Bitcoin ETFs and central bank reserves are boosting liquidity, reducing volatility, and pushing Bitcoin toward institutional-grade financial integration.

Growing institutional adoption and government-level initiatives are dramatically reshaping Bitcoin’s liquidity profile. Strong inflows into spot Bitcoin ETFs now rival traditional ETF volumes, while a newly announced Strategic Bitcoin Reserve backed by seized assets adds a long-term institutional layer.

Together these developments are redefining Bitcoin liquidity dynamics, reducing volatility and positioning Bitcoin more akin to a mainstream financial asset.

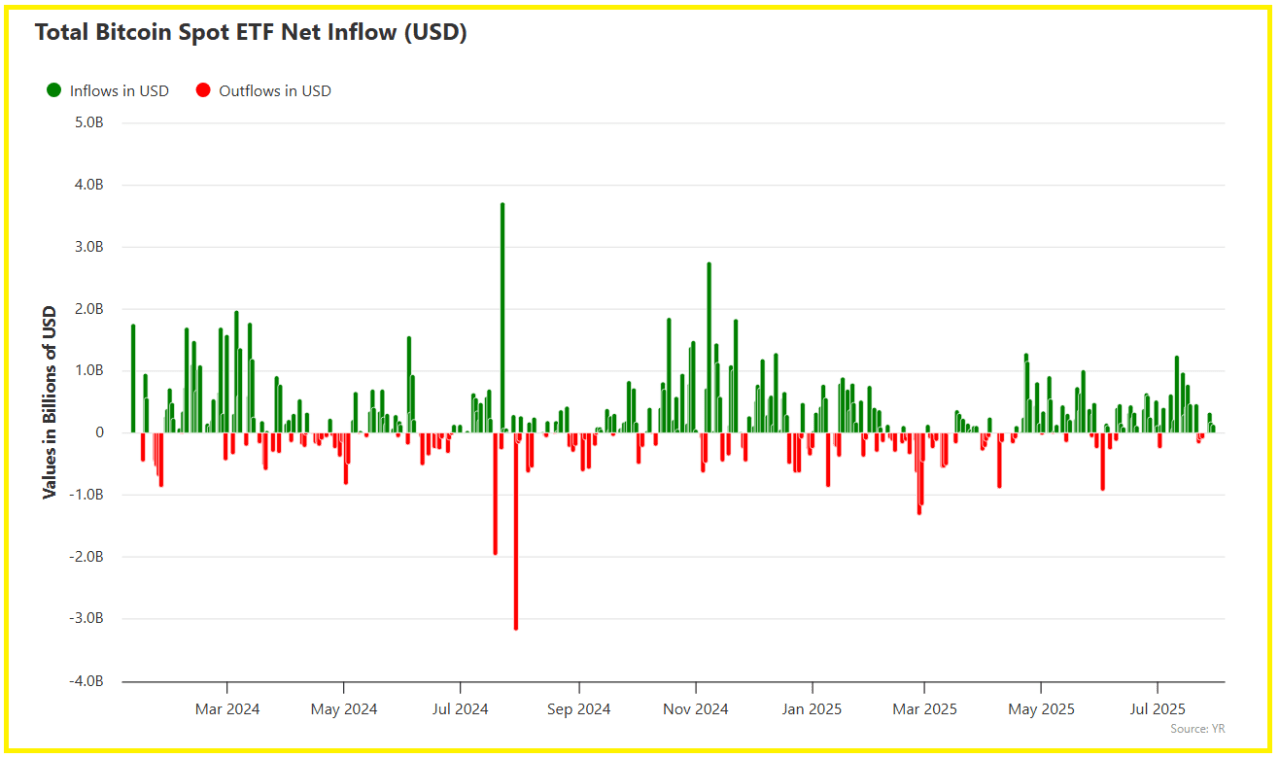

Soaring ETF Inflows and Institutional Liquidity

Institutional demand via Bitcoin ETF inflows has accelerated sharply in 2025. On July 16 alone, U.S. spot Bitcoin ETFs saw roughly $783 million in net inflows, contributing to over $51 billion year‑to‑date.

Firms such as BlackRock’s IBIT and Grayscale’s GBTC are leading the charge, with net assets soaring and trading volumes matching major equity ETFs.

