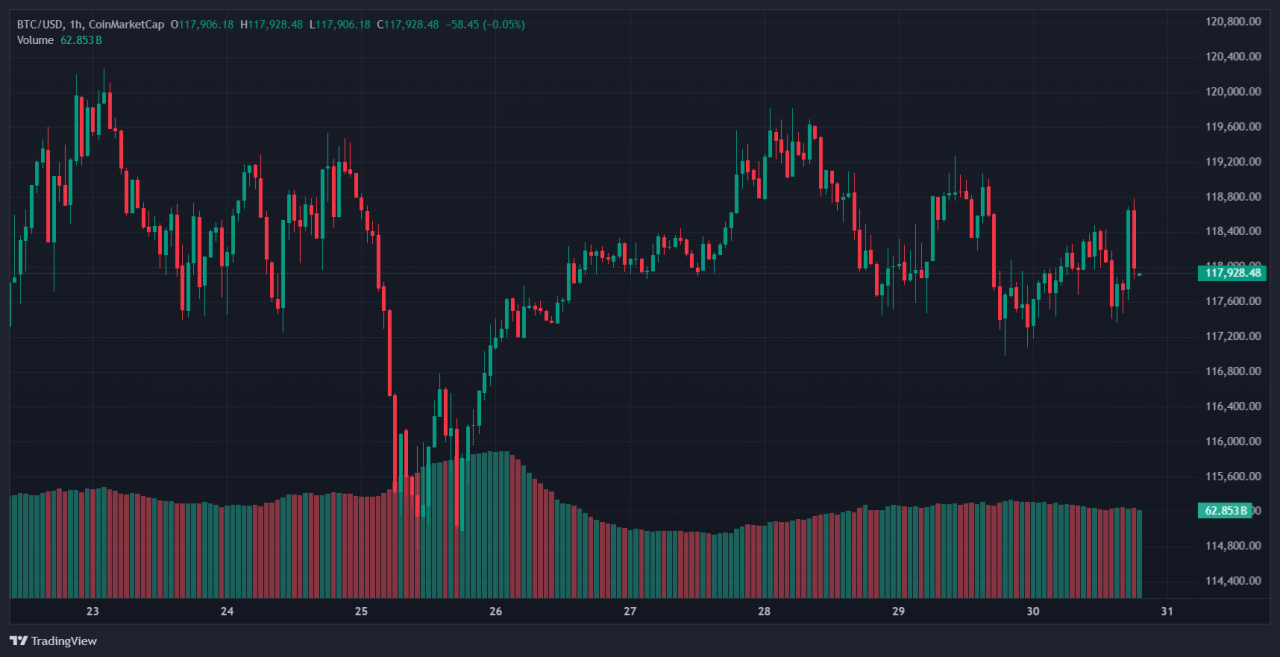

Bitcoin is consolidating just below $120,000, stiff resistance verified by several analysts – holding tightly between $115 000 and $120,000 across multiple sessions.

This setup aligns with a classic bull‑flag pattern, suggesting a measured breakout could push toward $126,000–$130,000, or even beyond if volume picks up.

