As major cryptocurrencies edge closer to critical resistance zones, investors are watching for signs of explosive breakouts—or the threat of breakdowns.

As the crypto market enters a pivotal phase, the price action of leading coins points to growing tension between bullish momentum and overhead resistance.

Bitcoin, Ethereum, and XRP have all staged significant rallies in recent weeks, but now hover near key technical levels. Whether they break out or falter here could shape the market’s direction heading into June.

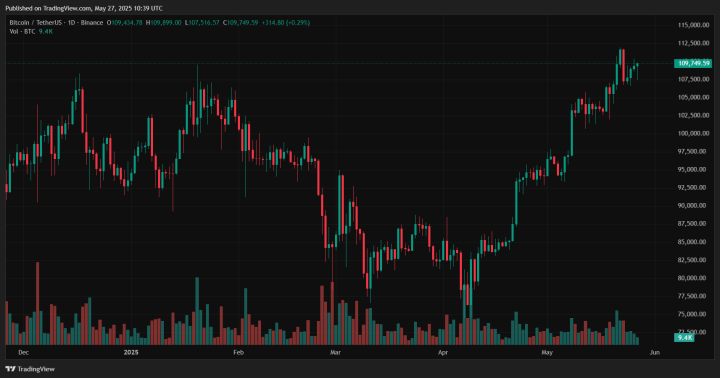

Bitcoin (BTC/USDT): Bull Flag or Exhaustion?

Bitcoin is currently trading around $105,424, following a strong uptrend from late April that pushed price above the psychological $100,000 mark. The recent formation of higher highs and consolidation just under $112,500 suggests a potential bull flag structure.

If buyers break above this resistance with conviction, a move toward $115,000–$118,000 looks likely. However, failure to break could invite a pullback to $105,000, where demand has previously supported price. Volume is stable, but a breakout requires renewed momentum.

Ethereum (ETH/USDT): Coiling for a Break?

Ethereum, trading at $2,633, has seen a sharp rebound from April lows and now consolidates just under $2,650. This sideways movement after a rally is often a bullish continuation signal.

A decisive breakout above $2,800 could push ETH toward $3,200, while a breakdown below $2,450 might test support around $2,200. Volume and candle structure hint at indecision, but bullish bias remains intact unless key support fails.

XRP (XRP/USDT): Triangle Tension Builds

XRP/USDT is trading in a tight range between $2.20 and $2.40, showing signs of consolidation after a modest April uptrend. Low volatility and steady volume suggest indecision, with price hovering just above the 20-day moving average.

This compression hints at a potential breakout or breakdown soon.

A close above $2.40 could trigger a bullish move toward $2.60, while a drop below $2.25 may lead to a decline toward $2.00 or $1.80. With the range tightening, traders should watch for a strong daily candle with volume to signal the next trend direction.

Conclusion

Bitcoin, Ethereum, and XRP are each hovering near critical technical zones. The broader market tone remains cautiously bullish, but the next few daily closes will be key.

A collective breakout from these consolidation phases could kick start another leg up for the crypto market, while breakdowns may trigger profit-taking and short-term corrections. Traders should watch resistance levels, volume spikes, and candle structure closely in the days ahead.

Gain Instant Access to the World’s First Blockchain Investing Research Service — Actionable Crypto Alerts, Built on 15+ Years of Market Experience

Discover market-moving insights and exclusive crypto forecasts powered by InvestingHaven’s proprietary 15-indicator methodology. Join smart investors using our premium alerts to stay ahead of the curve—before the big moves happen.

This is how we are guiding our premium members (log in required):