Citi analysts have highlighted ETF demand as the primary short‑term driver of Bitcoin price moves, noting a tight statistical link between flows and price.

Daily inflows above $150 million remain common, boosting trading depth and improving arbitrage efficiency across markets.

Central Bank & Sovereign Reserve Adoption

On March 6, 2025, the U.S. executive order formally established a Strategic Bitcoin Reserve funded with government‑seized BTC, estimated at around 200,000 BTC, with no planned sales and only budget‑neutral additions.

Multiple U.S. states and countries – including Pakistan and Bhutan – are advancing legislation or pilot programs for similar reserves.

While federal disclosures around reserve operations remain limited, the symbolic and strategic shift toward crypto as a sovereign reserve asset is clear, reducing perceived market fragility and backing Bitcoin as a long-term store of value.

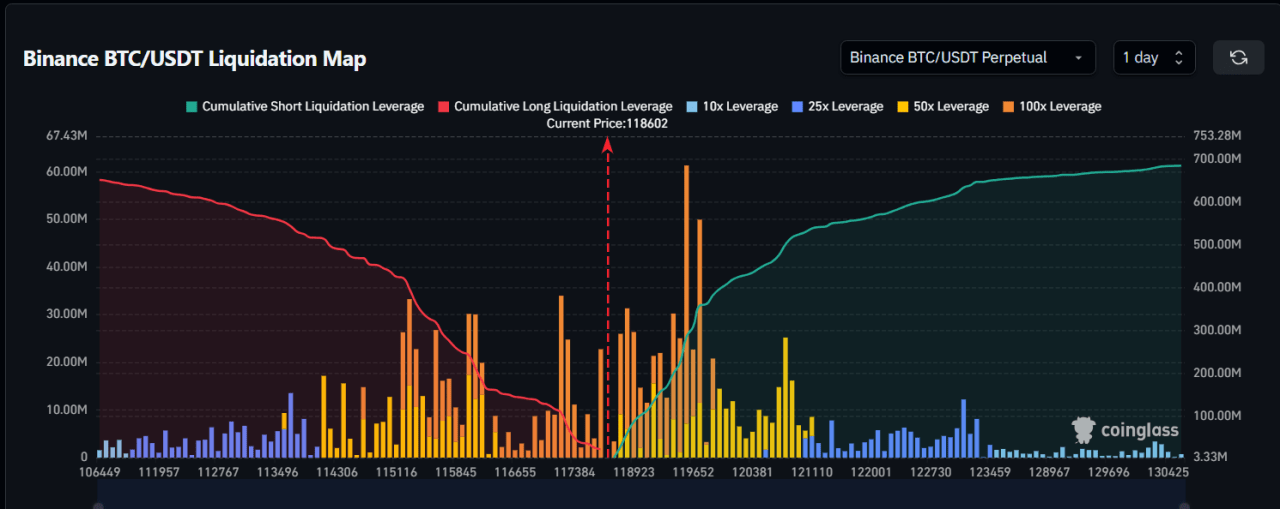

Combined Effect on Bitcoin Liquidity Dynamics

The convergence of ETF inflows and sovereign reserve holdings is strengthening Bitcoin’s liquidity backbone. ETF bid‑ask spreads are now comparable to major commodity funds, and arbitrage mechanisms operate within tighter bounds.

Meanwhile, the reserve acts as a silent anchor, absorbing shocks and reducing supply-side volatility.

Bitcoin is evolving from a speculative fringe asset to something increasingly treated as institutional-grade liquidity, with rising correlation to equities markets (reaching up to 0.87 in 2024) signaling deeper macro integration.

Conclusion

Institutional money via spot Bitcoin ETFs, combined with the emergence of a government-backed central bank Bitcoin reserve, is recalibrating market liquidity. These forces are delivering deeper order books, narrower price swings, and more predictable flow-led pricing.

As ETF demand grows and sovereign reserve frameworks mature, Bitcoin is stepping into a new era of institutional Bitcoin adoption, embedding it firmly within global liquidity and portfolio allocation discussions.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Alt Season 2025 – Progress Update (July 26th)

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)

- Crypto Charts Are Improving, Just Have A Look At These 3 Leading Indicators (July 6th)

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)

- BTC And Altcoins About To Hit Big Support Areas (June 22)