Bitcoin and XRP offer strong investment potential, but both come with unique risks that require careful strategy and informed decision-making.

Investing in Bitcoin or XRP can be appealing, especially amid rising prices and media hype. In July 2025, Bitcoin hit a record high above $123,000 due to increasing institutional demand and supportive legislation like the GENIUS Act.

Meanwhile, XRP is gaining renewed traction after resolving years of legal uncertainty. But before jumping in, you need to understand what these assets offer and the risks they carry.

Weekly Crypto Market Analysis

Our public blog posts share broad market commentary, but they don’t dive into the assets with real breakout potential. For timely, actionable insights into major cryptocurrencies, fast-growing altcoins, and tokens with explosive upside, we recommend our premium crypto analysis. This service highlights leading indicators, market momentum, and emerging narratives shaping the next big moves.

Premium service: Crypto price analysis >>

Why Investors Are Drawn to Bitcoin and XRP

Bitcoin: Digital Gold in an Inflation Era

Bitcoin is seen by many as “digital gold.” Its supply is limited to 21 million coins, and halving events – like the one in April 2024 – reduce the issuance rate every four years, making it increasingly scarce. This structure appeals to investors looking to hedge against inflation and diversify away from fiat currencies.

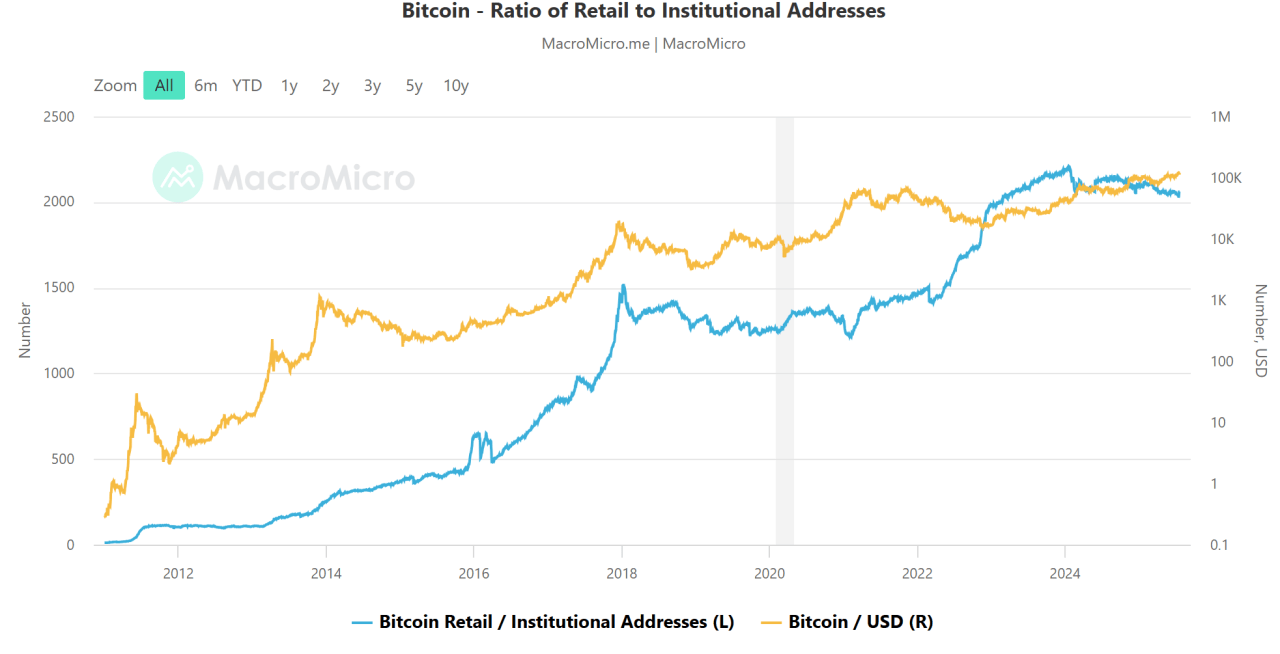

Institutional confidence is also growing. In 2025 alone, Bitcoin ETFs attracted over $50 billion in inflows, with major players like BlackRock and MicroStrategy continuing to accumulate BTC.

