Bitcoin price predictions for the next 12 months remain bullish for the most part, with some even expecting the world’s largest cryptocurrency by market cap to hit $200,000 by early 2026.

Bitcoin has been nothing short of a rollercoaster ride this year, with prices fluctuating between a low of $74,000 and a high of $109,000.

Institutional interest and macroeconomic factors, particularly a 90-day trade truce between the US and China have helped the world’s largest cryptocurrency by market cap rally a whopping 50% in recent week.

With the asset already sitting comfortably above the closely-watched $100,000 level, investors are increasingly interested in finding out what’s next for Bitcoin – what will BTC be worth about 12 months from now?

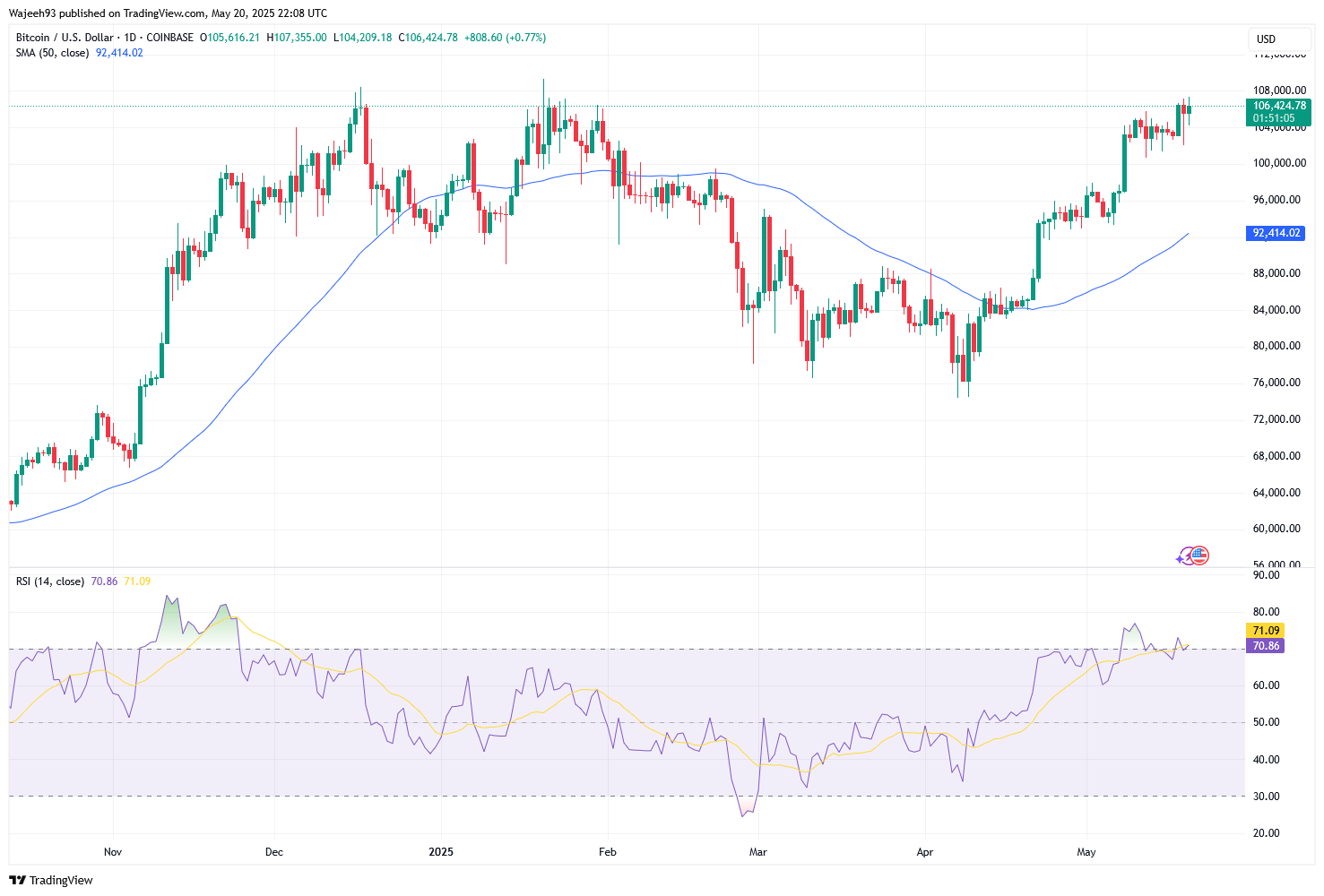

Bitcoin Technical Analysis: Bullish Momentum or Overbought Risks?

Bitcoin’s technicals currently indicate continued momentum in the months ahead. It’s forming an ascending channel at writing that could push prices toward $130,000 by the end of next month (June).

While the Relative Strength Index (RSI) sits above 70, indicating overbought conditions, the coin’s 50-day moving average is trending upwards, reinforcing confidence among buyers.

Following a cooler-than-expected CPI print last week, traders believe that the Federal Reserve will soon return to cutting interest rates, potentially driving capital further into the risk-on assets like Bitcoin.

Experts Commentary: Where Analysts Believe BTC Price is Headed

According to crypto analyst that goes by “TradingShot”, the world’s largest cryptocurrency could be headed for $134,000 in the near term as long as it stays above a key support at the $90,000 level.

Ali Martinez also expects BTC to be worth a lot more in 12 months from now, predicting a more than 10% increase to $120,000 in the near term.

Among even more bullish Bitcoin price predictions is one from the Standard Chartered Bank that believes continued institutional demand could help it nearly double from here and print a new all-time high of $200,000 by the end of 2025.

Fundamentals Suggest BTC Will Be Worth a Lot More in 12 Months

Fundamental factors favor a sharp increase in Bitcoin price over the next 12 months as well. These include solid institutional interest as evidenced in ETFs seeing more than $600 million worth of net inflows in recent weeks.

Plus, the regulatory environment is expected to turn much more accommodative under the Trump administration, which could bring even the more conventional and conservative investors to BTC in the second half of 2025.

US President Donald Trump is even interested in setting up a strategic Bitcoin reserve that could unlock unprecedented demand for the crypto king, potentially helping its price hit new milestones over the next 12 months.

Bottom Line: Should You Invest in Bitcoin Today?

While tariffs driven uncertainty and geopolitical tensions on multiple fronts (Ukraine, Middle East, South Asia) could keep volatility in place in the near term, both technicals and fundamentals signal Bitcoin will be worth much more than today in 12 months.

If institutional inflows continue and the macroeconomic environment favors BTC, it’s reasonable to believe that its price may be well on its way to hit the much-anticipated $200,000 level by early 2026.

Gain Instant Access to the World’s First Blockchain Investing Research Service — Actionable Crypto Alerts, Built on 15+ Years of Market Experience

Discover market-moving insights and exclusive crypto forecasts powered by InvestingHaven’s proprietary 15-indicator methodology. Join smart investors using our premium alerts to stay ahead of the curve—before the big moves happen.

This is how we are guiding our premium members (log in required):

- Is A Massive Breakout Coming? (May 18th)

- Top Altcoin Picks in the Strongest Emerging Narrative (May 9th)

- Bitcoin’s Must-Watch Chart Structure, What It Means For Top Altcoins (May 6th)

- Charts – XRP, Theta, Uniswap, and two RWA Token Tips (April 29th)

- Juicy Opportunities Are Starting To Show Up On The Charts (April 24th)