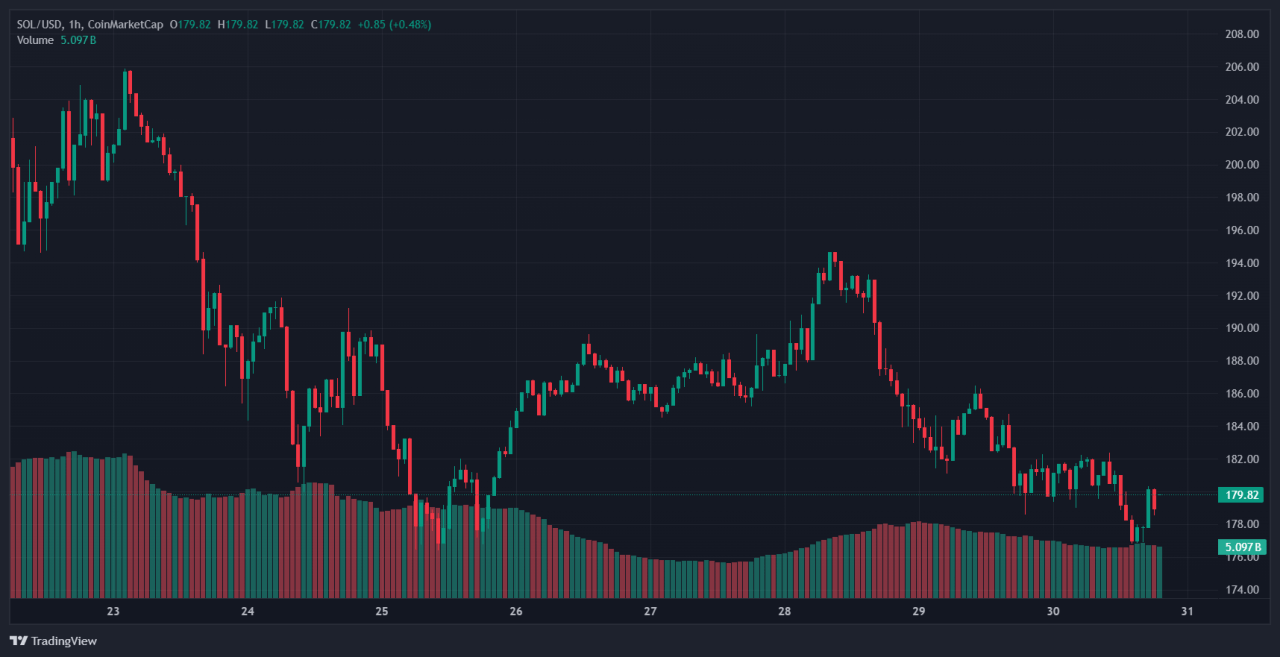

Meanwhile, Solana is struggling to hold key support near $175, based on a 38.2% retracement of its recent rally from $125 to $206. In this Bitcoin vs Solana guide, we compare BTC’s breakout potential with SOL’s make-or-break technical state.

Bitcoin vs Solana: Chart Analysis

Bitcoin in a Bull‑Flag Setup

Bitcoin’s price structure features a pole followed by a tight consolidation – typical of a bull‑flag breakout formation. Resistance around $120,000 continues to cap upside, but a decisive breakout could trigger a move toward $126,000–$130,000, or even higher if institutional inflows persist.

Analyst Katie Stockton sees possible upside to approximately $134,500 if the pattern verifies.

On-chain metrics remain supportive; institutional flows into Bitcoin ETFs are strong, open interest remains elevated, and market liquidity continues riding momentum across exchanges.

Solana at a Critical Support Zone

Solana has retraced sharply from its summer peak near $206, now testing the $175 support zone – a pivotal level based on the Fibonacci retracement from the recent rally.

Price action around $187–$188 serves as immediate resistance; reclaiming this zone would be key for bullish sentiment recovery.

However, negative SOPR readings and declining taker CVD suggest waning momentum and increased sell-side pressure. Breaking below $175 likely opens a deeper correction toward $167 or lower.

Conclusion

In this comparison, the Bitcoin bull flag breakout structure appears stronger and better supported than Solana’s vulnerable position. If BTC breaks through $120,000 with volume, it could trend quickly toward $130 ,00+ or beyond.

Conversely, Solana must hold $175 and reclaim $188 to validate any recovery. Failing either level may expose downside risk. Traders focused on SOL Fibonacci retracement levels and SOL momentum signals should proceed cautiously, while BTC price target of $130K look increasingly plausible.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Alt Season 2025 – Progress Update (July 26th)

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)

- Crypto Charts Are Improving, Just Have A Look At These 3 Leading Indicators (July 6th)