Bitcoin’s institutional surge and clearer regulations offer strong wealth-building potential, but success depends on strategy, timing, and risk control.

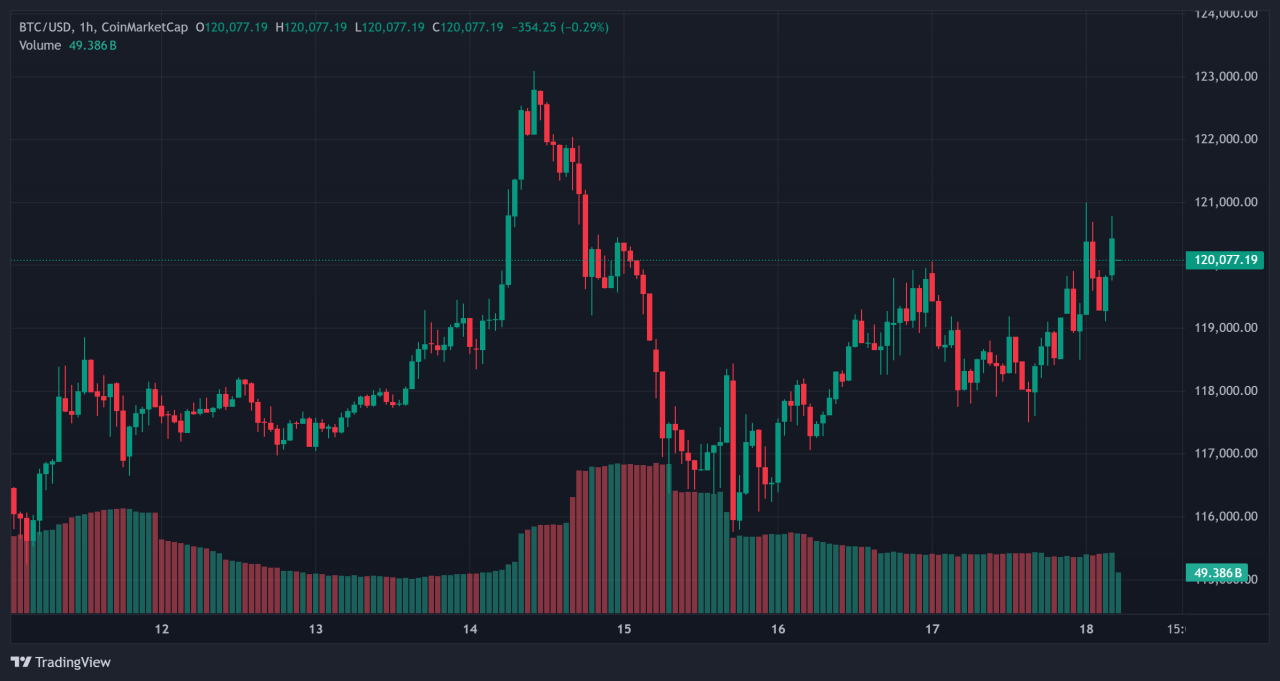

Creating actual wealth from Bitcoin is no longer a mere dream. As of July 2025, Bitcoin has surged above $123,000 after attracting $50 billion in ETF inflows, up from $35 billion in 2024.

With institutions, companies, and even countries accumulating Bitcoin, now the big question is: can individual investors realistically build wealth by investing in Bitcoin?

Let’s find out.

Institutional Momentum & Mainstream Integration

Record ETF inflows, like BlackRock’s iShares Bitcoin Trust crowning $88 billion in AUM, show growing trust. In early July, $1.18 billion poured in in a single day. Deutsche Bank notes this wave of institutional capital is elevating Bitcoin into traditional finance portfolios.

Meanwhile, countries like El Salvador and Bhutan are exploring reserve holdings, hinting at global de‑dollarization trends.

Price Catalysts & Risk Awareness

Several bullish forces are aligning in Bitcoin’s favor. Technical charts show classic cup‑and‑handle and inverse head‑and‑shoulders patterns supporting a move toward $130,000–150,000 by year‑end.

ARK Invest and Bloomberg Int’l forecasts also point to a climb of $150K–$200K by early 2026. This is similar to our Bitcoin predictions of $200K-$250K by 2030.

Plus, the Genius Act and Clarity bill give Biden-era crypto frameworks more credibility. However, volatility remains high: 25% swings are common, and risks like security breaches and regulation shifts still loom.

Actionable Paths for Investors

Everyday investors have options. ETFs such as IBIT offer institutional-grade access without the hassle of private key management. IBIT alone pulled in $2.4 billion recently.

For direct holders, cold storage is vital. Analysts suggest allocating 1–5% of your portfolio to Bitcoin as a high-risk, high-reward asset, aligning exposure with goals and risk tolerance.

Conclusion: So, Can You Create Wealth From Bitcoin?

Yes, you can create wealth with Bitcoin, but only through deliberate strategy. Institutional tailwinds, improving regulation, and powerful technical trends are waving bullish signs.

Still, Bitcoin’s defining trait is volatility, and success depends on disciplined allocation, secure custody, and planned entry/exit levels. For investors prepared to ride its ups and downs, Bitcoin remains a compelling wealth-creation asset.

How to get started Investing in Bitcoin?

If you want to start investing in Bitcoin you first need to choose a reputable platform like eToro where you will be able to create an account, make a deposit and purchase bitcoin. You can read more about investing in Bitcoin via eToro here

Our latest crypto alerts – instantly accessible

Our analysis has helped investors navigate the way through the cryptocurrency market.

If you are serious about investing in Crypto then it’s wise to seek some guidance.

This is how we are guiding our premium members (log in required):

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)

- Crypto Charts Are Improving, Just Have A Look At These 3 Leading Indicators (July 6th)

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)