KEY TAKEAWAYS

- Forced liquidations cleared heavy leverage, which allowed price to rebound fast once selling pressure faded.

- Thin weekend liquidity made price swings sharper than usual, so relatively small trades caused big moves.

- ETF flows, funding rates, and exchange reserves now provide the clearest clues about the rally’s strength.

- Traders should cut leverage and focus on risk control, while long term investors should watch accumulation data.

- Should you invest in Bitcoin now?

Billions in forced liquidations erased excessive leverage and reset market positioning. Bitcoin’s sharp rebound exposed real demand and fragile liquidity.

Bitcoin crashed into the low $60,000s, erased billions in leveraged positions, then surged back above $70,000 in less than two days. Market trackers estimate about $2.5 billion in liquidations across derivatives during the drop, with one hour alone seeing more than $80 million wiped out.

Total crypto market value fell by roughly $290 billion before buyers stepped in and reversed the slide.

The rebound happened after traders saw liquidations thin out, funding rates stabilize, and aggressive buyers step into weak order books.

RECOMMENDED: Is Bitcoin Finished? Washington Rejects Bailout As Price Plummets

The Weekend Crash And Recovery

Bitcoin’s drop began with a wave of leveraged long liquidations as price broke key support levels.

Exchanges triggered automatic margin calls, which pushed more selling into already thin order books. Within hours, billions in positions disappeared.

The wider crypto market lost about $290 billion in value during the selloff. Once most forced sellers exited, aggressive buyers entered the market. Bitcoin climbed from the low $60,000s back above $70,000 in under 48 hours.

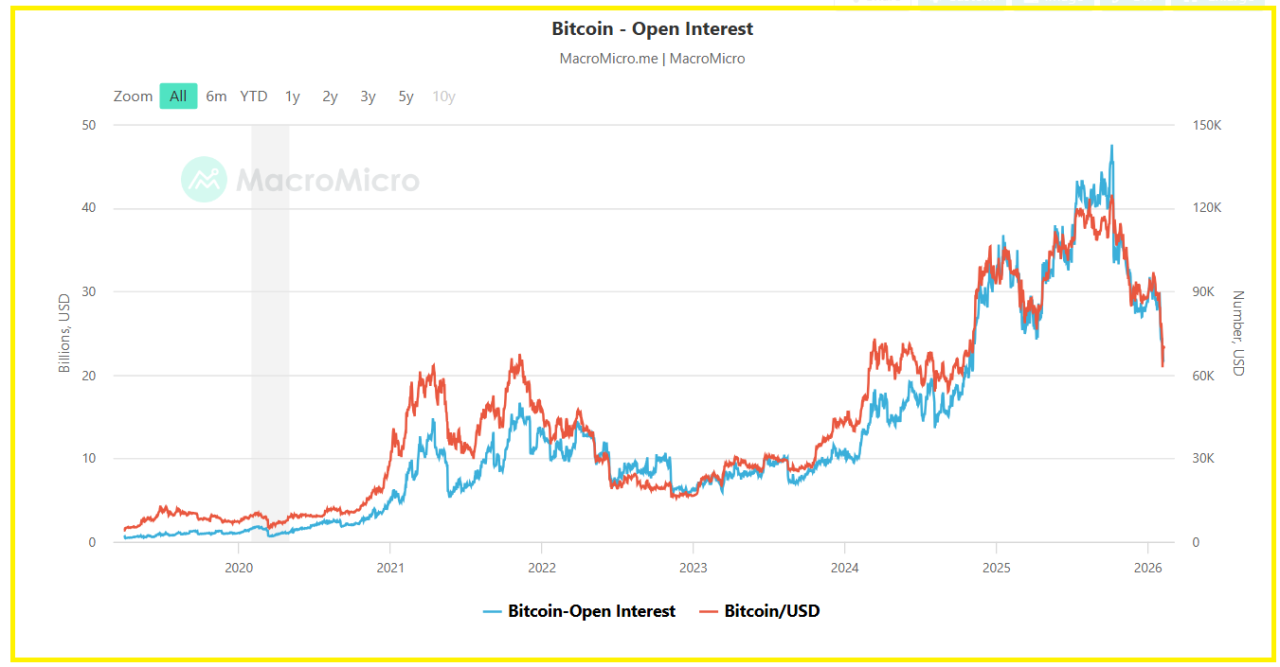

Open interest fell sharply during the crash, which shows that leverage flushed out of the system. Funding rates also cooled, meaning that traders reset their positioning instead of chasing extreme bets.

RECOMMENDED: Metals Meltdown Sends Bitcoin To A 10-Month Low – What’s Next?

Why The Rebound Happened So Fast

Liquidations create a chain reaction. When traders lose margin, exchanges close positions automatically, which pushes price lower and triggers more liquidations. That spiral dominated the early crash.

Once the bulk of forced selling finished, the opposite effect kicked in. Short sellers rushed to close positions as price bounced, which created a short squeeze. Thin weekend liquidity amplified every trade, so modest buying moved price sharply.

Options expiries and ETF rebalancing added directional flows that accelerated the bounce.

This rebound looked violent because it came from forced positioning changes rather than slow organic demand.

ALSO: Analysts Predicts 50% Bitcoin Surge – But Not Without Warning

Rally Or Temporary Bounce? The Signals To Watch

A sustainable rally needs consistent follow through across measurable data.

Strong ETF inflows show institutional demand returning. Falling exchange, on the other hand, reserves indicate that investors move coins into long term storage instead of keeping them ready to sell.

Positive funding rates confirm that traders expect higher prices without extreme leverage. On chain data showing accumulation by long term holders adds confidence.

That said, you should look out for warning signs such as ETF outflows, funding rates turning negative, rising exchange balances, and heavy put option activity.

If Bitcoin closes several days above $70,000 while reserves fall and ETF inflows stay strong, bullish momentum gains credibility. If those metrics reverse, the rebound could fade quickly.

What To Do Now

If you are an active trader, you should reduce leverage and scale into positions rather than entering all at once. Smaller position sizes help you survive sudden liquidation waves.

You can also use protective options strategies such as collars or small puts for downside protection without forcing panic exits. Otherwise, monitor liquidation heatmaps and funding rates to help anticipate pressure zones.

If you are a long term investor, however, you should focus on steady accumulation rather than chasing sudden spikes. Use dollar cost averaging with on chain accumulation trends for a disciplined approach.

You should also track ETF flows because large institutional moves often influence broader market direction. Importantly, exercise, patience and clear rules to reduce emotional trading mistakes.

ALSO READ: Did The U.S Steal $15B Bitcoin From A Chinese Scam King? Here Is The Truth

Conclusion

The weekend liquidation removed excessive leverage and reset market positioning, which allowed Bitcoin to rebound with speed.

This improved technical conditions and restored trader confidence, yet a single squeeze does not confirm a lasting bull run.

Sustained ETF inflows, declining exchange reserves, and stable funding rates will determine whether this rebound grows into a broader rally.

Without consistent support from those metrics, the surge above $70,000 could remain a sharp but temporary recovery rather than the start of a long upward trend.

Should You Invest In Bitcoin Now?

Before you invest in Bitcoin, you’re going to want to read our next premium crypto alert which will be published in the coming days. We will reveal key crypto assets to consider in 2026 with explosive potential.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.