Regulatory advances like the GENIUS and pending CLARITY Acts are further strengthening investor trust by laying out clearer rules for digital assets.

XRP: Fast, Affordable, and Built for Utility

XRP is designed for speed and efficiency in cross-border payments. With transaction times under five seconds and minimal fees, it enables real-time settlement across borders, something legacy systems still struggle with. RippleNet, the network supporting XRP, is already used by over 300 financial institutions worldwide.

The token’s legal situation has also improved. A July 2023 U.S. court ruling clarified that XRP sold on secondary markets is not a security, and by mid-2025, all appeals had concluded. This clarity reopened U.S. exchange listings and boosted market confidence, paving the way for XRP futures ETFs and broader institutional interest.

Long-Term Outlook: Are They Worth Holding?

Bitcoin’s appeal as a long term investment lies in its deflationary design, institutional adoption, and increasing legitimacy. The fixed supply, combined with growing demand, has historically pushed prices higher, particularly following halving cycles.

Recent legislation has further reduced regulatory uncertainty, encouraging broader adoption by both retail and institutional investors.

XRP’s strength in real-world utility makes it a viable long term investment. As RippleNet expands, demand for XRP as a liquidity bridge may grow. The SEC’s dropped appeal in early 2025 boosted prices by 14%, boosting optimism among investors.

Ripple is also developing sidechains, DeFi integrations, and interoperability solutions, positioning XRP as a foundational asset for global finance, not just a payments tool.

Key Risks to Understand

Bitcoin: Volatility, Sustainability, and Market Dynamics

Despite strong fundamentals and the appeal for wealth creation, Bitcoin remains highly volatile. Price swings of 20–30% can occur over days, often triggered by macroeconomic shifts, regulatory news, or changes in institutional flows.

While many view it as an inflation hedge, research suggests Bitcoin may underperform during inflation surprises, casting doubt on this narrative.

Another concern is energy use. Bitcoin’s proof-of-work mining consumes massive electricity, raising environmental criticisms. Though renewable adoption is improving, sustainability remains a debated issue.

XRP: Regulatory, Competitive, and Structural Risks

Although XRP has gained legal clarity, risks remain. The court ruling focused on secondary market sales, but Ripple’s institutional transactions were flagged as unregistered securities, leaving the door open for future scrutiny.

While the SEC ended its case in March 2025, regulatory shifts could still impact XRP’s trajectory.

Competition is another factor. Central bank digital currencies (CBDCs), stablecoins, and an upgraded SWIFT system could erode XRP’s core use case. Additionally, XRP’s pre-mined nature and the large amount held in escrow raise concerns about supply overhang and long-term dilution.

How to Approach Investing in Bitcoin or XRP

Before investing in Bitcoin or XRP, define your thesis. Are you interested in Bitcoin’s deflationary store-of-value model, or XRP’s utility in financial infrastructure? Your strategy should match your risk tolerance and long-term goals.

For Bitcoin, financial advisors typically suggest allocating no more than 2–10% of your portfolio to crypto. For XRP, consider that it’s tied to a narrower use case and depends heavily on Ripple’s success and adoption by global institutions.

Timing also matters. Bitcoin tends to rally in post-halving years, and major events like ETF approvals or legislative developments often drive price spikes. XRP, on the other hand, may surge on legal milestones, new partnerships, or central bank integrations.

Always have a clear entry and exit strategy to avoid emotional decision-making.

Conclusion

Bitcoin and XRP offer compelling investment narratives. Bitcoin benefits from institutional momentum and a deflationary design, while XRP stands out for its speed, low fees, and regulatory progress.

However, both face real risks, from volatility and environmental concerns to legal and competitive pressures.

Don’t invest based on hype. Take time to understand each asset’s fundamentals, monitor key developments, and align your investments with a long-term strategy. A disciplined, informed approach is your best defense in the fast-moving world of crypto.

If you think you need some assistance, we outline key analysis and identify potential entry and exit points in our premium crypto alerts

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)

- Crypto Charts Are Improving, Just Have A Look At These 3 Leading Indicators (July 6th)

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)