KEY TAKEAWAYS

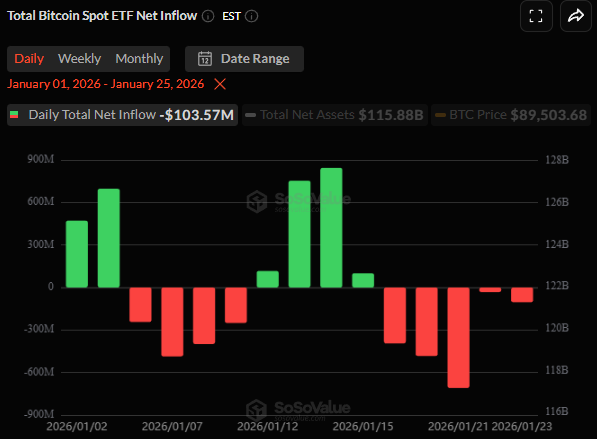

- U.S. spot Bitcoin ETFs recorded about $1.7B in net outflows across five consecutive days.

- One trading session accounted for roughly $700M of withdrawals, increasing spot selling pressure.

- Futures liquidations in the tens to hundreds of millions intensified price swings and widened intraday ranges.

Large ETF withdrawals added steady selling pressure while leveraged liquidations turned a slow pullback into sharp intraday swings.

Over five trading days, investors withdrew about $1.7B from U.S. spot Bitcoin ETFs, including a single-day outflow of roughly $700M.

The selling pushed Bitcoin below $90,000 and raised volatility as futures traders closed positions under pressure.

RECOMMENDED: Trump Tariffs Spark Overnight Crypto Bloodbath – $100B Wiped

ETF Outflows Put Pressure On Bitcoin Prices

ETF flow data shows a clear pattern of daily redemptions that added up quickly.

Each day of withdrawals released fresh supply into the market.

When these redemptions stacked together, they reduced liquidity and made prices more sensitive to sell orders.

The largest daily outflow, at about $700M, coincided with a drop below $90,000.

Higher trading volume followed, which suggests that the market struggled to absorb the extra supply without adjusting prices lower.

This steady flow of selling set the tone for the week.

RECOMMENDED: Massive $150M Bitcoin Buy Plan Could Ignite Next BTC Rally

Liquidations Turn A Pullback Into A Sell-Off

Once Bitcoin began to slide, leverage took control of the move.

Futures markets rely on borrowed capital, so even small price declines can force traders to close positions.

Liquidation trackers reported losses ranging from tens of millions to well over $100M during short time windows.

Each liquidation added more sell orders, pushing prices down further and triggering additional stops.

This chain reaction explains why the move felt sudden, even though ETF outflows had built up over several days.

ALSO READ: Billionaire Ray Dalio Says Banks Are Losing Faith in Fiat – Why Are Bitcoin Traders Excited?

What The Market Is Responding To Now

Traders now focus on two live indicators: daily ETF flows and liquidation totals.

Lower outflows and reduced liquidations usually calm volatility.

Continued redemptions or fresh liquidation spikes increase the chance of sharp intraday moves.

In the short term, these data points shape price action more than long-term narratives.

Conclusion

The $1.7B ETF outflow wave, combined with heavy leverage, created a fast and uneven market.

Until selling pressure eases, Bitcoin is likely to remain sensitive to sudden moves.

Although a quote from the most well known investor of our time springs to mind…

“Be fearful when others are greedy, and greedy when others are fearful,” – Warren Buffett

We’ll be covering the current potential opportunities in the crypto market in detail in our next Premium Crypto Alert which will be published in the coming days.